- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Help! I plan to converting a business and personal car to personal use - How to report it and recapture the depreciation?

The car used for business activity was purchased as a personal car back in 2009. Then in 2011 I started using it for my business along with personal use. I have been taking a standard mileage deduction all these years. In 1/1/2023, I converted this vehicle to personal use and I didn't sell it. In "Business and Income expenses", I select "I stopped using this vehicle in 2023" and put the date "1/1/2023".

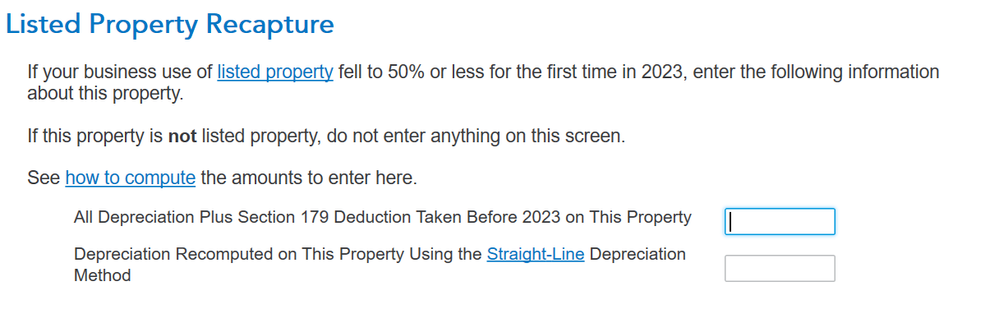

I followed the instruction on TurboTax. Go to the Less Common Business Situations section. Choose Sale of Business Property. On the next screen, Any Other Property Sales?, check the recapture box to enter your recapture information. I had business miliage and personal miliage for each year from 2012~2022.

1. For the first value, should I use the "Depreciation Rate per Mile" multiply "Business miliage" and add every year? Or should I use schedule C part II line#9 (Car and truck expenses) and add them every year?

2. How do I calculate depreciation using the Straight-Line Depreciation method for second value?

I read othe questions but am still confused. Thank you.