- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Confusion about "Enter Prior Year Roth IRA Contributions"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confusion about "Enter Prior Year Roth IRA Contributions"

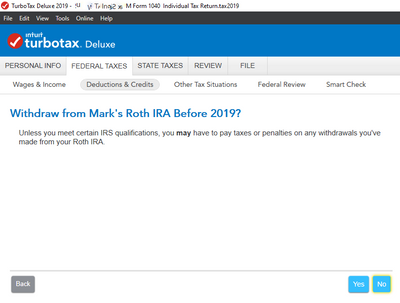

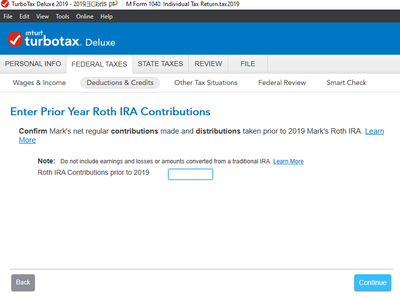

I am not yet 591/2, and unfortunately my total Roth IRA withdrawals—early distributions—from the inception of my account through the end of 2018 exceed the total contributions made for that same time period. Therefore, for my 2019 taxes, when this Turbo Tax page is asking me to "confirm my net regular contributions made and distributions taken prior to 2019," what am I supposed to put in the blank? Zero? I know this means I am going to pay one heck of a penalty. 😱

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confusion about "Enter Prior Year Roth IRA Contributions"

It asks for the total of ALL contributions ever made to any Roth IRA account that you have not already withdrawn. Removing your own contributions are never taxable.

For example, if you have contributed a total of $50,000 to Roth IRA's over the years and last year (or before) you withdrew $6,000 then $44,000 would remain so that is what you would enter. If you have never has any distribution from any Roth IRA account then the total is what you enter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confusion about "Enter Prior Year Roth IRA Contributions"

But I have withdrawn money from my Roth IRA...a lot. In fact, my withdrawals exceed my contributions, which means I've benefitted from the earnings as well. Using your example, if I had contributed $50,000 through the end of 2018 and withdrawn $58,000 during that same time period, I would have a negative number. That's why I think I am going to have to put "0" in the blank and end up paying a hefty penalty. Isn't that correct?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

loyal-but---user

Level 3

mariocelaya2

New Member

joycesyi

Level 2

zbchristy501

Returning Member

johnsantaclara1

Level 4