- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Yes, there is a better way of reporting this in your Turbo Tax Self-Employed account. Let me enter the steps for you.

- Go to federal>wages and income

Rentals, Royalties, and Farm>Rental Properties and Royalties (Sch E)

Go through the prompts and answer the questions about your royalty.

You will eventually come to page that has you enter your 1099 MISC.

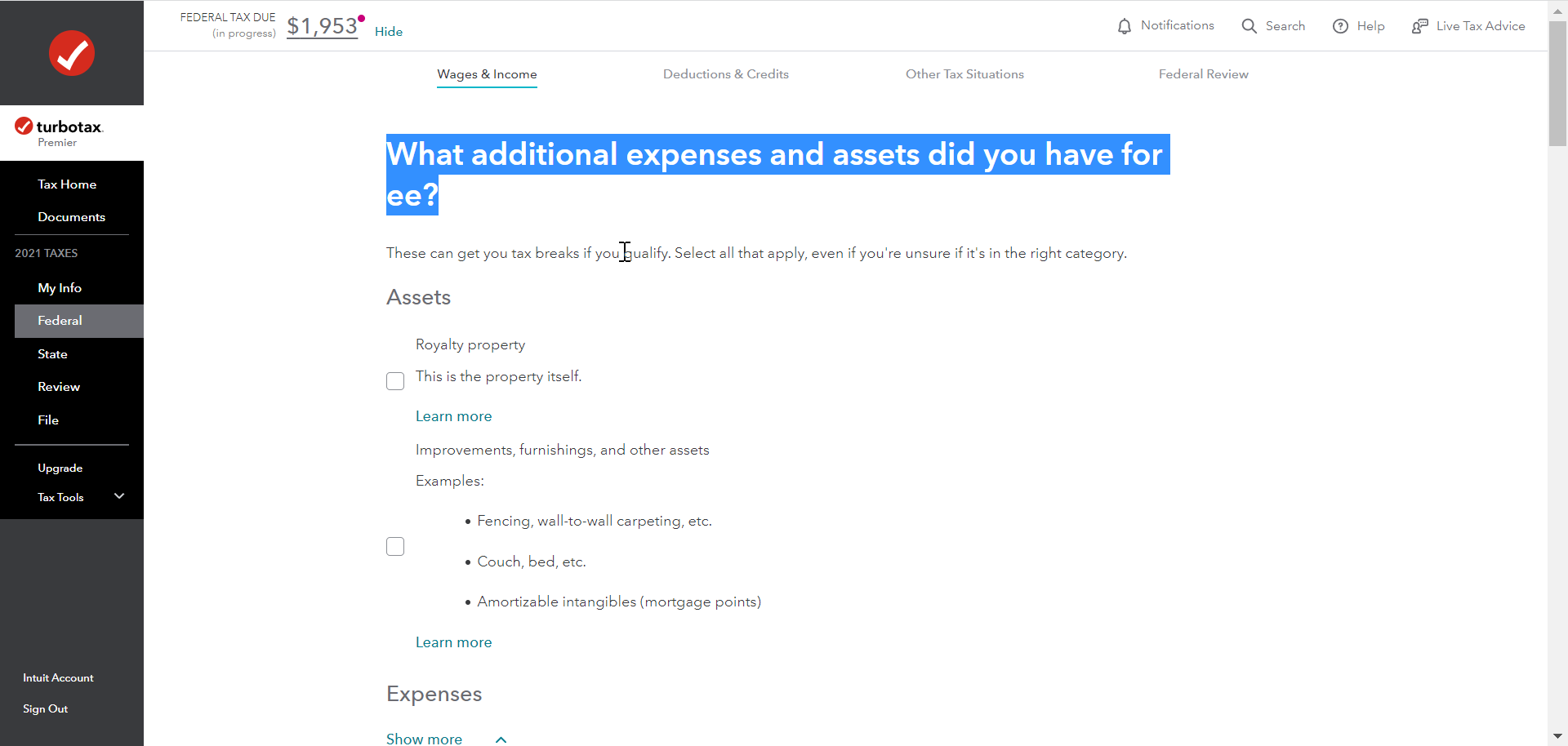

Then you arrive at a page to enter your expenses. Here is what this look like in your online Turbo Tax program.

If you entered your 1099 MISC in a section other than I outlined above, you may wish to delete them from that section and enter those forms the manner that I have described above.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 15, 2022

3:14 PM