- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 475 MTM elected trader 1099 misc wash sales

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

I qualify and elected for 475 MTM 2 years ago and changed my accounting when i filed my taxes in 2023. My question is, I called Fidelity my broker and although I submitted a wash sales suppression form because I am MTM, they keep showing wash sales in my 1099 misc. When I called them, they said they're not supposed to suppress wash sales from short sales.

Is this true? I thought MTM meant that "traders who make the Sec. 475(f) election are deemed to have sold all their stocks and securities for their FMV on the last business day of the tax year. In other words, every position in the trader’s trading account is marked to market and is deemed to be sold at that price at the end of each year. As a result, traders must recognize all gains and losses on the constructive sales as of that date."

does this not account for short sales?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

where is the fidelity form for "suppression of wash sales"

I'd like to see what it says. I have a fidelity account.

-

Are you saying tha only wash sales listed are related in some way to a short sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

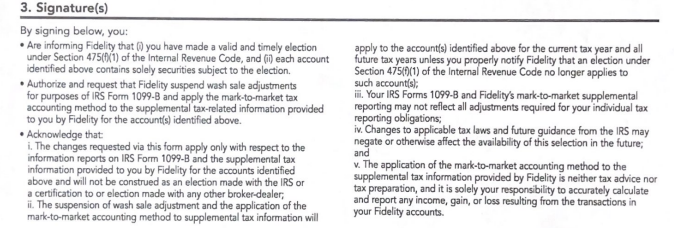

the form you can't find online, they have to email it to you. It is 1 page long, i put my name, my social, my fidelity account # and sign. The name of the form is called Mark-to-Market Accounting and wash sales suppression. here's the only fine print of the form attached

I submitted for this last year July 2023, and when i received my 1099, it had wash sales, when I called they said "you're right, they should be suppressed, let me send this to our tax team"... weeks later the tax team said "it's correct, those are just suppression of the short sales". I called back saying that makes no sense, by law when i filed for 475 MTM and qualified, it's supposed to only show my net gains or net loses for the year and all sales are to be considered as closed as of end of each day. No wash sale rule applied.... they called back and said, "nope, the forms are correct"... but my tax CPA team say No, the forms are wrong... so i don't know who is right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

A) IRS rules for reporting transactions are not always the same for brokers as for individuals.

B) Fidelity doesn't give tax advice. your tax professional does.

C) it's very difficult to get outfits like Fidelity, TD Ameritrade to admit their forms or reporting is incorrect.

D) see the acknowledgment disclaimer iii and v.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

thanks- yeah I talked to my CPA and they ask me to get fidelity to fix their reporting. But Fidelity refuse to do so. So I am not sure what to do now. I though by law they had to fix the reporting if I am MTM qualified and changed my accounting.... because of this, i fear my taxes are always wrong when we file them using this report.

Any recommendation on what to do with Fidelity? other than stop day trading the full month of December to avoid wash sales? lol... I don't want to have to leave them either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

is the disallowed amount equal to the proceeds from the short sale?

or is it the proceeds minus the security fmv on Dec 31?

The real question is how is this reported when you actually close the short in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

475 MTM elected trader 1099 misc wash sales

Fidelity doesn't show which sales are short vs which are long in the 1099 for me to know if the wash sales are disallowed just from short sales or not, but below is an example of what we see.

I trade every day multiple orders a day, in an out within minutes and sometimes seconds. never hold anything overnight. All with Margin. as you can see below, it shows realized gain/loss -147K, but loss disallowed is +138K - even when you add these up, the total is -9k - but I was net positive last year...

| Total Proceeds | 786,783,222.23 |

| Total Cost Basis | 786,930,372.97 |

| Total Wash Sales (loss disallowed) | 138,037.13 |

| Realized Gain/Loss | -147,150.74 |

| Box AShort-Term Realized Gain | 1,097,222.94 |

| Box AShort-Term Realized Loss | -1,244,373.68 |

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

J S

Level 2

mrlloyd95

Returning Member

olio1987

Level 3

fastlapp

Level 1

Jonfatica

New Member