- Community

- Topics

- Community

- :

- Discussions

- :

- Investing

- :

- Investing

- :

- is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

My vehicle is used in my property rental business.

My vehicle (bought in 2021) , turbotax applied depreciation method SL - HY in 2021 This year (2022), turbotax uses 200DB/HY. I don;'t see a way to select from a list of depreciation method. Is the change of depreciation method allowed ? do I need to fill 3115?

2. If I cannot change from SL - HY to 200DB/HY. how do I make turbotax to also select SL - HY in this year ?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

No, you do not need to file form 3115. Special depreciation is only available in the year you place an asset into service. It must be new and you are the original owner. TurboTax has selected the correct depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

Hi ShrlynW, thank you for your reply.

which one is special depreciation ? SL - HY or 200DB/HY ?

The vehicle was new in 2021 , turbotax has selected SL - HY. and depreciation rate it used was 10%

This year 2022, turbotax has selected 200DB/HY, 20% depreciation rate. so that's normal?

Where in IRS's publication I can find such case?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

Yes, 200DB/HY (200% double-declining / half-year) is the correct depreciation method for a vehicle in the second year of service. SL-HY (straight-line / half-year) is not usually applicable for a vehicle in the first year, so you may wish to review the Depreciation Report for last year.

This report is called "Form 4562 Depreciation and Amortization Report," and is included in your complete return when you print or save it as a PDF.

Find the vehicle on this report and look at two columns: Section 179 and Special Depreciation Allowance. Are there any amounts in these columns? If so, this is the depreciation expense you claimed last year. Also look at the last column for Current Depreciation. Typically, when you claim accelerated depreciation (Section 179 or Special Depreciation), there will be no Current Depreciation. If this is the case, the Method/Convention listed for the vehicle wasn't used and isn't a factor this year.

Here is a link to IRS Pub 946 How to Depreciate Property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

Hi PatriciaV,

I looked at last year Form 4562 Depreciation and Amortization Report, for the vehicle : Section 179 is 0. Special Depreciation allowance is 0. Current Depreciation is not Zero. So looks like Turbotax has used SL-HY for this vehicle last year and but used 200DB/HY for this year.

Both year turbotax does not give me the option to select a Depreciation method.

My questions are : 1) is the change of Depreciation allowed ? 2) what should I do to fix it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

While it's possible to change the depreciation method for an asset, the process is quite involved, involving the IRS, and usually requires the assistance of a tax professional.

The method applied for this year is correct. If you can accept what was reported last year and continue with 200DB/HY for the rest of the years remaining, you don't need to do anything.

Your other option is to upgrade to TurboTax Live, which will allow a tax expert to work with you by phone or screen sharing. They can help you verify that the vehicle was entered correctly last year and that your current status is good for the future. If you're interested in this option, see How do I connect with a Tax Expert in TurboTax Live?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

I can accept what was reported last year. I just want to resolve this as simple as possible.

So it means I don't have to keep the depreciation method same across years ?even last year I've used SL, this year I can use 200DB, and it won't be a flag for IRS ?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

A change in the method of computing depreciation is generally a change in accounting method that requires the consent of the IRS and the filing of Form 3115 ( Reg. §1.167(e)-1). Turbo Tax does not support this form but you may download this here to fill out and send in.

You will not be able to make the change until it is approved by the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

hmm,

I don't know what's going wrong why turbo tax has used different accounting method in the two years and thus caused this complexity for me. as I said, I just want to keep this simple. Is there a way that I can edit turbo tax to use SL again in this year so I do not need to fill 3115 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

No, you should not be trying to switch back to SL depreciation for your vehicle. Your 2022 tax returns are correct using the MACRS 200DB method. Your issue is you need to amend your 2021 tax return to report the correct depreciation method.

In the first year placed in service, you can use standard mileage rates or actual expenses for your vehicle. If you use actual expenses, you depreciate your vehicle with the MACRS 200DB/HY method. If you use the standard mileage deduction in the first year, you can switch to actual expenses, but you are then required to use the SL method for the remainder of the vehicle's useful life.

Per the IRS:

Generally, the Modified Accelerated Cost Recovery System (MACRS) is the only depreciation method that can be used by car owners to depreciate any car placed in service after 1986. However, if you used the standard mileage rate in the year you place the car in service and change to the actual expense method in a later year and before your car is fully depreciated, you must use straight-line depreciation over the estimated remaining useful life of the car.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

I found out the turbotax used SL last year (2021) was legit since last year the vehicle's business usage was below 50%. However this year(2022) the vehicle's business usage has increased to over 50%. I think for this situation this vehicle shall continue using SL because first year (2021) the business usage was below 50%. However turbotax 2022 does not give me such option

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

Since you used the vehicle less than 50% in the year placed in service as well as reporting actual expenses instead of taking the standard mileage deduction, you are correct.

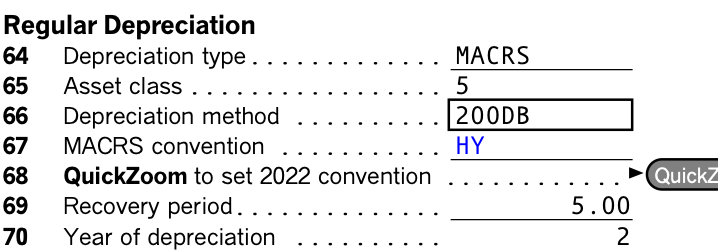

If you are using a CD/Download version of TurboTax you can change the depreciation method for 2022 by following these steps:

- Within your return, use the Forms icon in the upper right of the screen to switch to Forms mode

- Scroll down on the left to the Car & Truck Wks (XXX) and select it

- Scroll down the worksheet in the preview screen to line 66 and use the dropdown to change the method to SL

- Use the Step-by-Step icon in the upper right of the screen to switch back to the interview process and proceed entering/reviewing your return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

@AliciaP1 , I 've tried to edit L66 of that worksheet based on your suggestion, however that line is not editable. I'm using turbotax premier, 2022 Mac. Sceenshot is attached.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

@AliciaP1 I still don't see how to make that field editable in the software

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

is it normal that turbo tax has used SL - HY for the vehicle in 2021 and used 200DB/HY in 2022?

The depreciation method cannot be changed without filing Form 3115 or amending your prior filed tax returns.

See the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.