- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Husband and Wife multimember partnership LLC suggests splitting all income/expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband and Wife multimember partnership LLC suggests splitting all income/expenses

My husband and I operate three separate rentals under this multimember partnership LLC of which he and I are 50/50 partners and we a=file Joint Married.

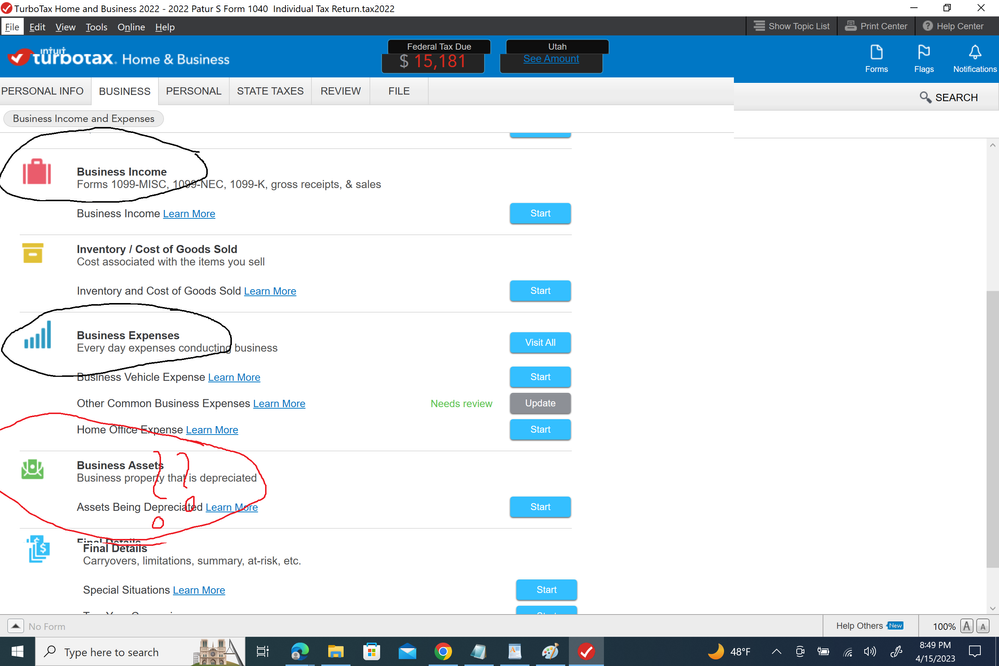

Turbotax downloaded Home and Business software is recommending that I create separate Schedule C for each of us and apply half the income/expense. Do I have to do it manually ie., do I have to half every expense and every income data entry point for me and remember all those values and re-enter when I am entering the Schedule C for him?

I Hope atleast some of this is automated - ideally when I enter the actual values into Schedule C, it'd ve been ideal for the software to split it two ways and create two Schedule C's if married filing joint.

Please advise.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband and Wife multimember partnership LLC suggests splitting all income/expenses

Unfortunately, you both need to create a Separate Schedule C for yourselves so that your SE Tax will be reported to each of you so these can be separately deposited into your Social Security accounts. Filing this as a Schedule C has its limitations in this regard if there is a husband/wife partnership of an LLC.

If you had filed a 1065 partnership return, you would have reported these income/expenses on an entity level and then the net business income (or loss) would have been evenly distributed between the two of you on your individual K-1's to be reported in your individual return. The downside of this through is that you would have needed to purchase the Business product to report the 1065 and then purchase the individual product to report your K-1's that reported the net income(or loss).

There is not an automated process that I am aware of where you can copy and paste information to move it from one return to another. My suggestion is to create both Schedule C's and enter each entry simultaneously in each schedule so you can stay on track.

Also, you might create a spreadsheet to create values and after this is complete, you can copy and paste information into each Schedule C. This may require a little work but may be effective.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband and Wife multimember partnership LLC suggests splitting all income/expenses

Thank you Dave. I have added all the Expenses and Incomes to an Excel sheet and divided each in half so it'd be easier for me to split as needed.

I have purchased a Home and Business desktop version of the Turbotax product. Will this not have a provision to both do business aka 1065 and personal aka Schedule K-1 for each of us? The product took me down a path of creating my Schedule C first and recommended that I create a Schedule C for my Husband later on as a different step. I have a couple of questions with that option [So when I create a Schedule C for my Husband, do I have to add a new Business with the same Name and EID but a different description and start entering the other one half Income/Expense? How about the other aspets on rental such as Assets and Refinance expenses that are depreciated. Do I need to enter one half these also? I want to be careful not to depreciate twice but also halving the asset [property price] does not make sense to me. Please advise.

If I have this totally wrong, Please advise how I go about creating a separate Schedule C for my husband?]

If I am able to take Option 1 and create a 1065 and two Schedule K-1s, will this product of TT Home and Business give me that option?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband and Wife multimember partnership LLC suggests splitting all income/expenses

Home and Business creates schedule C's. You would need TurboTax for Business to create the 1065. However, 1065s were due March 15th and you have already incurred a late fee - and a pretty steep one - if you go that route so it may be better to just continue with the schedule Cs for this year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Husband and Wife multimember partnership LLC suggests splitting all income/expenses

Thank you Robert. My CPA has confirmed they have filed extensions for me. They normally do this and file my LLC and personal at the same time every year.

Thank you,

Saritha.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

fillini00

Level 2

fillini00

Level 2

palmtree33

New Member

joycesyi

Level 2

Martin Yue

New Member