- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

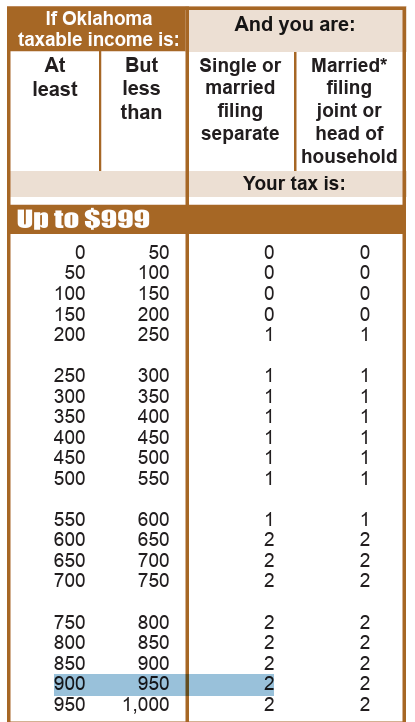

@DaveF1006 , regarding your posting stating "Line 5 represents the additional subtraction that is the difference between the federal depletion and the additional Oklahoma depletion allowance. Here is the screenshot and how this is to appear in your return. Don't be concerned if all income is showing because your final return results because your Oklahoma tax is based on the percentage between Oklahoma based income and your overall income for the year. Your taxable income, if this is prepared correctly is $936, which represents your Oklahoma Sourced income."

My 1099-MISC Box 2 (Royalties) = $1200 and Box 16 (State Tax Withheld) = $62. If my OK taxable income is $936, then according to OK 511-NR form, my tax (filing single) is $2. So does this mean I should get back $60 (State Tax Withheld $62 - OK Single filing tax $2 = $60)? However, this isn't the case as my federal adjusted gross income (mainly from TX) also comes into play in the state of OK? I am thoroughly confused. Can you please help me understand?

Thank you,

Tulane