- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

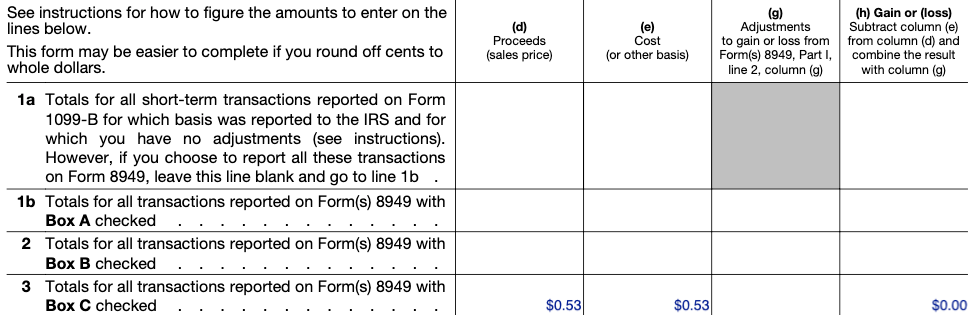

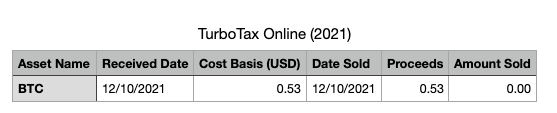

I lost my cryptocurrency to a scam, so there is no gain but loss. I used CoinLedger as the crypto service to generate the tax report and form 1040(screenshot 1 below), but the result was only 0.53 as proceeds(screenshot 2 below is the CVS report below). If their report doesn't include any loss, do I still need to file it on TurboTax? The reason I asked is that I purchased the desktop version but it doesn't support crypto. If there is nothing to file, (as I have no gains and loss is not listed, I can still use the desktop version to file and do not need to buy the TurboTax online version to file tax, correct? Does that make sense? Or I should still need to buy the online version in order to upload the $0.53 proceeds on the crypto. Does IRS only require filing if there is gain, loss, and income?

Below, their CVS report for my crypto transaction doesn't list anything but only the $0.53 proceeds. For Schedule D(screenshot above) again shows no gains and no loss.