- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I purchased 3 trucks to rent out like UHAULS. Cost in 2021 was approx $100K. Can I depreciate those as an expense for my LLC business? Special rules? Type of depreciatio?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased 3 trucks to rent out like UHAULS. Cost in 2021 was approx $100K. Can I depreciate those as an expense for my LLC business? Special rules? Type of depreciatio?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased 3 trucks to rent out like UHAULS. Cost in 2021 was approx $100K. Can I depreciate those as an expense for my LLC business? Special rules? Type of depreciatio?

Yes, you are allowed to depreciate. No, you can't take a year's worth of depreciation.

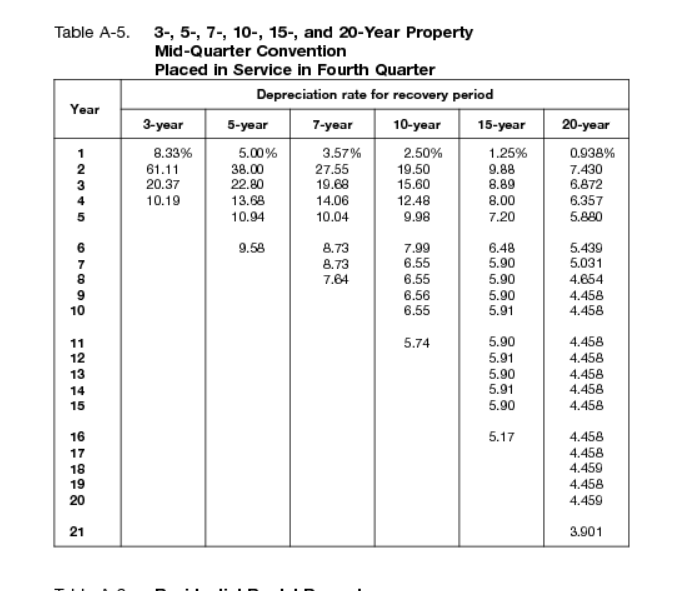

When you place assets in service in the fourth quarter, your depreciation is limited in the first year. You are subject to the midquarter convenion. You'll make up for it in the second year.

Use this convention if the mid-month convention does not apply and the total depreciable bases of MACRS property you placed in service during the last 3 months of the tax year (excluding nonresidential real property, residential rental property, any railroad grading or tunnel bore, property placed in service and disposed of in the same year, and property that is being depreciated under a method other than MACRS) are more than 40% of the total depreciable bases of all MACRS property you placed in service during the entire year.

Under this convention, you treat all property placed in service or disposed of during any quarter of the tax year as placed in service or disposed of at the midpoint of that quarter. This means that 1½ months of depreciation is allowed for the quarter the property is placed in service or disposed of.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I purchased 3 trucks to rent out like UHAULS. Cost in 2021 was approx $100K. Can I depreciate those as an expense for my LLC business? Special rules? Type of depreciatio?

Yes, you are allowed to depreciate. No, you can't take a year's worth of depreciation.

When you place assets in service in the fourth quarter, your depreciation is limited in the first year. You are subject to the midquarter convenion. You'll make up for it in the second year.

Use this convention if the mid-month convention does not apply and the total depreciable bases of MACRS property you placed in service during the last 3 months of the tax year (excluding nonresidential real property, residential rental property, any railroad grading or tunnel bore, property placed in service and disposed of in the same year, and property that is being depreciated under a method other than MACRS) are more than 40% of the total depreciable bases of all MACRS property you placed in service during the entire year.

Under this convention, you treat all property placed in service or disposed of during any quarter of the tax year as placed in service or disposed of at the midpoint of that quarter. This means that 1½ months of depreciation is allowed for the quarter the property is placed in service or disposed of.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kevin167

New Member

justintccasey

New Member

patrishwalls

New Member

mjayanthr

New Member

denisegvw

Level 1