- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- depreciation being possibly incorrectly included on property rented < 1 year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

I closed on a condo on 5/4/21. At that time the property was tenant-occupied and I assumed ownership of their lease. The tenants occupied the property until their lease ended on 6/30/21 and I moved in two days later. The condo was my primary residence for the remainder of 2021.

I received prorated rent for May from the condo's seller as a part of the closing transaction and a rent payment from the tenants for June. During 2021 I paid insurance, mortgage interest, HOA dues, and repairs on the condo.

I entered all of this into TurboTax and it is giving me a depreciation credit I don't think I should have. Here is how I entered the information into TurboTax:

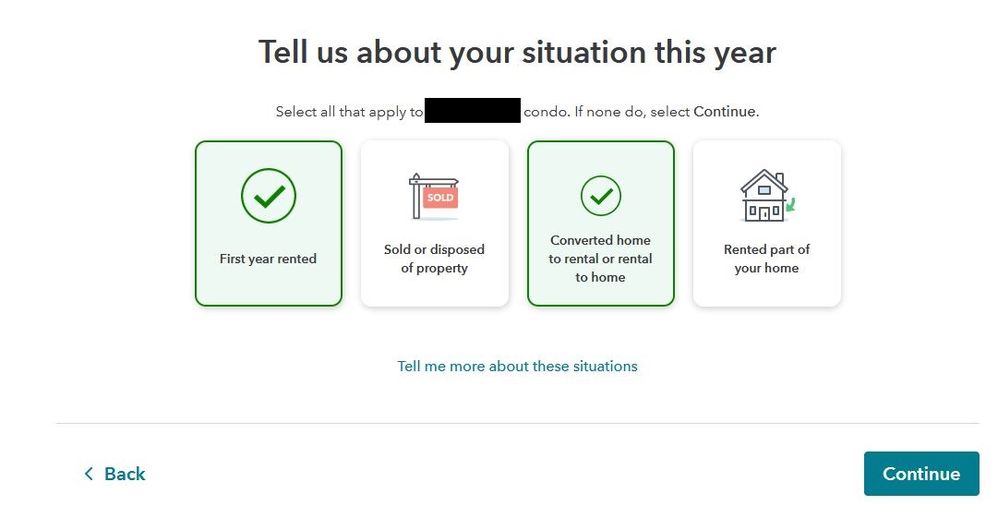

"Tell us about your situation this year"

-> "First year rented"

-> "Converted home to rental or rental to home"

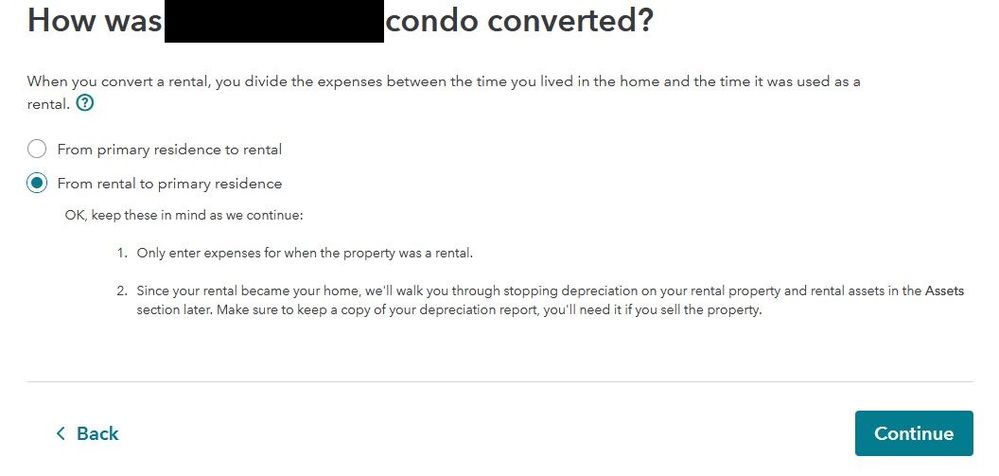

"How was condo converted?"

-> "From rental to primary residence"

Then TurboTax tells me:

Since your rental became your home, we'll walk you through stopping depreciation on your rental property and rental assets in the Assets section later. Make sure to keep a copy of your depreciation report, you'll need it if you sell the property.

I then filled out the rest of the information (expenses, etc.). When I click on the Edit button next to the "New rental property" text under the "Assets" heading, I reach a screen that says:

"Congrats on renting out condo for the first time!"

I then answered the following questions:

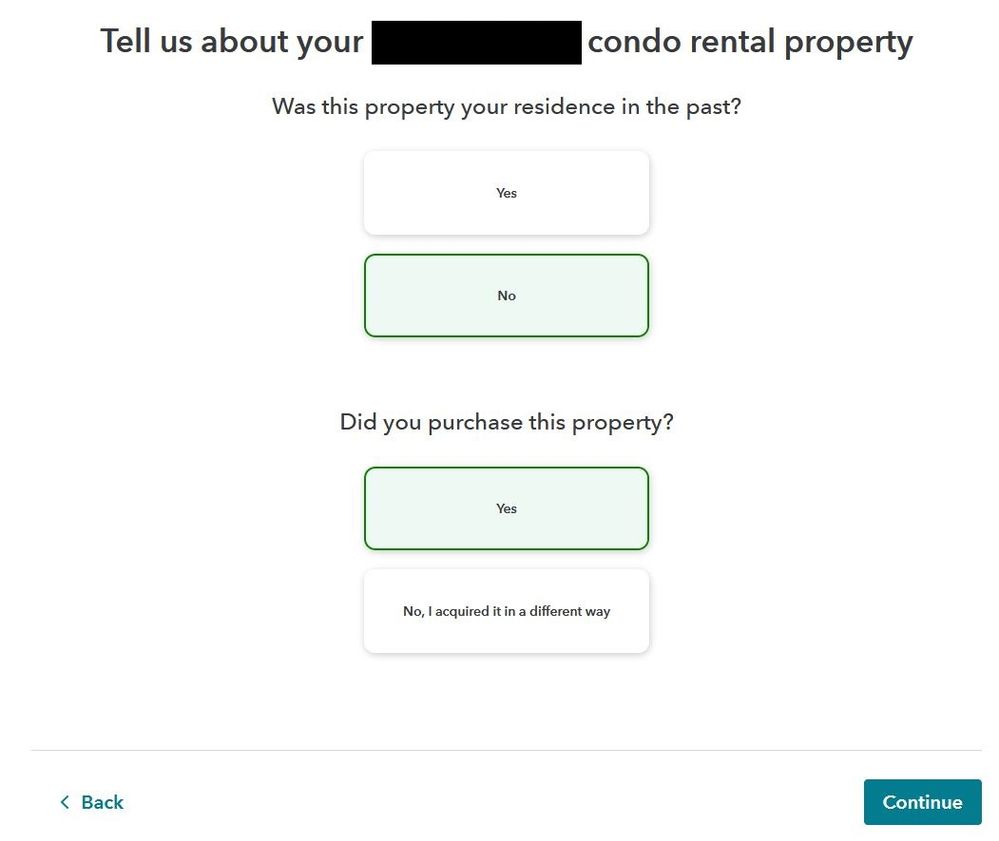

"Was this property your residence in the past?"

-> No

"Did you purchase this property?"

-> Yes

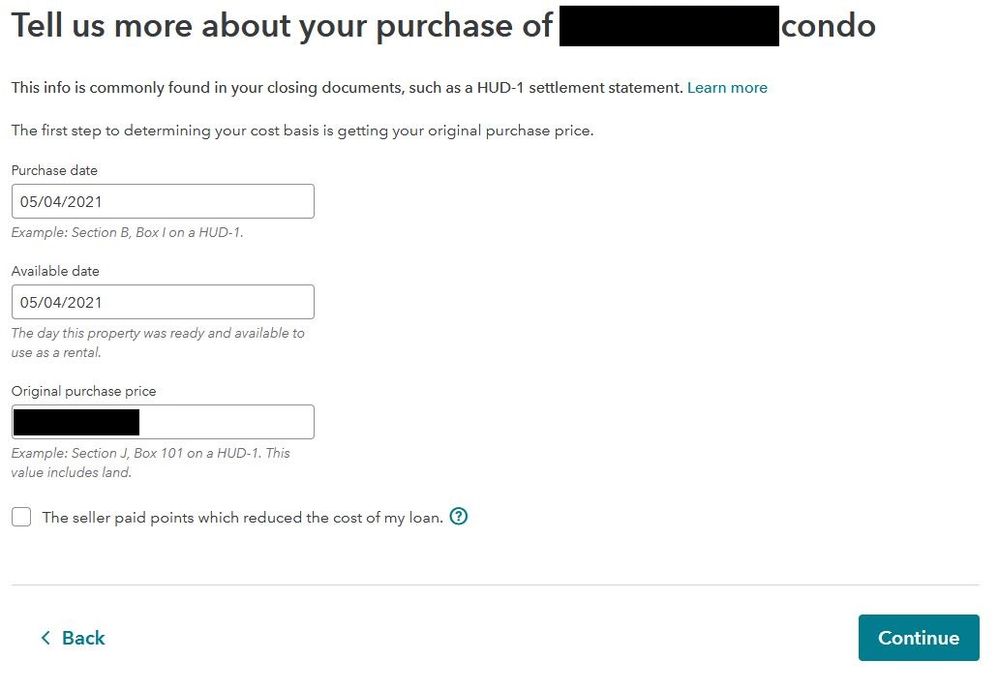

I then went through several more screens of entering purchase information (original purchase price, purchase date = sale date, escrow fees, property tax info, etc.) and finally reach a screen that says:

Rental expense deduction

$7,292

The deduction appears to be due to depreciation but I don't believe it applies to my situation. IRS Publication 527, page 6 says (https://www.irs.gov/pub/irs-pdf/p527.pdf:(

Excepted property. Even if the property meets all the requirements listed earlier under What Rental Property Can Be Depreciated, you can’t depreciate the following property.

• Property placed in service and disposed of (or taken out of business use) in the same year.

Given the above, is this a problem and how do I fix it? Did I answer a question incorrectly during the interview?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

You are correct. You do not take depreciation for property that is placed in service and removed from service in the same year. Did you enter the date of purchase, and the date of the conversion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

For your specific and explicit situation, this is simplicity at it's best. For that property in the assets/depreciation section, simply enter the same exact amounts in both the COST and COST OF LAND column. Then no depreciation will be taken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

I think I found part of the problem - I forgot to enter my days of personal use. Once I did that, the depreciation credit dropped off.

Related question - now it's showing 0 net income for the rental even though rental income exceeded the portion of expenses allocated during the time the property was rented. Does that sound correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

No, it does not sound correct. You should have no personal use days entered. Personal use only applies during the period of time that the property was considered to be a rental property.

It was a rental property from the time that you purchased it until the time that you converted it to your personal residence. You would only enter personal use days if you used the property during that couple of months that it was considered to be a rental property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

The interactive help says:

A day of personal use is any day, or part of a day, that your property was used by:

1) you for personal purposes

The following are NOT treated as personal use days:

* days you used the dwelling as your main home before (or after) renting it, if:

1) the unit was rented 12 months or more or will be.

2) the dwelling unit was not rented 12 months or more but was sold.

I used the dwelling for personal purposes but neither 1) or 2) apply in my case, so wouldn't my usage be treated as personal use days?

Also if I remove the days of personal use, does that mean I need to manually calculate what portion of my expenses apply to the period of time the property was used as a rental? When I had days of personal use included the fraction that applied to the time the property was used as a rental was calculated automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

Given that this isn't accurate, wouldn't I need to file an amended return to fix the basis if I ever decided to rent the property out in the future?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

I'm not seeing a screen exactly like the one shown in your post. How do I get to it? I did enter the "Purchase Date" and "Available Date" (5/4/21). I don't see where to enter a conversion date. I did enter a "Days rented" in the box under "Rental type and usage" when I clicked "Edit" next to "Rental property info".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

There is no information as to whether or not you rented in 2021. If you did, enter the information in the Rental Section. If not, enter it in Sale of Business Property.

Full steps for entering rental property:

- The first entry for the sale is found during the set-up of the property: Tell us about your situation this year/Click Sold or disposed of property

Next, the asset section of expenses will already be checked:

*Assets

*Sold rental property

Includes info on the property you sold or disposed of. Since we know this applies to you, we've already selected it.

- After you click on Asset, you will be asked about the purchase: Tell Us About This Rental Asset

- In the screen Tell Us More About This Rental Asset, you will indicate the sale the date of the sale, and the date you began using it for business. You can see the screenshot in a previous answer.

- Next: Confirm Your Prior Depreciation

- Next: Special Handling Required?

- Next Home Sale?

- Next: Sales Information. This is where you will be asked about the sales price.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

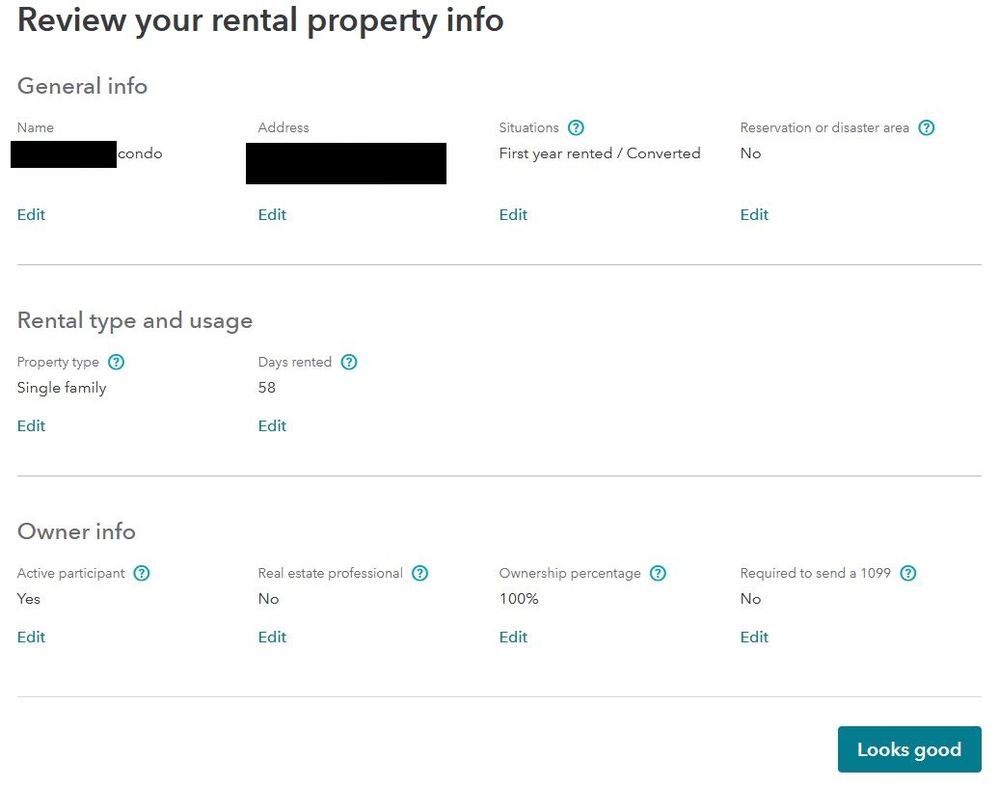

I didn't sell the property - it became my primary residence after the tenants moved out. Here are the selections I made on each screen:

Did I enter one of those incorrectly given my situation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

Your entries look good except I don't see where you marked that you purchased the asset new for 2021. You need to mark that you purchased the property in 2021. That would also be causing the depreciation issue. The program doesn't know all the facts. Once you mark the purchase information, it should ask about the conversion date. Right now, the program thinks you have had this property for a while.

Carl is right about the cost and land to get through the depreciation part, if necessary. There is a big difference between worksheets used and information entered versus what actually goes on your tax return. In the case of basis = land, nothing goes on your tax return. When you decide to rent the condo later, your basis may well have changed with improvements and such anyway.

Your goal is for the tax forms to be correct. The entries and worksheets are just helpers that do not go to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

The purchase date was entered 2 screens after the one in my prior post titled "Tell us about your ___ condo rental property". Here is the screenshot:

Is there some other place the purchase date needs to be entered?

> Once you mark the purchase information, it should ask about the conversion date.

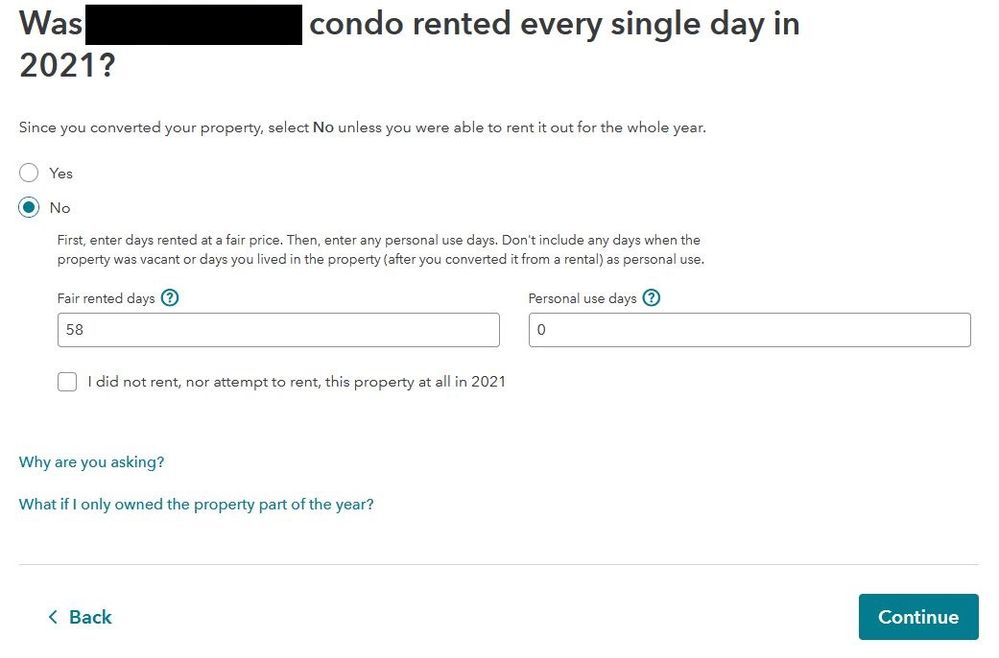

I can't find a place to enter the actual conversion date. There is a screen that starts with "Since you converted your property, ..." and asks for the number of "Fair rental days" and "Personal use days" (see 3rd screenshot in my prior post). Is there somewhere else that is supposed to ask about a specific conversion date as opposed to just calculating it from the other information I have provided?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

I updated my software and the conversion question regarding date is not there. You were able to eliminate the depreciation. You just need to report the income and expenses associated with the rental. The date of change only matters in that you get the right expenses. Are you able to report just the income and expenses that go with your rental?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

Despite what Publication 946 says, I am convinced that depreciation *IS* allowable for real estate even if it is in service for less than a year.

There is a Regulation that states the rule that depreciation for property that was "placed in service" and taken out of service during the same year is not allowed. However, that Regulation does NOT apply to real estate, and even though I have extensively looked, I have never found anything that disallows the depreciation for real estate.

So that is why TurboTax is calculating the depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

depreciation being possibly incorrectly included on property rented < 1 year

> However, that Regulation does NOT apply to real estate, and even though I have extensively looked, I have never found anything that disallows the depreciation for real estate.

This is possibly a dumb question, but what is the difference between a "property" and "real estate" in the context of your post? I would think those terms are interchangeable but this is the first time I've ever had to consider depreciation.

I ended up filing my taxes with a different product and their support reps confirmed I was not seeing any depreciation in their version of my taxes due to Publication 946. It's also possible their software was wrong.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

c0ach269

Returning Member

SB2013

Level 2

Idealsol

New Member

SB2013

Level 2

Kenn

Level 3