- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I rent rooms in my house. In the asset section on schedule E do I put the price of the house or the rented % price?

PICS AT BOTTOM. I understand that when you rent rooms in your house, you must calculate the percentage rented based on the square feet used solely by the renter. So I rent 2 rooms and I've calculated it to be around 25%. I've then filled the schedule E deductions based on this percent. So 25% of the total of utilities, taxes, interest, etc. Also calculated to rented months so 10 month of out the 12 by diving the 25% by 12 x10. I've put the remainder of taxes, interest, etc on Schedule A.

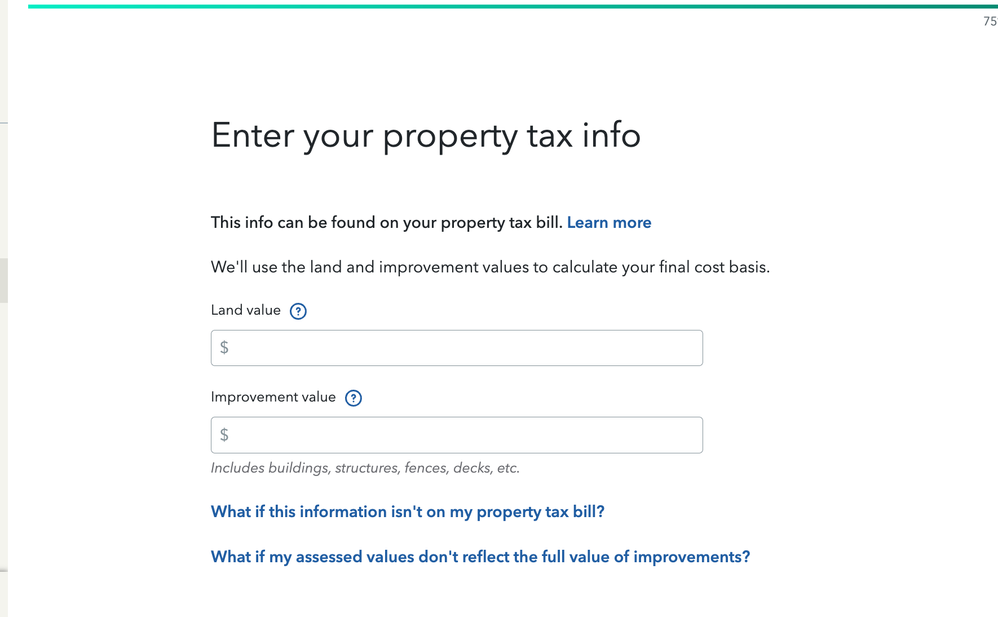

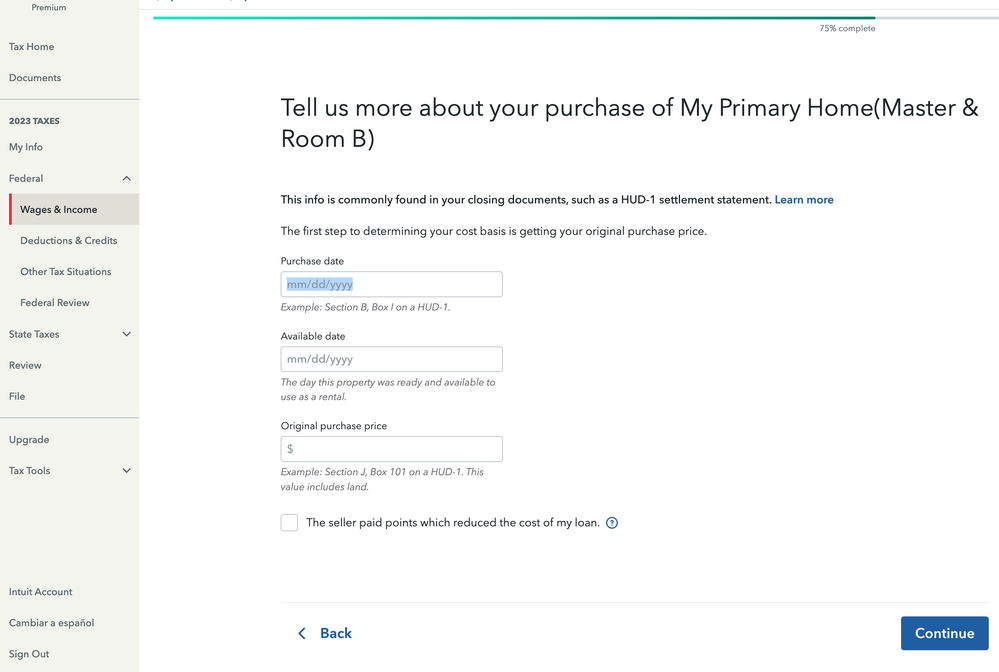

The one thing that has me confused is that on the Asset section at the bottom when you add details about the house, there's a section to enter the price of the house, purchase date, & date it was available as a rental. Do I put the full price of the house or do I need to calculate the price of the rented portion(25%) of the house. In the first screen, it sounds like I put the full purchase price. On the second screen where I put the land value section, is that where I calculate the 25% of the purchase price of the rented section? THANK YOU SO MUCH!