- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

Last year I lost about $4500 due to a cryptocurrency investment scam. I'm not sure how to properly record this as a loss on the forms. I should clarify, this was due to a Ponzi-Scheme type of loss (Shizupan/"Pig Butchering" scam).

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

You were able to write off theft against business income but not as a capital loss in the past.

Even if your situation was a theft from your business, you would not be able to claim the losses today, unless the loss was attributable to a federally declared disaster.

This deduction has been suspended until at least 2026 under the Tax Cuts and Jobs Act (TCJA) that went into effect in 2018.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

If you want to deduct this, you should consult a tax professional in your area.

The issue is, is this an investment loss or a theft loss. If it's an investment loss, you report the loss by "selling" the investment for zero dollars, and reporting whatever taxable basis you had (the money you originally invested). If it's a theft loss, it's not deductible due to the tax reform law which otherwise increased the standard deduction and lowered the tax rates to offset the lost deductions.

Generally, the difference between a theft and a loss is that in a theft, there must be a thief. There is a tax court case of a forged painting. When the taxpayer discovered the forgery, they wanted to take a theft loss for the lost value, because that deduction was better for them in their situation. But the facts were that the forgery was at least 80 years old, so neither the gallery owner who sold it or the previous owner who consigned it could be said to be a "thief". Since no thief could be identified, the court ruled it was an investment loss, and that they couldn't even deduct the investment loss until they realized the loss by selling the painting for less than they paid.

Turning that around, a cryptocurrency that fails due to bad coding or market forces might be a loss, but if there is a thief, then it's theft.

If you deduct it as an investment loss and are audited, you would have to prove it was not theft and there was no thief, and it was just a badly run business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

The other possibility is special rules relating to Ponzi schemes. The problem is, I can't find a definitive statement on whether or not Ponzi scheme losses are still allowable even though general theft losses are not. (This is complicated because investment losses are deductible, and theft of personal property is not deductible, but Ponzi schemes are in between.)

You may want to see a tax professional. Also, Ponzi losses are not supported by Turbotax, so you will have to figure it out yourself using the IRS revenue procedures.

https://www.irs.gov/newsroom/help-for-victims-of-ponzi-investment-schemes

The IRS provides two items of guidance to help taxpayers who are victims of losses from Ponzi-type investment schemes.

- Revenue Ruling 2009-9 provides guidance on determining the amount and timing of losses from these schemes, which is difficult and dependent on the prospect of recovering the lost money (which may not become known for several years).

-

Revenue Procedure 2009-20 simplifies compliance for taxpayers by providing a safe-harbor means of determining the year in which the loss is deemed to occur and a simplified means of computing the amount of the loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

What if all the company officials were Russian actors? It turns out that the "Ponzi scheme" I invested in was all run by actors. The actual thief was never identified, and the trading website disappeared! I don't believe there's any chance of ever recovering the money! Can I explain this to the IRS if audited, and still put it down as an investment loss? Also, if I don't put it in as an investment loss, can I use the basis of the crypto purchase on other sales IE; first in, first out rule, as if I still owned the original investment?

So, I have the original basis(purchase price), and the date and price it was transferred to the trading scam. It's obvious it was converted to their trading platform at that time. Should I just report this as a sale of crypto at that time, even though I gained nothing?

I would appreciate some clarification on this. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

@Philouis wrote:

What if all the company officials were Russian actors? It turns out that the "Ponzi scheme" I invested in was all run by actors. The actual thief was never identified, and the trading website disappeared! I don't believe there's any chance of ever recovering the money! Can I explain this to the IRS if audited, and still put it down as an investment loss? Also, if I don't put it in as an investment loss, can I use the basis of the crypto purchase on other sales IE; first in, first out rule, as if I still owned the original investment?

So, I have the original basis(purchase price), and the date and price it was transferred to the trading scam. It's obvious it was converted to their trading platform at that time. Should I just report this as a sale of crypto at that time, even though I gained nothing?

I would appreciate some clarification on this. Thanks.

I don't have any additional information for you than what I posted above. You may want to discuss with a tax professional. Theft losses are not deductible unless the theft occurs as a result of a declared disaster. Investment losses are deductible. Ponzi schemes are a gray area since they are both.

Looking at your facts, and thinking about crypto scams in general (where the scammer creates a coin and steals the initial investment) it sounds a lot more like a non-deductible theft than a traditional Ponzi scheme which usually plays out over years. But I am not a tax professional. If you want to deduct this as a Ponzi loss, you should seek professional advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

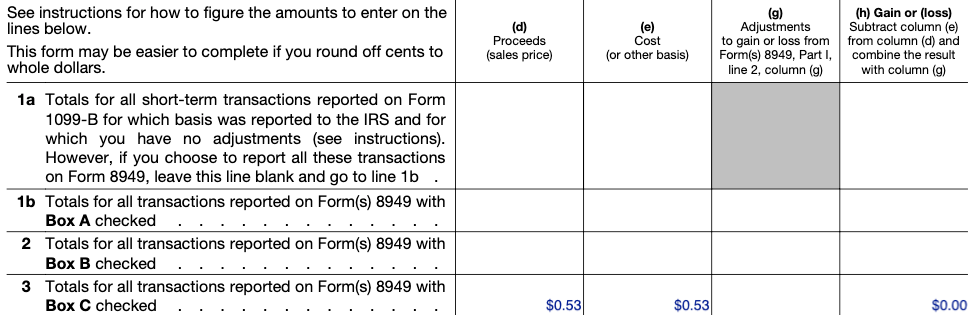

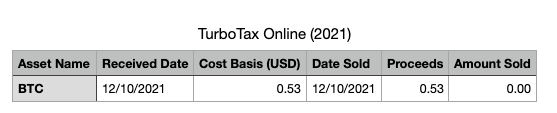

I lost my cryptocurrency to a scam, so there is no gain but loss. I used CoinLedger as the crypto service to generate the tax report and form 1040(screenshot 1 below), but the result was only 0.53 as proceeds(screenshot 2 below is the CVS report below). If their report doesn't include any loss, do I still need to file it on TurboTax? The reason I asked is that I purchased the desktop version but it doesn't support crypto. If there is nothing to file, (as I have no gains and loss is not listed, I can still use the desktop version to file and do not need to buy the TurboTax online version to file tax, correct? Does that make sense? Or I should still need to buy the online version in order to upload the $0.53 proceeds on the crypto. Does IRS only require filing if there is gain, loss, and income?

Below, their CVS report for my crypto transaction doesn't list anything but only the $0.53 proceeds. For Schedule D(screenshot above) again shows no gains and no loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

with desktop you can go into forms mode

then click on "forms" at top left

the open form or F6

enter capital asset sales in the jump to line

double click on the worksheet (wksht)

highlight the worksheet then finish

then the blue add form

you are now where you can enter the single item from the info shown for Turbotax online

or in step-by-step mode

wages and income tab

the select the blue choose icone

scroll down to investment income

on the line that says stocks bonds click on start

click thru til it asks did you get a 1099-B answer yes

select I'll type it myself

when asked enter anything for name it's not really used

i'll enter one sale at a time

as for what you lost in the scam. if it was a PONZI type scheme you can claim a casualty loss (an itemized deduction)

note that in the desktop version you must check the rev proc line right above the quick zoom for PONZI type scheme.

if you're not sure it was a PONZI type scheme check with a tax pro.

note this will only benefit you if loss and other itemized deductions exceed your standard deduction

you can not take a capital loss.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

I don't believe that losses on cryptocurrency held for personal use are deductible, although others have a different opinion.

Losses on cryptocurrency held for investment purposes are deductible on schedule D. You can enter the loss manually (under sales of stocks, bonds and other investments) if you don't have a statement you can import.

Theft due to a Ponzi scheme is also deductible by a different process, and applies to either an investment loss or personal loss. But it really needs to be theft, with an actual thief or thieves who stole the money, and not just a badly run failed business.

With a capital loss, you can deduct up to the amount of your capital gains plus $3000, if the loss is more than that, you carry it over to the future. With a Ponzi theft loss, you can deduct it all at once, but there is a deductible equal to 10% of your gross income. Ponzi losses are also somewhat tricky to calculate for example--if you invested $10,000 and they claimed your investment was worth $20,000 before they shut down, you didn't really lose $20,000, and you might have gotten some money back early, which makes it more complicated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

What about the online version?

where can you enter Ponzi Scheme?

The issue here I have is that I have purchased the desktop version(without knowing it doesn't support cryptocurrency investment). If the cryptocurrency investment was lost to a scam and there is no income, gain, or loss, can I just use the desktop version and not worry about posting cryptocurrency transactions?

Does IRS require to post all the transactions or only file if you have income, gains, or loss?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

I fell into the "Pig Butchering" scam and lost all the money. I've read all posts here. I've been looking for the answer but nothing is clear. Wonder if anyone is being in the same with my situation has found out the solution or found the right tax professional that understands and helps you out, please Pls share/introduce to me. I'm looking for one in Massachusetts area but haven't found any yet.

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

Not sure about the nature of a "pig butchering" scam. If it was an investment, the most efficient way to claim a loss is if you were able to close the transaction such that you realized a loss. In other words, you were able to sell your investment which would allow you to realize a loss. To claim this was a worthless security is more complicated and we would need more information from you to better assess your tax situation. Moreover, even with additional information, our advice may be to seek assistance from a personal tax advisor.

A theft loss may be an option for you, although, there are requirements for proving theft and similar to a worthless security, whether you can claim a theft loss will turn on the evidence. A theft is the taking and removal of money or property with the intent to deprive the owner of it. The taking must be illegal under the law of the state where it occurred and must have been done with criminal intent. The amount of your theft loss is generally the adjusted basis of your property because the fair market value of your property immediately after the theft is considered to be zero.

Below is a link to an IRS webpage that addresses casualty, disaster, and theft losses which you might find helpful.

Casualty, Disaster and Theft Losses

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

Thanks for your response. You might have already known about "Pig Butchering Crypto Scam" and I add it here for anyone that hasn't known yet:

The latest crypto scam is being called “pig butchering” because it is a heavily scripted and contact intensive fraud meant to fatten the prey (or victim) before slaughter (or taking their money).

Emanating from Southeast Asia, the crypto investment scam typically starts with the fraudster making contact with the victim via social media, dating apps, or WhatsApp using a fake profile. They slowly build a relationship and rapport to earn the victim’s trust before casually mentioning they make significant amounts of money through cryptocurrency investments.

When the victim expresses interest in making an investment, the scammer will direct them to websites that appear to be legitimate cryptocurrency exchange platforms. In reality, the scammer exclusively controls the exchange.

The victim will usually go to a mainstream exchange like Coinbase, buy stable coins (like: 1 USDT = 1USD), and transfer a few small investments to the fake platform’s wallet. The scammer will then post modest gains and even allow the victim to withdraw small amounts of money once or twice as a way to build trust and prove the platform is legitimate.

Once convinced that the platform is legitimate and the gains are real, the victim will start making larger investments, sometimes in excess of hundreds of thousands of dollars. In many cases, victims get this money from personal loans, retirement assets, and home equity lines of credit.

When the victim eventually wants to withdraw the larger investments made, they are denied by the scammer. The fake platform will say the victim must pay a percentage (10-30%) of the requested amount in taxes before the withdrawal can be processed. This requirement is a lie. Even if the victim does pay the purported taxes, the scammer will continually deny the withdrawal of funds for one reason or another.

Eventually, the scammer vanishes, cuts off contact, and takes the victim’s invested money resulting in another successful pig butchering crypto scam.

So far I haven't got any clear info of how the victims could claim their losses on tax return. I've been reaching out to check with the a few local tax specialists but none of them have experienced with this situation. They mentioned the Ponzi scam but Ponzi is different; which the investors transfer money directly from their banks to the companies that probably can be traced by the U.S. via the bank transactions. On the contrary, the Pig Butchering scam is the investors transfer money from their banks to their legal crypto wallet (coinbase) and then purchase the USDT to transfer to the fake exchange platform (could be international). Soon the money transferred to the fake exchange platform via the private encrypted keys, it's gone without trace...

My case is probably the same as @jadoye ; wonder if Jadoye has found the solution yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

The additional information you provided seems to suggest that the scam was marketed as a type of investment product where investors' funds were managed by the promoter of the investment. It further seems to suggest that the investors were seeking to make a profit and at times were able to withdraw funds. However, at this time, perhaps no one knows definitively how the money was handled. Was it at any time invested in any legitimate venture or was it a situation where early investors were allowed to withdraw some money all of which came from later investors--your basic Ponzi scheme.

Your best option may be to continue to pursue this as a theft loss. As noted in the prior post, theft losses of this type are fact specific, and the facts need to prove:

- that a theft occurred under the law of the jurisdiction wherein the alleged loss occurred,

- the amount of the loss; and,

- the date the taxpayer discovered the loss. The taxpayer bears the burden of proving by a preponderance of evidence that a theft actually occurred.

Intent to defraud is a question of fact to be determined from all the circumstances of the case and usually must be proved circumstantially. Courts must examine the evidence to determine whether an alleged thief behaved in a manner consonant with an intent to defraud; a record establishing a mere ordinary breach of contract or fiduciary duty will be insufficient to support a finding of a party’s intent to defraud.

You need to collect your documents, particularly those that support your money transfers, and speak with an attorney about initiating a complaint alleging theft. If this matter involves any type of offshore activities, then you might have to discuss the matter with federal authorities.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I claim a capital loss from lost cryptocurrency due to a cryptocurrency investment scam?If so, how would I do this?

The fake platform called "bitso.vip or bltso.vip" and I guess it's not in the U.S.

All the docs of transactions I do captured all. The problem is I couldn't be able find the right tax professional in MA that has done/experienced the same case as mine to help me to file the tax return. I've talked to a few and they said they need to do the research to find out and will charge me per hour. I'm in the difficult situation after lost all the money and wouldn't be able to afford paying too much for the tax professional's research. If they have done helping the scam victims in the same case and confirmed, then I can try to find money to pay their fee within my affordable budget.

I don't know if you have any connection to the tax professional that you can recommend?

The scam I've got is the same as this one:

Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

zyppy

Returning Member

eveonbike

New Member

howverytaxing

Returning Member

shani20902tt

New Member

marvingurewitz

New Member