- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to enter 199A information for schedule k-1 with large number of passhrough entities

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 199A information for schedule k-1 with large number of passhrough entities

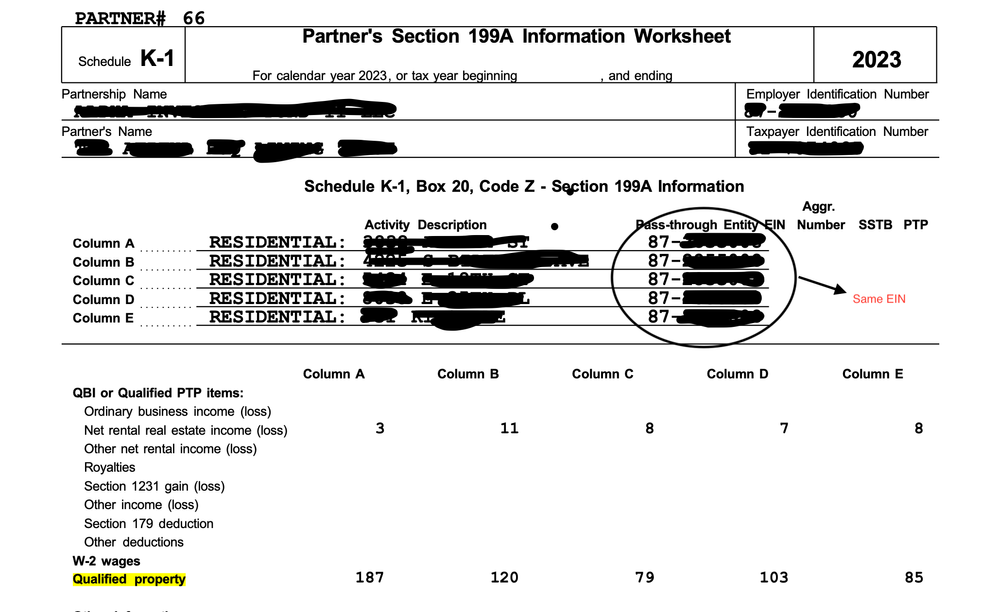

Question 1. I have a schedule K-1 where in “Partner's Section 199A Information Worksheet” there are about 170 passthrough entities, but all of them with same EIN. Image below.

In this case should I add up the rental real estate income/section 1231 gain/qualified property etc and enter the sum in one schedule K-1 or I have to enter ~170 schedule K-1. Obviously this large number is not practical to enter by hand, are there any other ways to do bulk entry?

Question 2. I have another schedule K-1 where “Partner's Section 199A Information Worksheet” has different EIN for each passhrough entity. How do I enter in this case? It appears previous forum answers say it should be independent K-1’s entered in TT. I also have box 1, 2 and 3 in schedule K-1. So in that case do I have to enter total 3 boxes times number of passthrough entities number of schedule K-1’s in turbotax? I have 5 passthrough entities so that’s 15 schedule k-1’s in turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 199A information for schedule k-1 with large number of passhrough entities

If the activities are similar (rental properties), you can enter the sum of each QBI category on one Schedule K-1.

Again, if the income category is the same, you can combine the information into one Schedule K-1. But you will need to set up a separate K-1 to report each income category (Box 1, Box2, Box 3). Enter the total QBI for each activity on the combined K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

j_pgoode

Level 1

angielovelace13

New Member

esewing

New Member

likesky1010

Level 3

hqat1

Level 2