- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

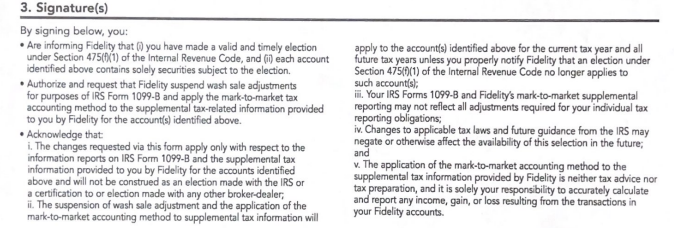

the form you can't find online, they have to email it to you. It is 1 page long, i put my name, my social, my fidelity account # and sign. The name of the form is called Mark-to-Market Accounting and wash sales suppression. here's the only fine print of the form attached

I submitted for this last year July 2023, and when i received my 1099, it had wash sales, when I called they said "you're right, they should be suppressed, let me send this to our tax team"... weeks later the tax team said "it's correct, those are just suppression of the short sales". I called back saying that makes no sense, by law when i filed for 475 MTM and qualified, it's supposed to only show my net gains or net loses for the year and all sales are to be considered as closed as of end of each day. No wash sale rule applied.... they called back and said, "nope, the forms are correct"... but my tax CPA team say No, the forms are wrong... so i don't know who is right.