- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- TurboTax 2023 Calculating Adjusted Qualified Education Expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Calculating Adjusted Qualified Education Expenses

TurboTax 2023 appears to be wrongly calculating Adjusted Qualified Expenses on this year's 2023 tax return.

I entered the following example below in TurboTax that is similar to my tax situation.

I entered $9000 in tuition payments from the 1099-Q. There were no scholarships, loans, or other situations. I then entered $1000 in books & other materials. We qualified for the America Opportunity Credit of $4000.

I took a 529 distribution of $1000 where $600 is basis and $400 is gain.

Turbo tax is saying that we owe taxes on the $400 gain.

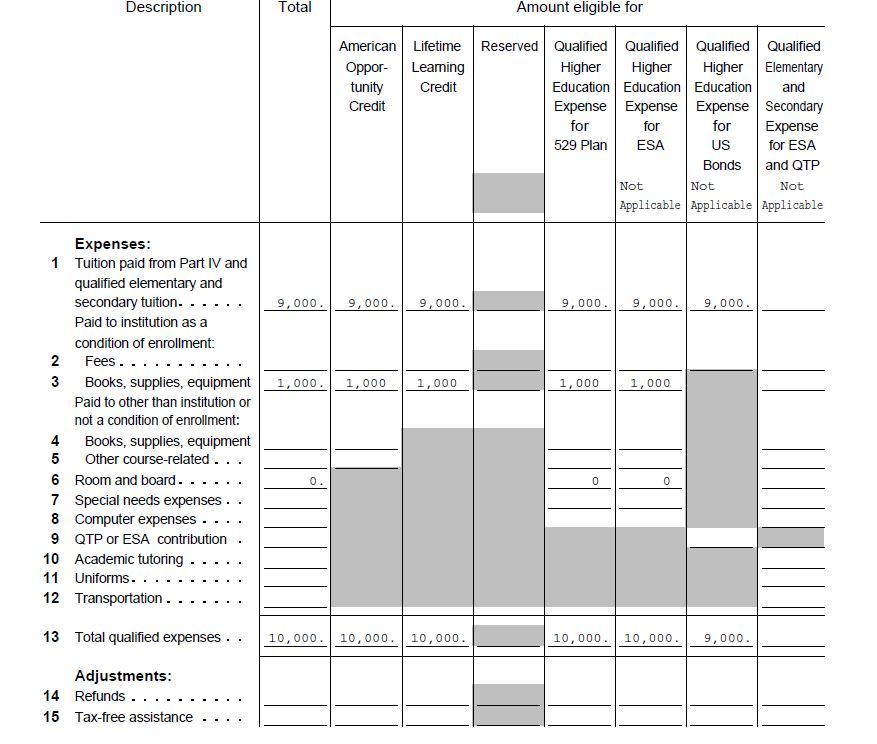

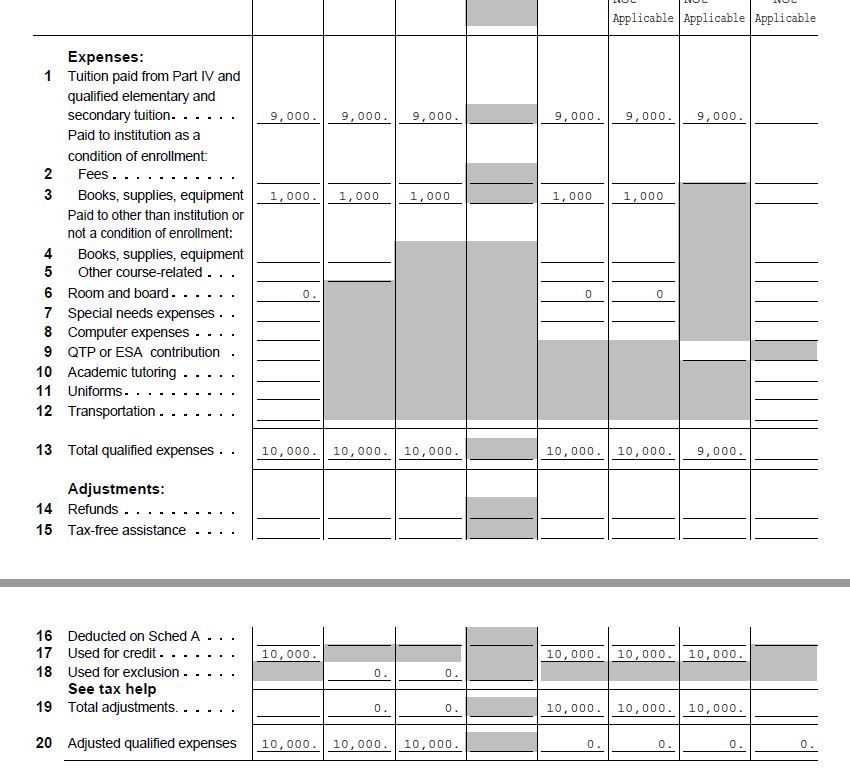

The Student Information Worksheet - Part VI Education Expenses, shows the summary with the incorrect calculation. (See the example outputs pasted at the bottom of this post. Look at the column under Qualified Higher Education Expense for 529 plan).

It shows

Line 1 - Tuition Paid $9000 - {which is correct}

Line 3 - Books $1000 - {which is correct}

Line 13 - Total Qualified Expenses $10,000 - {which is correct}

Line 17 - Used for Credit $10,000 - {which is NOT correct. Should be $4000}

Line 19 - Total Adjustments $10,000 - {Not correct due to line 17. Should be $4000}

Line 20 - Adjusted Qualified Expenses (529 plan column) $0 - {Not correct due to line 17. Should be $6000}

I should be allowed to take up to a $6000 529 distribution without any of the gain being taxed.

Even though I took a $1000 529 distribution with $600 basis and $400 gain, Turbo Tax is saying that all of the $400 gain is taxable.

I have had the same situation in previous tax years, where I have taken the $4000 American Opportunity deduction. The $4000 AOC deduction was deducted from my total qualifying expenses. The resulting adjusted qualifying expenses were always higher than what I took for the 529 distribution, so I never had to pay any taxes on the distribution. This appears to be a bug.

I tried this with another tax program and it performed all the calculations correctly. It properly used $4000 for the AOC credit in line 17 and it properly calculated line 20 to be $6000 for the allowed 529 distribution with no additional tax.

I looked at the answer given in : turbotax-taxing-a-529-distribution

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship***

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (usually on the student’s return)

In my example there was no scholarship, so this value was zero, which is what results in $6000 can be used against the 1099-Q. In this case, I see TurboTax is taking all that was paid in tuition and books ($9000 + $1000 => $10,000) and using the entire amount as the credit, instead of using $4000 credit which is the correct amount used for the AOC credit.

I called TurboTax customer service. One of the service agents entered the same values in their customer support version of TurboTax as me and got the same exact results. They entered the same tuition amount from the 1098T, the books, and the 529 distribution amount from the 1099-Q. They ended up with the same exact incorrect calculations on the Student Information Worksheet, Part VI, education expenses, and resulting message that taxes were owed on the 529 distribution gain as I did.

I am still waiting to hear back from TurboTax on my issue. I am also concerned about this issue especially since the other tax software program that I used for this same scenario is calculating correctly. It never made this error in previous years of filing for our education credit and 529 distribution.

I am hoping that TurboTax will be able to resolve this issue.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Calculating Adjusted Qualified Education Expenses

Yes, that's the usual error, TT incorrectly uses $10,000 for the tuition credit, instead of $4000.

Go through the entire education interview until you reach a screen titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to “Education Information”. When you get to the screen titled “Amount Used to Calculate Education Deduction or Credit”, verify the amount you want to use or change it. You may reach that screen sooner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Calculating Adjusted Qualified Education Expenses

Yes, that's the usual error, TT incorrectly uses $10,000 for the tuition credit, instead of $4000.

Go through the entire education interview until you reach a screen titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to “Education Information”. When you get to the screen titled “Amount Used to Calculate Education Deduction or Credit”, verify the amount you want to use or change it. You may reach that screen sooner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Calculating Adjusted Qualified Education Expenses

Thanks so much!!! This is really exciting!!!

After going through the menus again in your post below, I was able to come to the screen, “Amount Used to Calculate the Education Deduction or Credit”. I then entered the applicable $4000 amount for the AOC credit and it populated the Student Information Worksheet, Part VI, Education Expenses, Line 17 with the correct value of $4000 in place of the previously incorrect $10,000 value.

What is very interesting is that the first time you go through and enter the Tuition information, that screen does not show up, so the user doesn't know that entry even exists. Then after entering the 529 information, and TurboTax using (in my case) some incorrect internal logic, it decides there was an excess distribution on the 529. Only then can the user go back through the Education Expense screens and get to that screen "Amount Used to Calculate Education Deduction or Credit". So, it is important to know that screen comes and goes depending on whether the 529 exceeds the tuition expenses or not.

I also found that if you have the correct $4000 amount set for the deduction on that screen and there is no excess penalty, and then you subsequently go back into that screen, TurboTax states:

We'll make this entry zero that's no longer needed.

Earlier you told us to treat $4,000 as a taxable education distribution in order to claim a larger education tax credit. However, it's no longer beneficial for any amount to be treated as a taxable distribution and used for an education credit. so we'll just make this entry zero.

It changes the value to zero and the user is no longer able to go back in and change the value. It shows as zero on Line 17 of the form, even though the user is still receiving a $4000 AOC deduction. At that point, the user cannot go back and change the value. The user actually has to either reduce the education expenses or increase the 529 distribution for TT to again register an excess distribution scenario in order to be able to get access to that screen again.

The bottom line is that once you go in and set the value to the way that you want, it is best to not go into that "Education Information" screen again. Otherwise, Turbo Tax may set the value to zero again. Now, I understand why possibly on previous year's forms that value was set to zero. Ideally that screen should always be there with the default value populated for the AOC credit, and instructions for the user as to why they might want to reduce that value.

It's also very important to double check the value being used on Line 17 of the Student Information Worksheet, Part VI, Education Expenses to be sure the correct value is being used, and also check lines 20 and 29 that the correct AOC credits are being applied. Go to print center, and Print with "include government and TurboTax worksheets", to check the calculations on the Student Information worksheet. I would also check the calculations in "Part VIII, Qualified Tuition Program (Section 529 Plan)"

That value (Amount Used to Calculate the Education Deduction or Credit) can also be used if for some reason you don't want to take the AOC credit in a given year. It could be a situation, where the student attends undergraduate college for more than 4 years, and in some of those years, the AOC tuition credit ends up being lower than the others. You're only allowed to receive the AOC credit 4X's, so you may want to elect not to take in some years, so that it can be used in a subsequent one. That value can used to do that. If you're in that situation, I suggest trying different values and be sure that you get the desired result.

I am very happy that with the above understanding of this behavior, it resolves my problem.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ualdriver

Level 3

larockmanhere

Returning Member

AggieJen

Level 3

adrian_moore100

New Member

chelsea23320

New Member