- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Thank you Dave. I have added all the Expenses and Incomes to an Excel sheet and divided each in half so it'd be easier for me to split as needed.

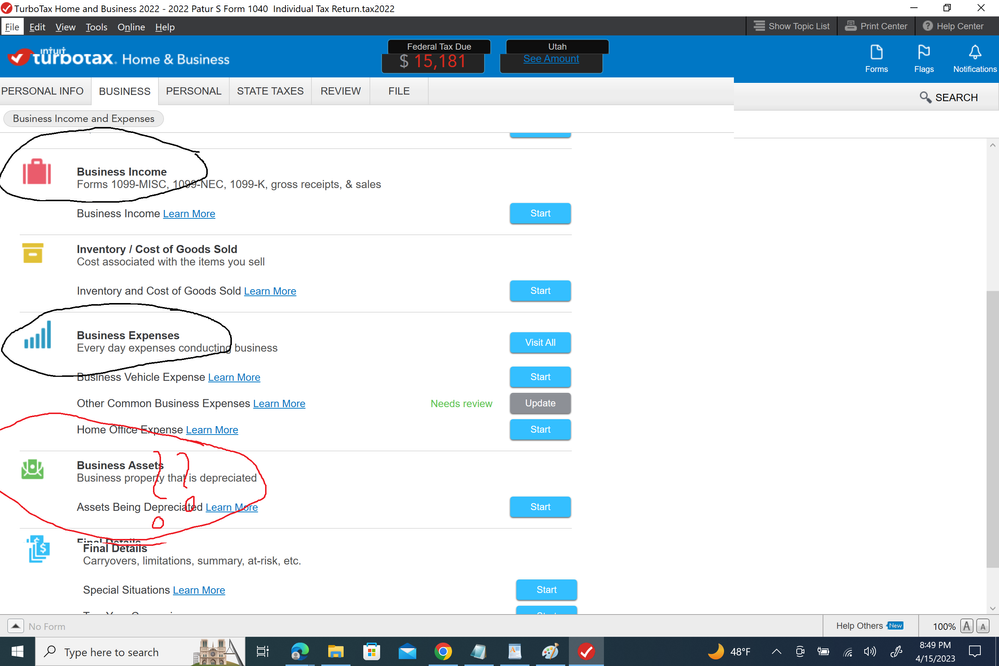

I have purchased a Home and Business desktop version of the Turbotax product. Will this not have a provision to both do business aka 1065 and personal aka Schedule K-1 for each of us? The product took me down a path of creating my Schedule C first and recommended that I create a Schedule C for my Husband later on as a different step. I have a couple of questions with that option [So when I create a Schedule C for my Husband, do I have to add a new Business with the same Name and EID but a different description and start entering the other one half Income/Expense? How about the other aspets on rental such as Assets and Refinance expenses that are depreciated. Do I need to enter one half these also? I want to be careful not to depreciate twice but also halving the asset [property price] does not make sense to me. Please advise.

If I have this totally wrong, Please advise how I go about creating a separate Schedule C for my husband?]

If I am able to take Option 1 and create a 1065 and two Schedule K-1s, will this product of TT Home and Business give me that option?

Thank you.