- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

PICS AT BOTTOM. I understand that when you rent rooms in your house, you must calculate the percentage rented based on the square feet used solely by the renter. So I rent 2 rooms and I've calculated it to be around 25%. I've then filled the schedule E deductions based on this percent. So 25% of the total of utilities, taxes, interest, etc. Also calculated to rented months so 10 month of out the 12 by diving the 25% by 12 x10. I've put the remainder of taxes, interest, etc on Schedule A.

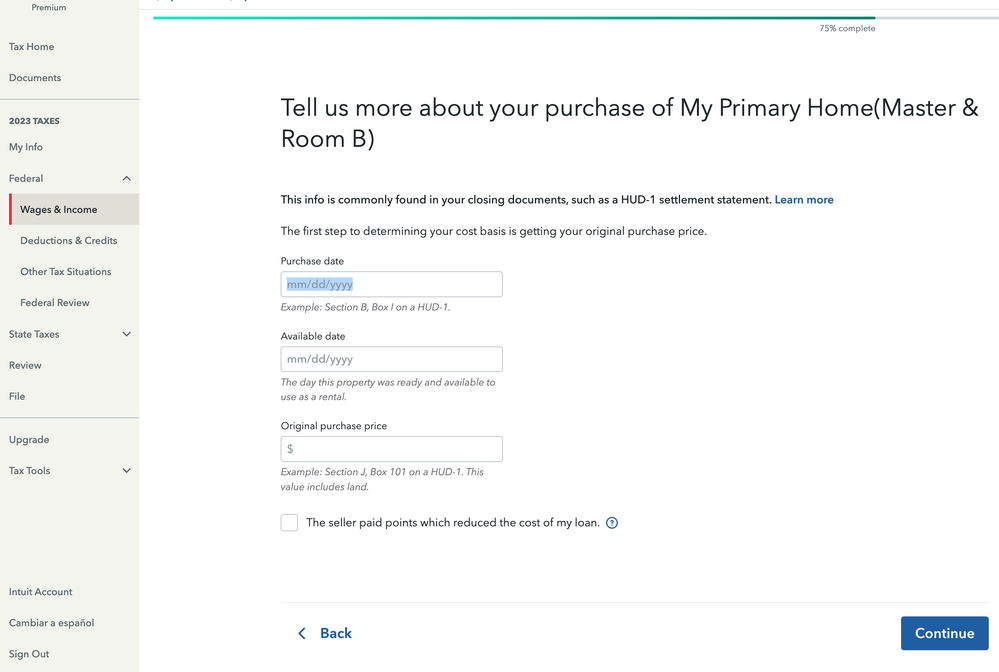

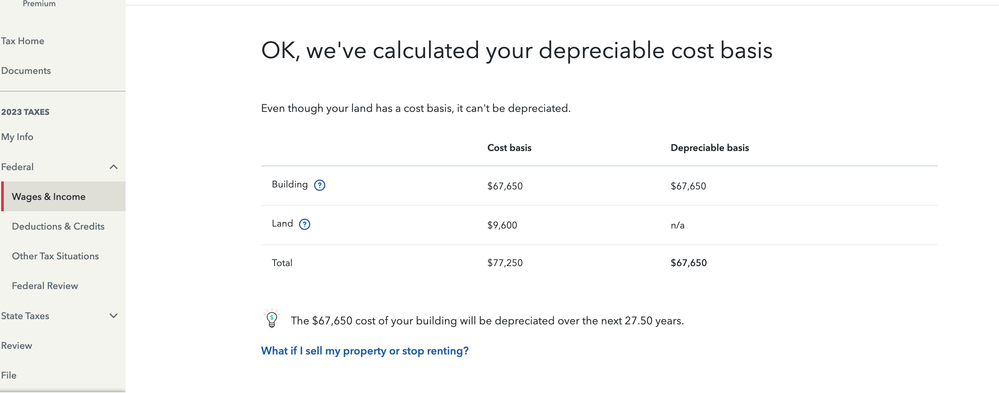

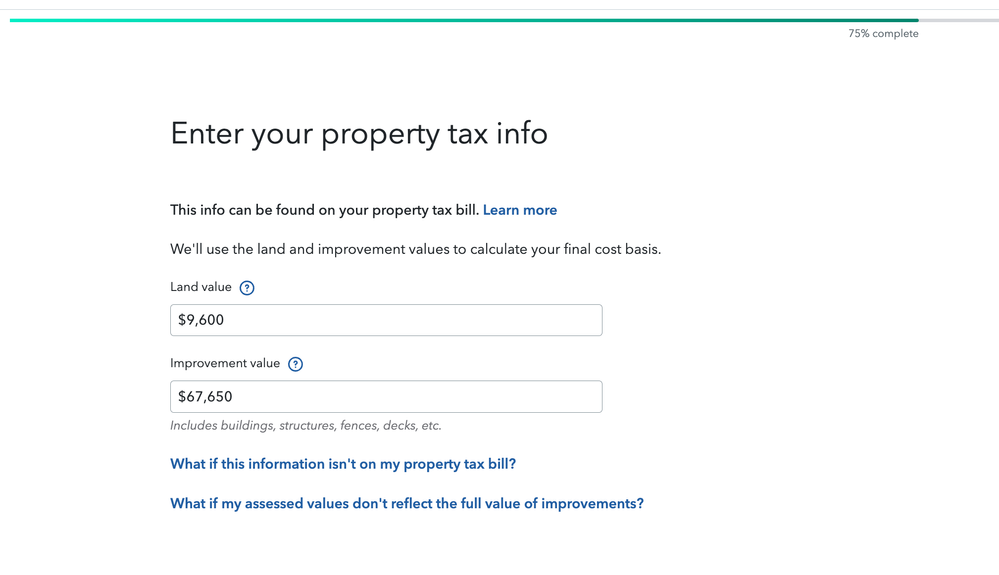

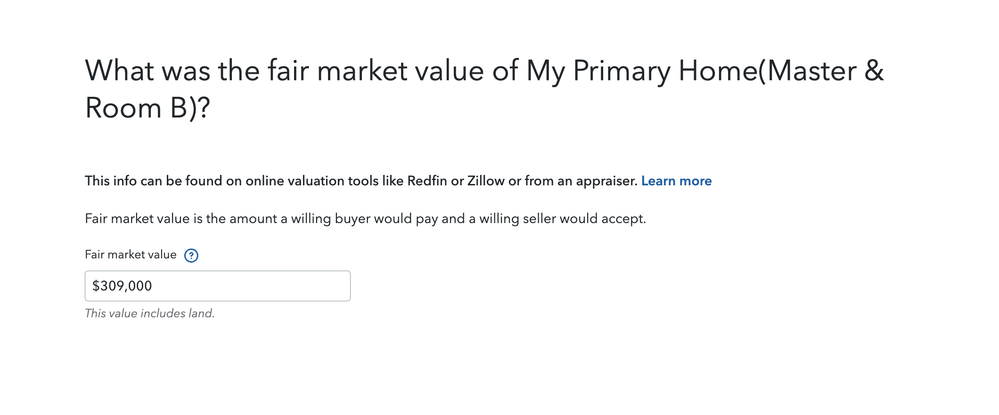

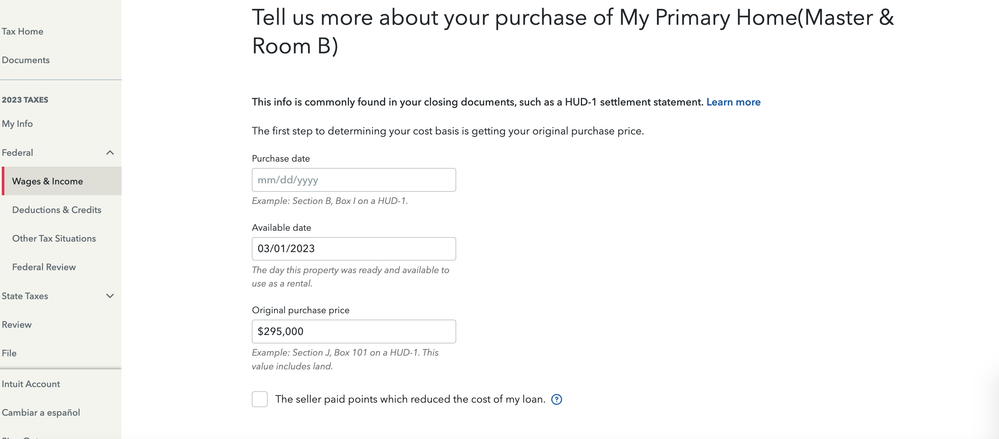

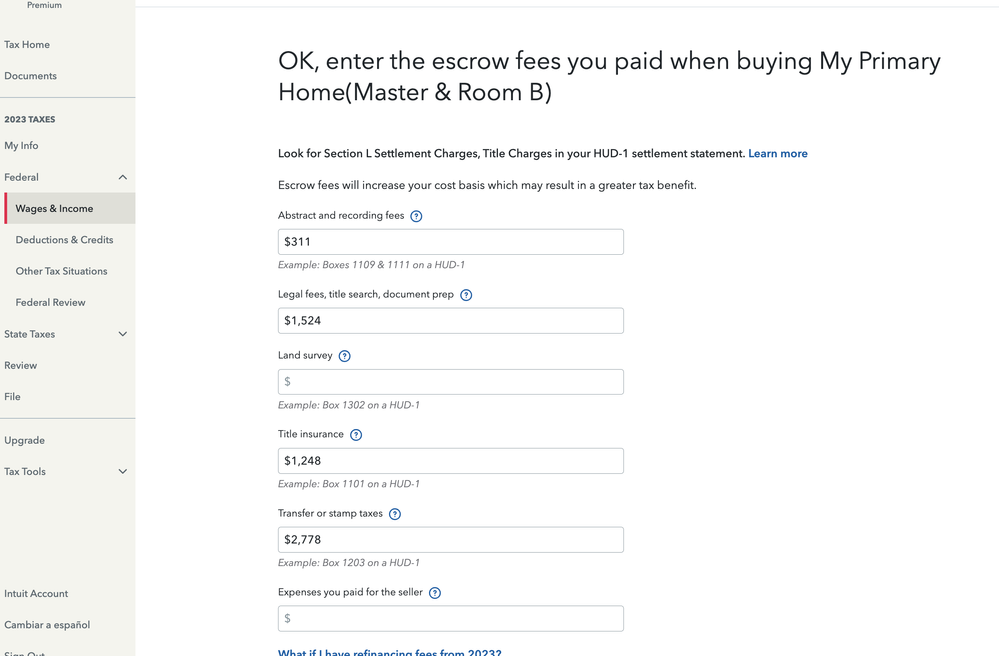

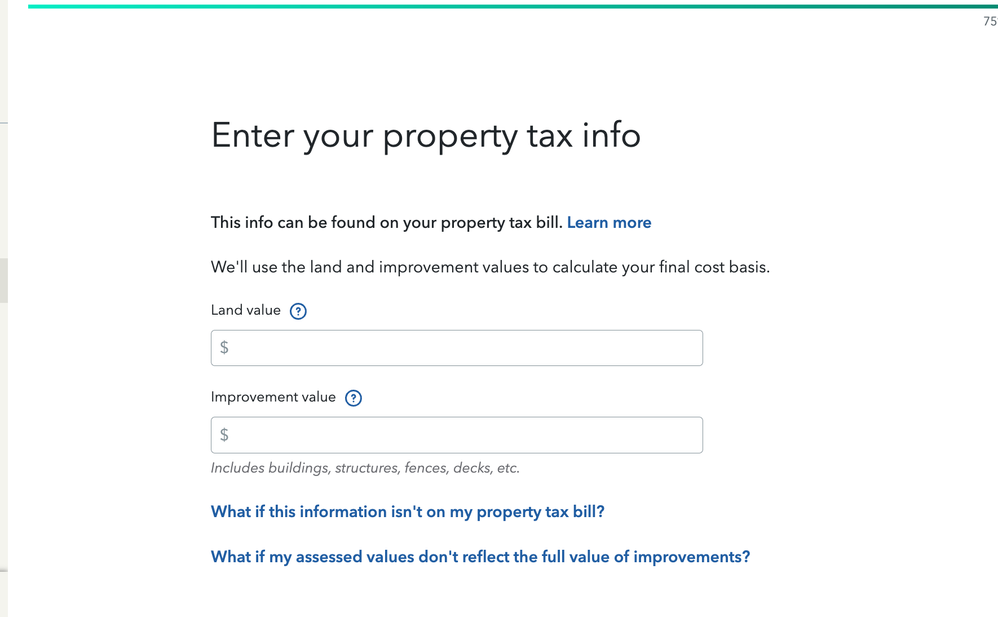

The one thing that has me confused is that on the Asset section at the bottom when you add details about the house, there's a section to enter the price of the house, purchase date, & date it was available as a rental. Do I put the full price of the house or do I need to calculate the price of the rented portion(25%) of the house. In the first screen, it sounds like I put the full purchase price. On the second screen where I put the land value section, is that where I calculate the 25% of the purchase price of the rented section? THANK YOU SO MUCH!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

If you told the program that you rent out 25% of your house, and that it was rented for 10 months, the program (not you) will do the math *for you*. So you enter the total of what you paid for the house, and the total of the property taxes you paid. Take note that these are the only two things the program will prorate for you. Everything else (including insurance cost) has to be manually prorated by you.

Also, be aware this as been highly problematic for several years now, for those renting a part of their primary residence. So *check* *the* *numbers* when you're done. See IRS Publication 946 at https://www.irs.gov/pub/irs-pdf/p946.pdf and use the MACRS worksheet on page 36 of that publication. For line 6 of the worksheet use table A-6 on page 71. I can't stress this enough *CHECK* *THE* *NUMBERS*!!!! I fully expect them to be wrong in the program, unless the programmers have actually fixed this issue - which I doubt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

Hi Carl,

Thank you for responding! I was never prompted to note the % of the house i rented. I chose to calculate values myself on the option to let turbotax calculate.

I've read on similar responses that the program won't calculate correct values so we need to do it ourselves. Is that not true? Any thoughts on the house and land value section? Do I need to redo and allow turbotax to calculate values for me?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

No, you do not need to redo your rental activity. If you have done all the proration of expenses yourself and you use the square feet of space rented divided by the total square feet you should be good to go. Sometimes, depending on what you enter it can be confusing and this way you know exactly what you have expensed. Keep your records together.

You can also enter the business percentage of the cost of your home for depreciation. If you calculate the business use percentage do not put in any percentage values for business use because your figures would represent 100% of the rented space. it is not necessary for you to enter the land value but you must remove that from the cost basis to arrive at the business use percentage of the building. You could use the tax assessment records to arrive at the portion of the purchase price attributable to land.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

Thank you so much for your response.

The land value is required on the web version. I tried leaving it empty but it won't let me continue so I calculated 25% of the land value and 25% of the market value and put it there as you can see on the screenshot but it looks like it gets the real depreciation info from the home purchase price. Can you help me confirm what values need to be placed on the home information section? Do I need to calculate 25% of the purchase price and all closing costs associated with it? Because the question is clearly asking for the full purchase price but I'm guessing I have to calculate the 25% of the purchase price even if those numbers would be a bit odd since you can't purchase a price for 67k around here. After taking 25% of the purchase price & market value & cost of improvements minus the land(25% of land number added there) my values would look more like the first picture. Is this correct ?

Also, where you can you can also enter the % of your home for depreciation, there's no section to do that in the web version. It may be because when I started I chose to calculate values myself ? I may have made this whole thing harder for me my calculating things myself but it sounds like we have to if we want to get things right.

Attaching these screenshots for clarify on the screens I'm confused about. Thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

Yes, you should enter only the 25% business use portion of the home and land.

- Your question: Can you help me confirm what values need to be placed on the home information section? Do I need to calculate 25% of the purchase price and all closing costs associated with it?

All entries should represent ONLY the business use percentage to arrive at the correct depreciation cost basis (actual cost x 25% business use for everything). Do NOT enter your total cost. It seems correct that because you indicated you would choose to calculate the values yourself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

OldCarGuy

Level 4

OldCarGuy

Level 4

obeteta

New Member

VB27

New Member

saalves2424

New Member