- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Depreciation Basis - Land Value "Market" vs. "Taxable" Value ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Basis - Land Value "Market" vs. "Taxable" Value ?

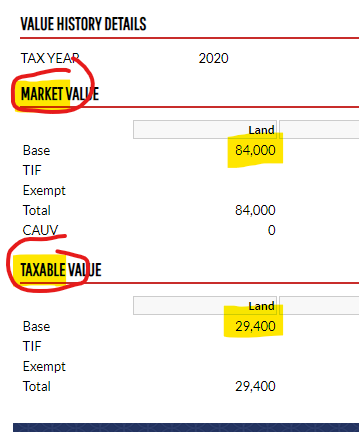

What should be used for a rental property depreciation calculation for Land value?

"Market" vs. "Taxable" ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Basis - Land Value "Market" vs. "Taxable" Value ?

none of the above. Land is rarely depreciable. the only situation I've ever come across where it was was when it was used as a waste dump by a private company. after so much no more use.

as for splitting the cost of real property between land and buildings, it's supposed to be based on their relative values. however, many tax bills do not reflect their true value. ask a realtor in your area.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Basis - Land Value "Market" vs. "Taxable" Value ?

Thanks for the response. Yes, I am aware of that. I'm asking in the context of subtracting the value of the land from the purchase price of the property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Depreciation Basis - Land Value "Market" vs. "Taxable" Value ?

@Mike9241 - can you help based on my clarification? Thanks

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

syounie

Returning Member

alvin4

New Member

jack

New Member

melillojf65

New Member

iqayyum68

New Member