- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- [Event] Ask the Experts: All About the Refund

- :

- Form 1310

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1310

This is more of a comment than a question. Form 1310 is an assertion that you are entitled to tax refunds as the surviving spouse or a court appointed representative. My mother in-law's 1040 was rejected. She was told she needed to fill out form 1310 because her husband died during the tax year. The return on turbotax was clearly prepared as married filing jointly, and that one spouse died during the year. In California, the surviving spouse automatically inherits assets as it is a community property state. I think TT should include this form when a spouse has died, because they required it in my mother in-law's case for no special reason.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1310

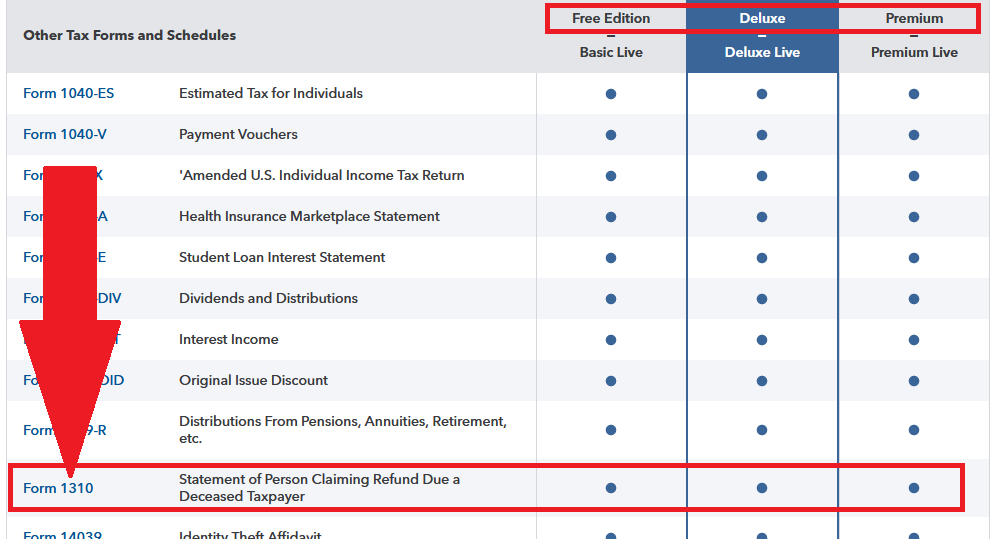

Perhaps I miscomprehended your post, but Form 1310 is included in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1310

Yes, you misread my question. TT did not direct us to form 1310 nor indicate anything else needed to be included in the return, other than filing married jointly and that the spouse had died. So that's what we did. Then, the return was rejected electronically, and was mailed back to us after many weeks, indicating that form 1310 was not there. Why didn't TT direct us to the form? I called TT for help and no one mentioned this as a possibility.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1310

TurboTax would not have directed you to a form 1310, since, according to the form 1310 instructions (extracted below), it is not required.

Who Must File

If you are claiming a refund on behalf of a deceased taxpayer, you must file Form 1310 if:

• You are NOT a surviving spouse filing an original or amended joint return with the decedent; and

• You are NOT a personal representative (defined later) filing, for the decedent, an original Form 1040, 1040-SR, 1040A, 1040EZ, 1040NR, or 1040-NR that has the court certificate showing your appointment attached.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

green2ski

Level 2

jello77

Level 3

angelmommynow

New Member

dlm999

Returning Member

kingmiranda

New Member