- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Allowed losses are not transferring from 8582 to Sch E

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allowed losses are not transferring from 8582 to Sch E

I have several K-1s entered and the allowed losses are correct on the form 8582 as well as the continuation statement, but they are not transferring correctly to Sch E from 8582. The numbers from the continuation statement seem to be transferring correctly, but not from the actual form 8582.

The program seems to be adding a loss to other income on Sch 1, but even that does not quite balance out correctly.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allowed losses are not transferring from 8582 to Sch E

What entries are you seeing in Part II of the Schedule E that look out of place? Please clarify.

What entries on IRS form 8582 Passive Activity Loss Limitations are incorrect?

The entry on Schedule 1 Additional Income and Adjustments to Income line 5 should transfer from Schedule E Supplemental Income and Loss line 41.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allowed losses are not transferring from 8582 to Sch E

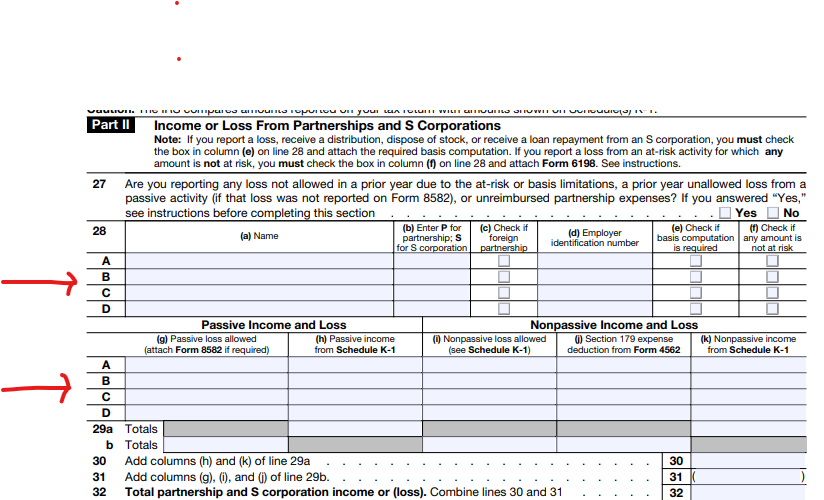

If I am understanding the form correctly...... On Schedule E Part II Line 28 column (g) the allowed loss figures should match the allowed losses for the same activities from 8582 part VIII. The figures from the continuation statement of form 8582 match exactly to Sch E, but the figures coming directly from 8582 part VIII do not match.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allowed losses are not transferring from 8582 to Sch E

If the loss is not being reported on iRS form 8582 Part VIII, on what section of IRS form 8582 (page 2) are they being reported?

As an example, a passive loss may be allowed on Schedule E line 28(g) and be reported on IRS form 8582 Part V because some other source of partnership income has been reported which 'covers' the loss reported on box 1 of the K-1.

Is this the source of the 'other income on Schedule 1' that you referred to? Is this the 'other income' reported on Schedule 1 line 8z? Schedule 1 line 4? Or somewhere else?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allowed losses are not transferring from 8582 to Sch E

Similar to the initial person who posted this question, I too am seeing that the passive allowed loss on Form 8582 (PART VIII) is not accurately reflected on Schedule E (line 28 g). Please help us understand why. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allowed losses are not transferring from 8582 to Sch E

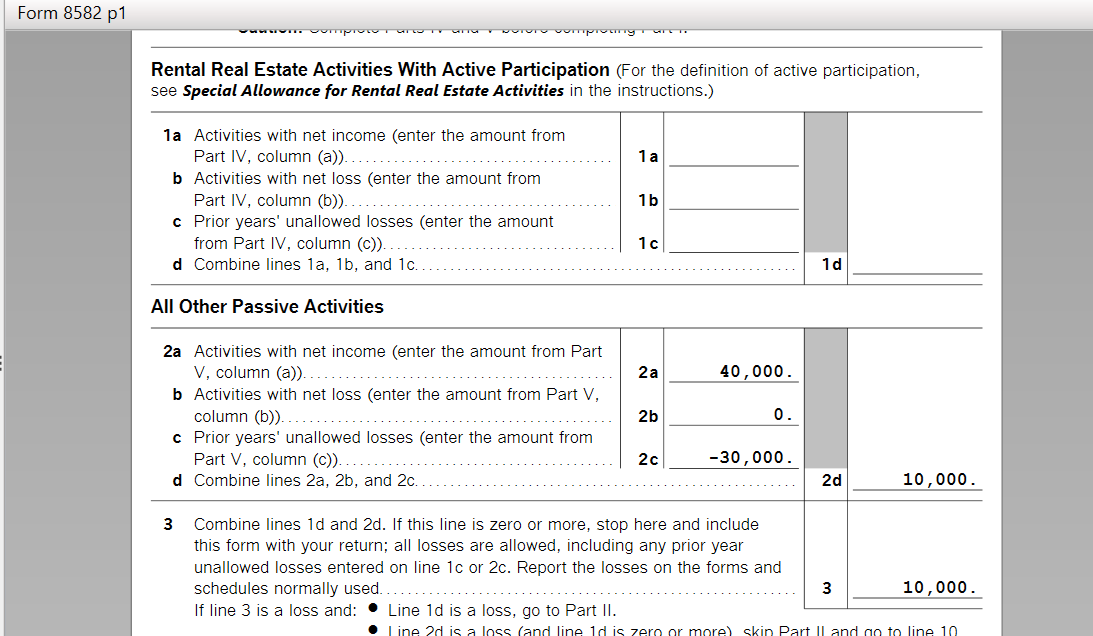

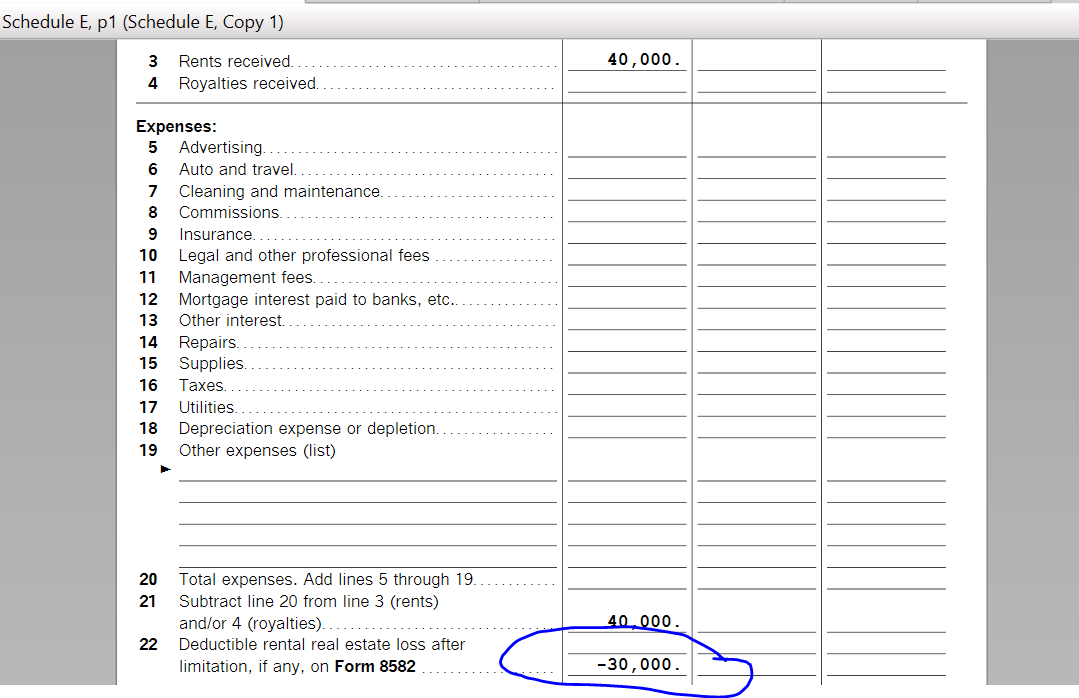

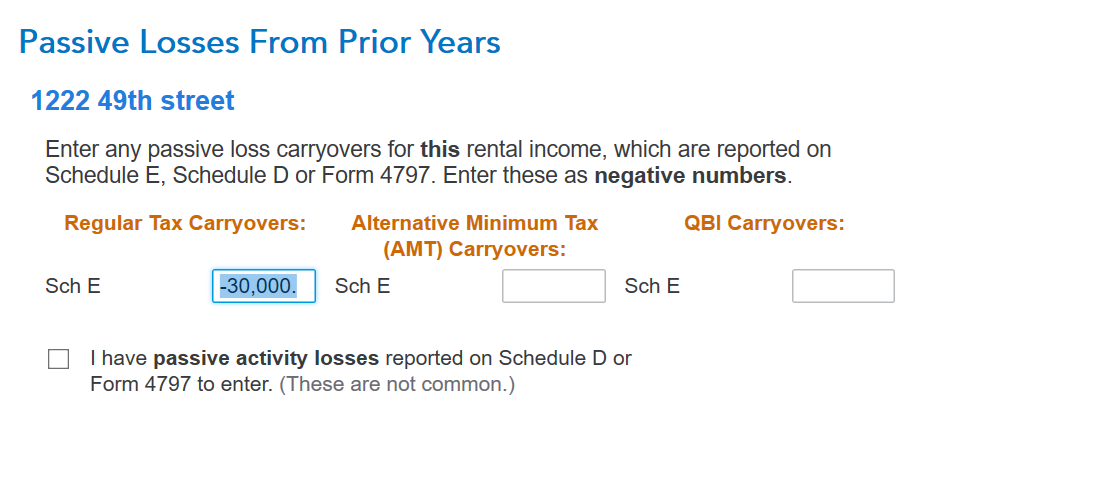

I tested it all out. By me it flows through seamlessly. See here

All entered from the original input here

I hope this helps you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JB_Tax

Returning Member

rhartmul

Level 2

mjtax20

Returning Member

patamelia

Level 2

Stevesleft

Level 1