- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Help! I plan to converting a business and personal car to personal use - How to report it and recapture the depreciation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help! I plan to converting a business and personal car to personal use - How to report it and recapture the depreciation?

The car used for business activity was purchased as a personal car back in 2009. Then in 2011 I started using it for my business along with personal use. I have been taking a standard mileage deduction all these years. In 1/1/2023, I converted this vehicle to personal use and I didn't sell it. In "Business and Income expenses", I select "I stopped using this vehicle in 2023" and put the date "1/1/2023".

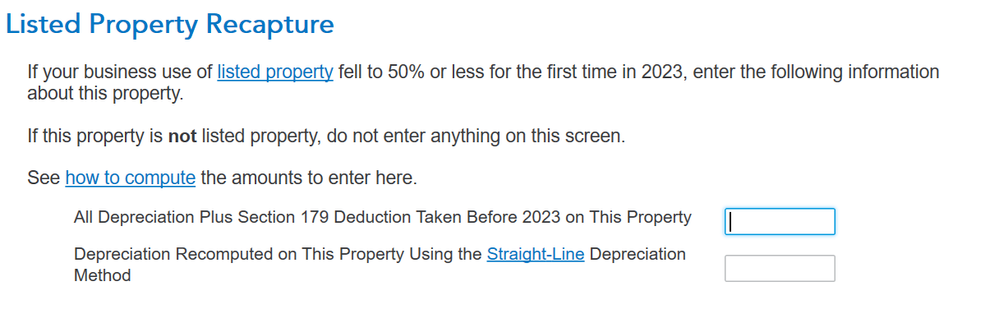

I followed the instruction on TurboTax. Go to the Less Common Business Situations section. Choose Sale of Business Property. On the next screen, Any Other Property Sales?, check the recapture box to enter your recapture information. I had business miliage and personal miliage for each year from 2012~2022.

1. For the first value, should I use the "Depreciation Rate per Mile" multiply "Business miliage" and add every year? Or should I use schedule C part II line#9 (Car and truck expenses) and add them every year?

2. How do I calculate depreciation using the Straight-Line Depreciation method for second value?

I read othe questions but am still confused. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help! I plan to converting a business and personal car to personal use - How to report it and recapture the depreciation?

First of all, do not report this in the Less Common Business Situations section. Instead report it the vehicle expense section in your self-employment income. To report go to Business expenses>business Vehicle Expense.

- You should see a vehicle summary. Select edit next to the vehicle.

- In the first screen that mentions, tell us about the vehicle, at the bottom of the page, check you stopped using this vehicle 1/1/2023

- As you proceed through the questions, it will ask if you used a mileage rate in the first year you deducted a business expense for the vehicle, here you will say yes.

- Continue through the interview, until it asks if do any these apply to your XXX. Here you will check you started using this for personal use.

- Then it asks if you converted this to non-business use. You will say yes.

Since you haven't sold the car, there is no depreciation recapture (or Capital gain/Loss) until you actually sell the vehicle. Once sold, then you would need to report a sale of the car and the depreciation taken in the past would need to be recaptured. i am going to give you a brief primer on how that works.

Depreciation is built into the amount of business mileage you claim every year. it is called a depreciation equivalent and is a percentage of your business miles claimed every year. It could be anywhere from 22 to 26 percent depending on the year.

Publication 463 has a depreciation equivalent schedule for each year dating back to 2000 in page 35 of the publication. So if you claimed $5000 business miles in 2012, you would multiply 5000 X .23= 1150. You will then figure out each total based off of the business mileage claimed for that year and multiply it by depreciation rate per mile for each year. Once you determine totals for each year, you will add all those up and that is the first value you will record.

You should keep a record of this every year until you sell the car. Meanwhile, delete the information you have already recorded in Sale of Business Property because you haven't sold it yet. Once sold, you may report it then.

As an FYI, if you actually sold it, value 1 is the total of all the depreciation equivalents form years 2012-2022. Value 2, is zero. This would only apply if you had taken actual expenses and not the mileage rate every year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Audio82

New Member

TaxWander

Level 3

megsrocky84

New Member

big toes

Level 2

wully7309

Level 1