- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1099-Misc Oil and Gas - Fustration

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Oil and Gas - Fustration

Maybe I'm just going about this the wrong way, but the way this appears in Turbo Tax is making it extremely difficult.

I have several 1099-Misc for oil and gas. So, I inputted all those in manually - no big deal the first time. I then saw the schedule-E form that automatically imported those 1099-MISC information in there. I had to go through each of those manually and select what type of property they were (royalty oil/gas) so I could get the 15% depletion.

I had been trying to find where I can enter the misc expenses related to these 1099 (taxes that the oil and gas operator deducted). It appears I then have to go through each of these items in the Schedule-E and re-enter the 1099-MISC information (federal ID, etc). Is there a better way than doing this all over again? - I feel like the software should just pull all these from the 1099-MISC I entered initially. It's just a lot of redundant work.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-Misc Oil and Gas - Fustration

Yes, there is a better way of reporting this in your Turbo Tax Self-Employed account. Let me enter the steps for you.

- Go to federal>wages and income

Rentals, Royalties, and Farm>Rental Properties and Royalties (Sch E)

Go through the prompts and answer the questions about your royalty.

You will eventually come to page that has you enter your 1099 MISC.

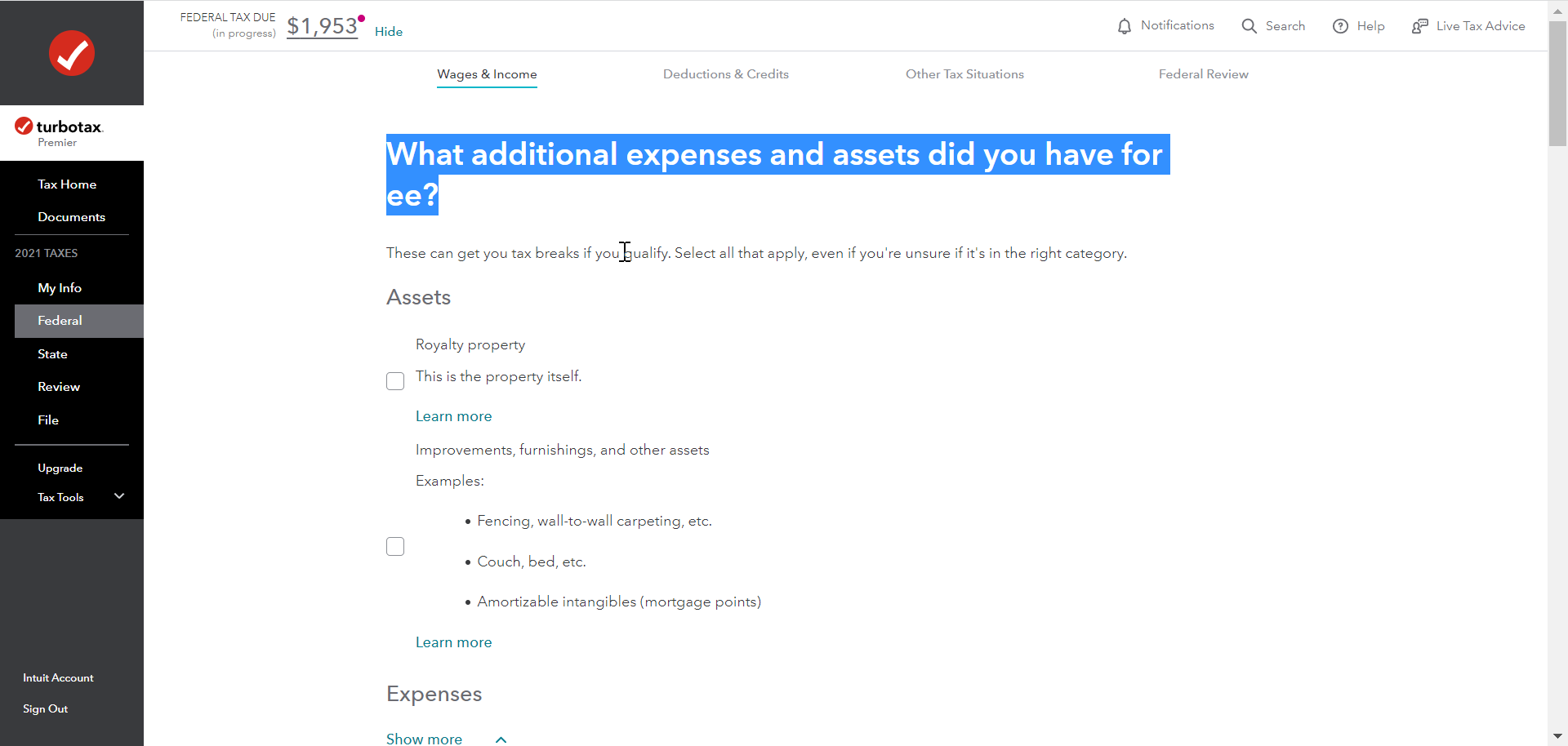

Then you arrive at a page to enter your expenses. Here is what this look like in your online Turbo Tax program.

If you entered your 1099 MISC in a section other than I outlined above, you may wish to delete them from that section and enter those forms the manner that I have described above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ramseydavid

New Member

golf22

New Member

CaddyGrn

Level 5

Gabriel11

Level 2

wisbechcambs

New Member