- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- 1031 Exchange - Turbo Tax Desktop - how to enter the information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 Exchange - Turbo Tax Desktop - how to enter the information?

How do I enter the information for a 1031 Exchange in the Turbo Tax Desktop (Home & Business) software? I went to the business section and on the property I exchanged there is no where to select that I did a like-kind of exchange. Please help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 Exchange - Turbo Tax Desktop - how to enter the information?

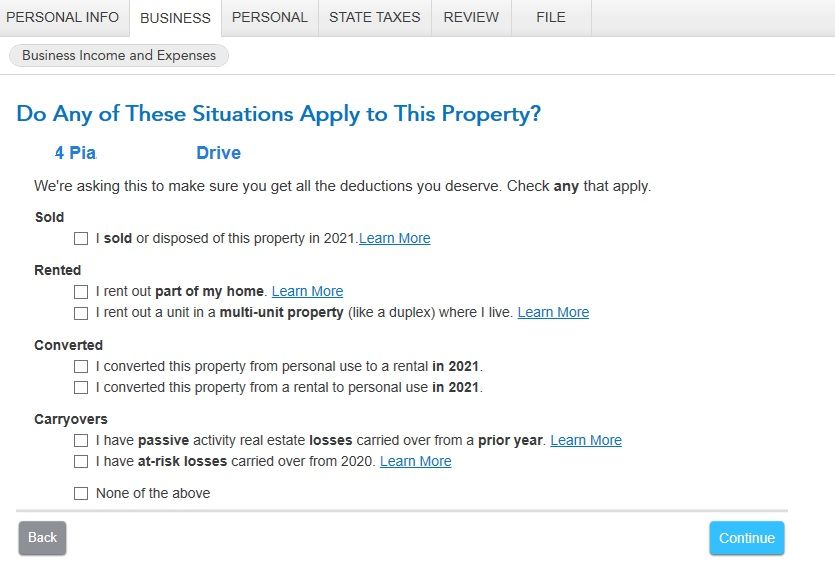

This response was not helpful and the link you sent doesn't work for the desktop version of TurboTax. I was able to figure out. In the business section of Turbo Tax where you enter your rental property information, on the property your sold in the like-kind of exchange (1031). Make sure your entry looks like this:

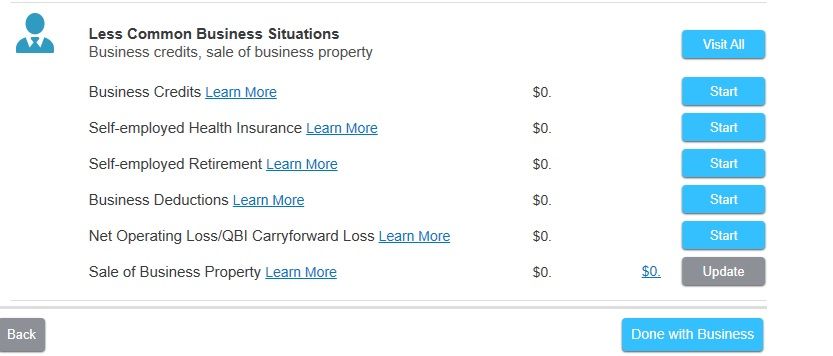

Then after you finish all your rental properties, on the business section at the bottom is this section. Click on the sale of Business Property.

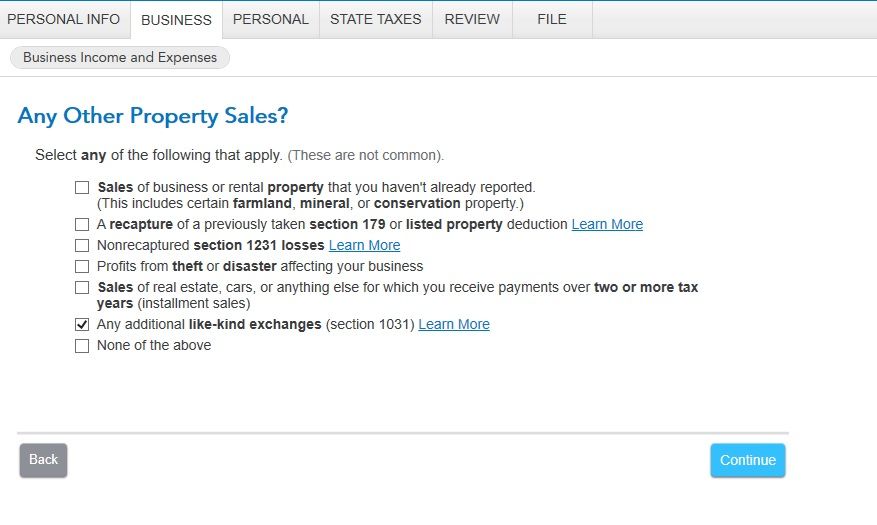

Now check the 2nd to last box at the bottom : Any like kind of exchanges. Now you are set and simply answer the questions that follow related to cost basis and sale of your property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 Exchange - Turbo Tax Desktop - how to enter the information?

You should enter the sales in the 1031 exchange section of TurboTax. Follow the interview and carefully answer all questions.

Please read this TurboTax Help topic for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1031 Exchange - Turbo Tax Desktop - how to enter the information?

This response was not helpful and the link you sent doesn't work for the desktop version of TurboTax. I was able to figure out. In the business section of Turbo Tax where you enter your rental property information, on the property your sold in the like-kind of exchange (1031). Make sure your entry looks like this:

Then after you finish all your rental properties, on the business section at the bottom is this section. Click on the sale of Business Property.

Now check the 2nd to last box at the bottom : Any like kind of exchanges. Now you are set and simply answer the questions that follow related to cost basis and sale of your property.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

priestleydave

New Member

user17545861291

Level 2

patamelia

Level 2

patamelia

Level 2

patamelia

Level 2