- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to handle 1099-DIV "cash liquidation distributions" of RSUs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

Hi folks, I have a specific scenario that, while probably not too uncommon, is a bit confusing for me.

1. I worked as an employee for a software startup in 2015. I received NNNNN restricted stock units (RSU) some of which vested. I left the company in 2017.

2. In 2019, the startup was purchased as an asset sale. In 2019, I received $XXXXX for my RSUs.

3. In 2019, I received a 1099-DIV which had zeros in all boxes except box #9 "cash liquidation distributions" with the $XXXXX amount. (I am in Texas so no state income tax)

4. In January 2020, I received a 1099-MISC with box #7 "non-employee compensation" with the $XXXXX amount.

Question: Having both the 1099-DIV and 1099-MISC statements confuses me. How do I treat this compensation for Federal tax-reporting purposes?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

slimandlam,

The TurboTax solution https://ttlc.intuit.com/community/taxes/discussion/1099-div-box-9-how-to-report/00/134868 shows how to treat the RSU cash liquidation. If, as I assume, you did not pay anything for the RSU's, your basis in them was zero and you treat the distribution as a long term capital gain.

The 1099-MISC is a problem. I recommend that you attach a PDF statement of explanation to your return that includes (a) your name(s) as shown on your return, (b) your SSN(s), (c) the tax year (2019) and Form 1040, and (d) Subject: 1099-MISC statement of discrepancy. The body of that note will show exactly what you have reported here: that the company issued you income forms 1099-DIV and 1099-MISC that duplicated the same income and you are appropriately reporting the 1099-DIV income as a capital gain.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

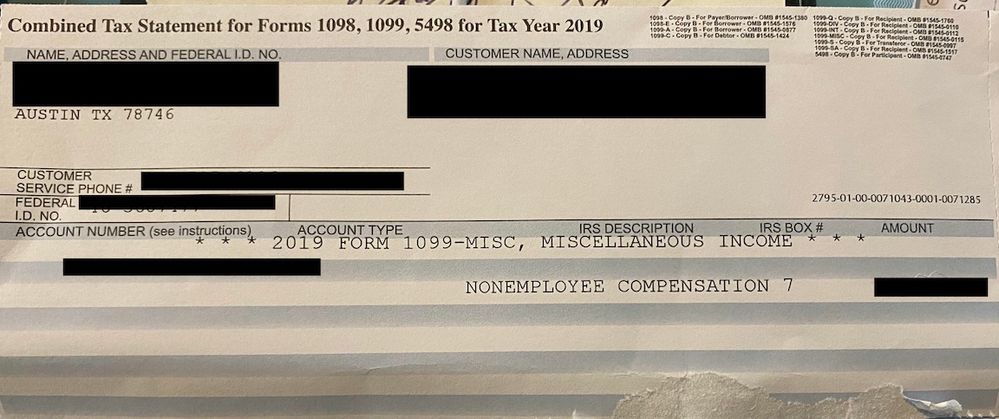

I should clarify that I didn't receive a real 1099-MISC. What I received was a "combined tax statement" that indicated that I *had* received a 1099-MISC in 2019. Could that be an error? I've attached the form here:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

I've confirmed that this 1099-MISC statement is a mistake. But, isn't there supposed to be another document besides the 1099-DIV? Like a Form 8949, or 1099-B or Schedule D, since the liquidation event was the sale of a company and all assets which includes my vested stock?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

You're post is somewhat confusing because it's not clear if you received money for your RSUs or the stock you acquired via your RSUs. I'm going to assume that you all these dollars are related to your stock because, typically, any RSUs that haven't vested when you leave the company are lost. This seems to be consistent with your use of "$XXXXX" everywhere with an indication that we are talking about the same amount in all cases. I'm also going to assume that when the RSUs vested while you were working there the vesting was properly handled by your company, i.e., the vesting created "compensation" and that compensation was included in your W-2s.

Give all of the above it does seem like whoever generated all these various tax forms screwed up. The long and the short of it, as I read your post, is that the company was sold and you received $XXXXX for your stock as the company, at least technically, was "liquidated." (As a shareholder I would have though that you might have received some documentation surrounding the event. Did you?)

So my take on this is that you use the "Stocks, Mutual Funds, Bonds, Other" interview, tell TurboTax that you didn't receive a 1099-B, and report your sale. Your proceeds are the $XXXXX. You basis is (# of shares sold) x (per share "fair market value) used by your employer to calculate the reported compensation). If you have more than one lot of stocks you'll do this calculation for each lot. There's no need to use the RSU "guided" tour here, simply tell TT that you "bought" the stock as of the date of the vesting(s) at a price per share that's the same as the per share fair market value(s).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

Oops. You're right. It is confusing. I'm talking about RSUs that were vested. That's the compensation I received at company liquidation time -- X$ per vested share. The 1099-DIV is correct. I've confirmed with the former CEO that the 1099-MISC mention is an error. However, shouldn't I also be receiving another form, like a 1099-B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to handle 1099-DIV "cash liquidation distributions" of RSUs?

"However, shouldn't I also be receiving another form, like a 1099-B?"

No. Planned liquidations - which this appears to be - are reported through the 1099-DIV. Such liquidations can span years so early distributions serve to reduce basis but if at some point the cumulative distributions exceed your basis you report that as a form of "sale."

"That's the compensation I received at company liquidation time.."

NO. The "compensation" - in the sense of "salaries and wages" - should have been recognized when the RSUs vested and that compensation should have been reported on the W-2. That "compensation" sets your basis for the stock and the liquidation distribution represents, in effect, the sale of that stock. I'm using the word in the "income tax" sense, not in the more general sense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.