- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I am LOST!!! NBLX (a PTP) was bought out by Chevron. I have a K-1 and a 1099 and feel like a tax moron.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am LOST!!! NBLX (a PTP) was bought out by Chevron. I have a K-1 and a 1099 and feel like a tax moron.

Honestly, I seriously rue the day I bought the d@mn "shares" or whatever you call them. Learned my lesson, never again. Can anyone help me? I'm going to (try) to attach photos of the front & back of the K-1

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am LOST!!! NBLX (a PTP) was bought out by Chevron. I have a K-1 and a 1099 and feel like a tax moron.

MLP reporting k-1 and 8949

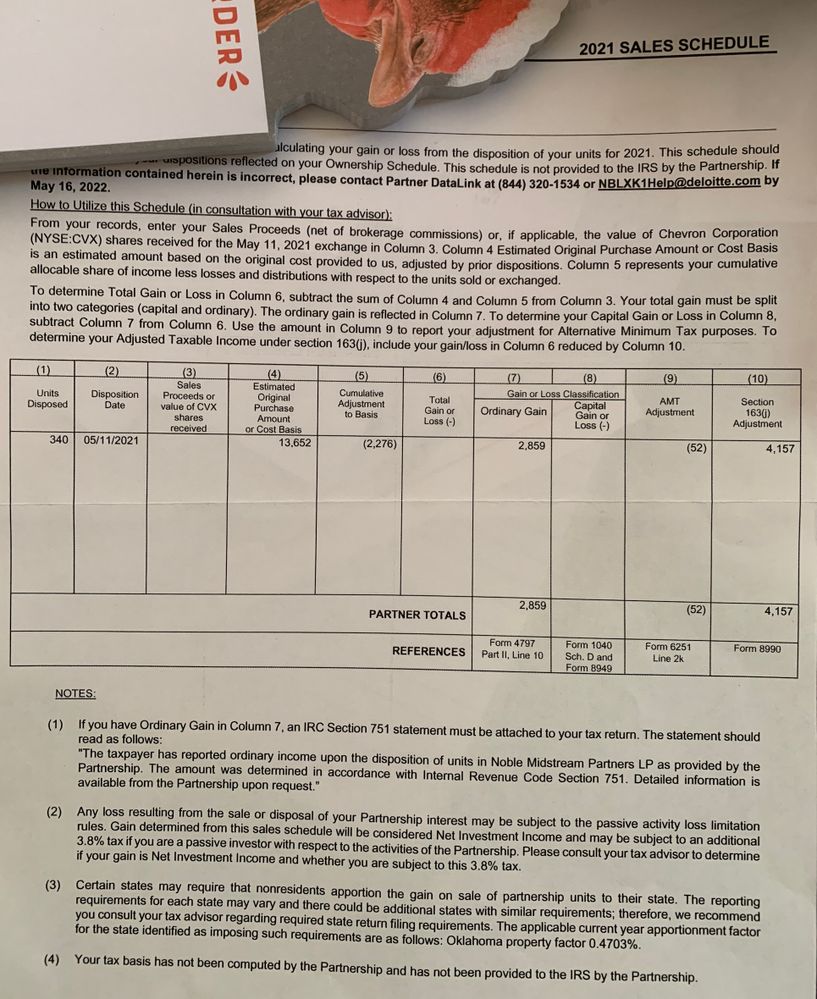

Please follow these instructions. Incorrect entries can result in entering the sale twice or otherwise incorrectly. Also see the sales schedule that was included with the k-1. you did not show this but there should be 1

Enter the k-1 info only important numbers from the k-1 (other than certain info in box 20) are line 1 and 10

Check the PTP box

since it's a total disposition proceed as follows:

Check final K-1

Check sold or otherwise disposed of the entire interest

Use QuickZoom to get to the following section

On the k-1 disposition section for sales price use the ordinary income (sometimes you’ll see a column with the “751” or the words ”gain subject to recapture as ordinary income” the $2859

Cost is zero

Ordinary income is the sales price.

This info flows to form 4797 line 10 and is taxed as ordinary income.

Now for the 8949.

The broker’s form is probably coded as B or E – sales proceeds but not cost basis reported to the IRS. This is because the broker does not track the tax basis. It used what you paid originally which is not correct.

The correct tax basis is:

What you paid originally, should be the same as what is on 8949,

Then there is a column on the sales schedule that says "cumulative adjustment to basis". If it’s positive add it to the original cost. If it’s negative subtract the amount

Finally, add the amount of ordinary income reported above. the $2859

The result is your corrected cost basis for form 8949.

Some other things. Look at line 20Z. Those numbers should be entered when you get to the QBI/199A questions. You don’t have to enter this info but then you lose out on a tax deduction = 20% of this amount.

the rest of the info is really irrelevant. Turbotax does not do form 8990 so you would have to do it manually and paper file your return. probably would have no effect on your return (it's the $32 on the first line)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am LOST!!! NBLX (a PTP) was bought out by Chevron. I have a K-1 and a 1099 and feel like a tax moron.

You can get Form 4868 from the IRS at www.irs.gov now.

you will have until Oct 15 to figure out your tax return.

You don’t need to file Form 4868 if you make a payment using the IRS

electronic payment options. Your extension will be automatically

processed when you pay part or all of your estimated income tax

electronically. You can pay online or by phone.

===

You can pay all or part of your estimated income tax due and **indicate that the payment is for an extension** using Direct Pay, the Electronic Federal Tax Payment System, or using a credit or debit card. Your extension is then automatically granted and you will receive a confirmation number for your records.

Still have questions?

Make a post