- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Recently married

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recently married

I recently got married, and we're trying to get our taxes to be as close to $0 when we file our taxes next year. When we use the IRS calculator to estimate taxes, it had said we would be getting $1,800 back as of now. How do we make it so our employers take less taxes from our paychecks so we don't end up getting a big refund? My salary is $55,000, my husband's is $60,030. I have a per diem job making $17/hour and I work about 10-20 hours a month. We live in CT.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recently married

The very last step in the IRS calculator provides information for new W-4s for both jobs -- with the assumption that you want to end the year with no refund and no balance due.

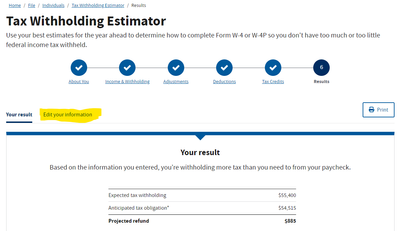

I made up some numbers and entered them into the calculator. The refund amount that it estimated I would get if I didn't change anything at all was $885. (The estimated tax liability was $54,515 and my fictional people were on track to have withholdings of $55,400.)

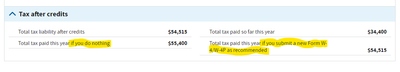

But, by making the changes recommended in the two W-2s below (one for each job), my fictional people would be on track to have $54,515 withheld -- resulting in an even-dollar return.

Go back to the IRS calculator, and -- on the Step 6 screen -- click on the link to Edit Your Information

Then, scroll to the bottom -- you should see a summary of what your tax withholdings would be with and without changes to your W-4s.

Thank you for participating in this event!

-- KimberW

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TedCar

New Member

bwadhwani

New Member

em451

New Member

kritter-k

Level 1

Ngoyangoya

New Member