- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1099-MISC Royalties from OK but live in TX with no land ownership nor business

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

Good evening,

I live in TX and received a 1099-MISC Royalties from a company in TX that drills in OK. Using TurboTax Premier, I have the following questions:

- 1099-MISC Line 2 Royalties: I have several options available to enter in royalties (a) OK W2 Wages, (b) OK Interest Income + Dividends, or (c) OK Rental, Partnerships, Etc. I believe my option will be 'c'. Is this correct?

- Gains or Losses from an Electing Passthrough Entity (PTE) (Yes/No): I have no idea what to enter here. I'm guessing this will be a 'Yes'.

- In selecting electing PTE 'Yes', TurboTax states "Enter any Oklahoma gains or losses covered by the election pursuant to the provisions of the Pass-Through Entity Act of 2019." If royalties = $1200, will $1200 be entered as a Gains in both "Total Amount" AND "Oklahoma Amount"?

- In the Passthrough Entity Information: I have "Passthrough Entity Name: ", "Passthrough Entity Employer ID Number: ", "Passthrough Entity Federal Taxable Income: ", and "Passthrough Entity Oklahoma Taxable Income: ". What do I need to enter for the "Federal Taxable Income" and "Oklahoma Taxable Income"? Is this where I enter $1200 under both?

- Oklahoma Adjustments: Lastly which of these applies to me "Income from an oil or gas well that is subject to depletion" or "Gain or loss from an electing passthrough entity" or "Other additions"? I do not believe the other handful of options apply to me.

Any help is greatly appreciated.

Thank you,

Tulane

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

It depends. You would enter the information FIRST in the federal return in your desktop version according to the steps I listed above, which includes the steps where you would enter your Oklahoma taxes withheld in Boxes 16-18. This information along with all your other income will populate in your Oklahoma non-resident return. You do not need to make any additional entries in your federal return.

Now when you prepare your Oklahoma non-resident tax return, you will allocate income that is Oklahoma income. in the allocations, all income will be mentioned. For the income that is excluded, leave those screens blank. The only income that will be recorded as Oklahoma income will be your royalty income that was already reported in your federal return. The amount allocated should be allocated here is your Royalty income minus the 15% depletion.

Now, i need to change my original answer regarding the 7% additional depletion allowance for Oklahoma. This will be entered as an Oklahoma subtraction because this will subtract rather than add to your Oklahoma income. First remove this from "Recapture of Depletion and/or Add Back of Excess Federal Depletion". We don't want this added to your income, but as a reduction because of the additional 7% allowance.

- Now go to the forms mode in your Turbo Tax program.

- Go to Schedule A-H in your Oklahoma State return of your software in the Forms mode and add $84 in Line 8 of this Schedule 511-NR-B Oklahoma Subtractions. Enter $84 in both columns.

I think also this you may have indicated this is a rental. It's not a rental, it is a royalty. This may be the reason why your depletion% is not being accounted for. Please review all your entries in your 1099 MISC section in the federal return and make certain where it asks what of income it is, indicate it's royalty income. Also there should be a screen that asks what type of royalty income it is, indicate it is Oil and Gas. This way, you will receive the 15% depletion allowance in your federal and state return.

Once everything is reported and done correctly, this is what your Form 511 NR form should look like this in the forms mode. Your overall income is not what is shown here but this does reflect Oklahoma source income in Box 4, which represents the $1200 income minus the 15% depletion percentage. Line 5 represents the additional subtraction that is the difference between the federal depletion and the additional Oklahoma depletion allowance. Here is the screenshot and how this is to appear in your return. Don't be concerned if all income is showing because your final return results because your Oklahoma tax is based on the percentage between Oklahoma based income and your overall income for the year. Your taxable income, if this is prepared correctly is $936, which represents your Oklahoma Sourced income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

Yes, you have chosen the correct answer for Oklahoma rental income. However, the remaining questions relate to income reported on Schedule K-1, not Form 1099-MISC. Change your answer for #2 to "no" and the next two questions will not be asked. For Oklahoma Adjustments, choose "income from oil or gas well that is subject to depletion."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

Hi, thank you PatriciaV for your insight. Having selected "income from oil or gas well that is subject to depletion", I now have "Oklahoma Oil Depletion Adjustment" that allows an optional depletion of 22%. TT states "If you elect this option, enter the allowable difference between your Oklahoma depletion amount and the depletion amount claimed on your federal return." As my 1099-MISC only shows Line 2 Royalties, I don't know if I can enter anything here. Is this correct?

In addition, I forgot to mention that my 1099-MISC also has line 16 "State Tax Withheld". Where do I enter in this number?

Thank you,

Tulane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

It depends. It sounds like you received a 1099 MISC rather than a K-1 so all steps in your original post in steps 2-4 are irrelevant so I would ignore these if this is the case.

If you are working in Turbo Tax Online, here are the precise steps you must take to complete your return.

- Go to federal>wages and income>other common income>1099 MISC

- Answer all questions regarding your royalty to complete your royalty information.

- After answering these questions, you will receive a screen that will allow you to enter income. Here you make the selection that your income comes from a 1099 MISC.

- When you begin recording information in your 1099 MISC, be sure you check the Box indicating My form has other info in boxes 1-17. This will expand the screen and you can enter your state tax information in Boxes 16-18.

- Once the information has been completed, your 15% federal depletion percentage will be automatically deducted and the net amount of your Royalty income will be reported in line 8 of your 1040 and your federal and state AGI will reflect this adjustment.

- Once done, your additional 7% depletion allowance will be factored in and subtracted from your Oklahoma-sourced income.

If you are working in Turbo Tax Desktop, the procedure is a little more complicated. Rather than listing this, if you are working in the Software, let me know at @DaveF1006 and I will list precise steps for completing this in Desktop.

[Edited 02/19/24|2:55 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

@DaveF1006 , I am using TT Premier from software on my desktop. Can you please give me instructions for filing my 1099-MISC? I have Line 2 Royalties and Line 16 State Tax Withheld to enter in.

Thank you,

Tulane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

Yes. Here is how to enter the information in the desktop version.

- Go to Federal taxes>Wages and Income

- 1099-Misc and other Common Income

- Income from Form 1099 MISC. Be sure to indicate this is Royalty income

- When you begin recording information in the form, be sure to check the box that mentions my Form has other information in Boxes 1-18. You will now have an opportunity to list the State Taxes that were withheld in Boxes 16-18. Be sure to enter the amount of royalty paid in Box 2 of the 1099 MISC form.

- Once this is finished and if this is properly filled out, you should see the net amount in Schedule 1 line 5 of your return that is a net amount after the 15% depletion is applied.

- Now you will go to the State Taxes Tab in your return and begin to prepare an Oklahoma State non resident return. Now begin allocating all your income. The only Oklahoma source income that should be claimed is the $1020 Royalty income.

- Now to claim the additional depletion allowance of $84, go to:

- The forms mode in your Turbo Tax software.

- Go to Schedule A-H in your Oklahoma return of your software in the Forms mode and add $84 in Line 8 of this Schedule 511-NR-B Oklahoma Subtractions. Enter $84 in both columns.

Let us know if this helps.

[Edited 02/19/24|2:25 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

@DaveF1006 , from Federal Taxes -> Wages & Income -> Source of 1099-MISC Income, there is (a) "Royalty investment income from a natural resource, intellectual property or other investment portfolio (no operating interest)" and (b) "Royalty income from being self-employed as a writer, inventor, artist etc. or operating any business derived from natural resources (Schedule C)". I chose 'a'.

Regarding your #6 below, before getting to "Oklahoma Adjustments", I entered in "Oklahoma Income", "Oklahoma Amount". Afterwards, Oklahoma Adjustments -> "Depletion recapture on a lease bonus on non-producing properties with a lease expired this year and/or add back of excess Federal depletion". For "Depletion Recapture", I have "Total Amount" and "Oklahoma Amount". If my Line 2 Royalties is $1200, then 15% depletion of $1200 is $180 and 22% of $1200 is $264. Therefore, $264-$180=$84 is my excess?? Do I put this number in both "Total Amount" and "Oklahoma Amount"? Is this correct?

Thank you,

Tulane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

Yes, you are correct. You would enter $84 in this section so you will receive this adjustment in your Oklahoma non-resident State return. You also are correct when you mention you report this as "A" "Royalty investment income from a natural resource, intellectual property or other investment portfolio (no operating interest).

I assume when you mentioned adding Oklahoma income, you allocated the Royalty income to the State of Oklahoma and all your other income blank when reporting this in your non-resident return. If this is an incorrect assumption on my part, just let me know.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

@DaveF1006 , yes you are correct. I only added Line 2 Royalties to Oklahoma Income->Rental, Partnerships, Etc->Oklahoma Amount column. However, I also see the "Federal Amount" column having the same amount. Is this correct? You mentioned in an earlier post that I need to add Royalties to Federal Taxes as well. Hence, I believe $1200 is showing in both "Federal Amount" and "Oklahoma Amount" for rental.

I would like to reiterate, under "Recapture of Depletion and/or Add Back of Excess Federal Depletion", do I insert $84 under both "Total Amount" column as well as "Oklahoma Amount" column?

Thank you,

Tulane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

It depends. You would enter the information FIRST in the federal return in your desktop version according to the steps I listed above, which includes the steps where you would enter your Oklahoma taxes withheld in Boxes 16-18. This information along with all your other income will populate in your Oklahoma non-resident return. You do not need to make any additional entries in your federal return.

Now when you prepare your Oklahoma non-resident tax return, you will allocate income that is Oklahoma income. in the allocations, all income will be mentioned. For the income that is excluded, leave those screens blank. The only income that will be recorded as Oklahoma income will be your royalty income that was already reported in your federal return. The amount allocated should be allocated here is your Royalty income minus the 15% depletion.

Now, i need to change my original answer regarding the 7% additional depletion allowance for Oklahoma. This will be entered as an Oklahoma subtraction because this will subtract rather than add to your Oklahoma income. First remove this from "Recapture of Depletion and/or Add Back of Excess Federal Depletion". We don't want this added to your income, but as a reduction because of the additional 7% allowance.

- Now go to the forms mode in your Turbo Tax program.

- Go to Schedule A-H in your Oklahoma State return of your software in the Forms mode and add $84 in Line 8 of this Schedule 511-NR-B Oklahoma Subtractions. Enter $84 in both columns.

I think also this you may have indicated this is a rental. It's not a rental, it is a royalty. This may be the reason why your depletion% is not being accounted for. Please review all your entries in your 1099 MISC section in the federal return and make certain where it asks what of income it is, indicate it's royalty income. Also there should be a screen that asks what type of royalty income it is, indicate it is Oil and Gas. This way, you will receive the 15% depletion allowance in your federal and state return.

Once everything is reported and done correctly, this is what your Form 511 NR form should look like this in the forms mode. Your overall income is not what is shown here but this does reflect Oklahoma source income in Box 4, which represents the $1200 income minus the 15% depletion percentage. Line 5 represents the additional subtraction that is the difference between the federal depletion and the additional Oklahoma depletion allowance. Here is the screenshot and how this is to appear in your return. Don't be concerned if all income is showing because your final return results because your Oklahoma tax is based on the percentage between Oklahoma based income and your overall income for the year. Your taxable income, if this is prepared correctly is $936, which represents your Oklahoma Sourced income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

@DaveF1006 , thank you for going through this with me in great length and detail. I want to let you know under Oklahoma Income > Rental, Partnerships, Etc. This is where I need to enter in $1200 - %15 depletion = $1020. (Note: Schedule A-H, Line 12 shows Rental real estate, royalties, partnerships, etc.) What is misleading is TT does not expand the description. Instead I discovered this while in Forms mode > Schedule A-H > Schedule 511-NR-1 Line 12. This is why I keep mentioning rental when in actuality, it also includes royalties.

In Schedule A-H > Schedule 511-NR-B: Oklahoma Subtractions, Line 8 is Additional depletion. This is where I enter $84 in both columns. What I notice is if I go back to Oklahoma Adjustments, the $84 that is included in Schedule A-H is now also automatically entered under Income from an oil or gas well that is subject to depletion.

I have reviewed my 1099-MISC and Line 2 does say Royalties. I have not seen a screen to ask me which type of Royalty Income this is and where I can type in "Oil & Gas".

@DaveF1006 , you have been an extremely helpful and patient tax consultant. I am truly grateful.

Tulane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

Good morning to you!! To get to the screen to make the choice that this is an oil and gas property, go to:

- Federal Taxes>wages and income

- Rental Properties and Royalties

- You will reach your Royalty summary page in the third screen.

- Select edit on your Royalty Property

- Now select Property Profile

- In the third screen, you should have a screen that looks like screenshot below. This is where you will make that selection.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

@DaveF1006 , thank you for your help. This whole royalties tax is a headache. Having gone through the steps in depth with you has educated me somewhat. I appreciate your guidance and expertise and for staying through this whole process with me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

@DaveF1006 , regarding your posting stating "Line 5 represents the additional subtraction that is the difference between the federal depletion and the additional Oklahoma depletion allowance. Here is the screenshot and how this is to appear in your return. Don't be concerned if all income is showing because your final return results because your Oklahoma tax is based on the percentage between Oklahoma based income and your overall income for the year. Your taxable income, if this is prepared correctly is $936, which represents your Oklahoma Sourced income."

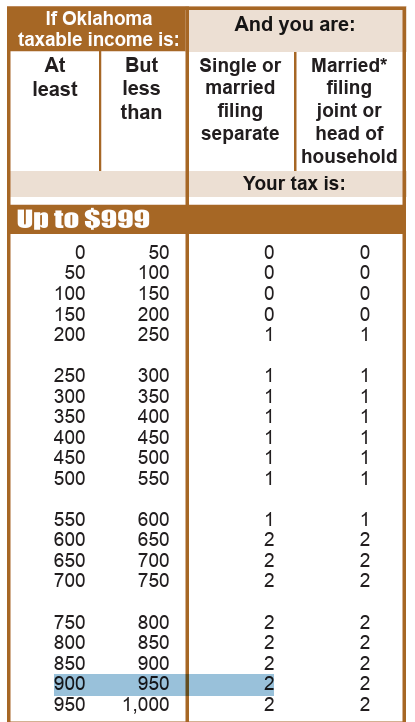

My 1099-MISC Box 2 (Royalties) = $1200 and Box 16 (State Tax Withheld) = $62. If my OK taxable income is $936, then according to OK 511-NR form, my tax (filing single) is $2. So does this mean I should get back $60 (State Tax Withheld $62 - OK Single filing tax $2 = $60)? However, this isn't the case as my federal adjusted gross income (mainly from TX) also comes into play in the state of OK? I am thoroughly confused. Can you please help me understand?

Thank you,

Tulane

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC Royalties from OK but live in TX with no land ownership nor business

To look at this in detail, to see why you are not getting a proper refund, we would like to see a diagnostic copy of your return. The information in this file is a sanitized copy meaning there is no personal information, only numbers so that we can troubleshoot in depth, check for calculation issues, and to see how certain items are applied. Here is how to order.

For Turbo Tax online, go to tax tools>tools>share my file with agent. When this is selected, you will receive a token number. Respond back in this thread and tell us what that token number is.

If you use the desktop version, go to the black stripe at the top of the program>online>send tax file to agent. Once you receive the token number, reply back in this thread and let us know what that token number is.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

David2024

Level 2

kcoriell

Level 2

kf_7

New Member

MrZeppo92

Returning Member

incometaxstar

New Member