- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2023 Calculating Adjusted Qualified Education Expenses

TurboTax 2023 appears to be wrongly calculating Adjusted Qualified Expenses on this year's 2023 tax return.

I entered the following example below in TurboTax that is similar to my tax situation.

I entered $9000 in tuition payments from the 1099-Q. There were no scholarships, loans, or other situations. I then entered $1000 in books & other materials. We qualified for the America Opportunity Credit of $4000.

I took a 529 distribution of $1000 where $600 is basis and $400 is gain.

Turbo tax is saying that we owe taxes on the $400 gain.

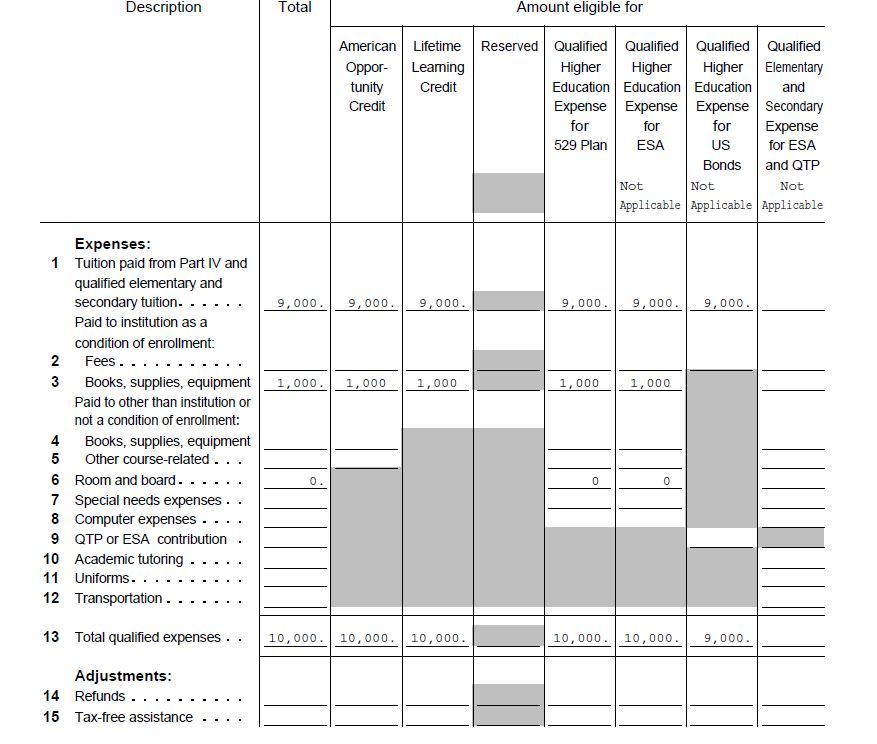

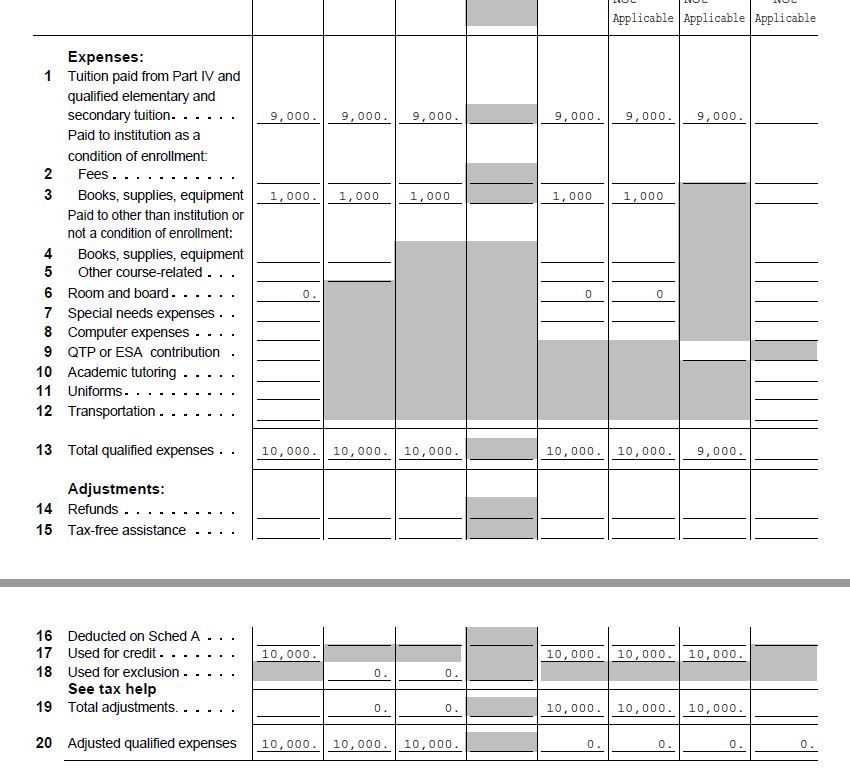

The Student Information Worksheet - Part VI Education Expenses, shows the summary with the incorrect calculation. (See the example outputs pasted at the bottom of this post. Look at the column under Qualified Higher Education Expense for 529 plan).

It shows

Line 1 - Tuition Paid $9000 - {which is correct}

Line 3 - Books $1000 - {which is correct}

Line 13 - Total Qualified Expenses $10,000 - {which is correct}

Line 17 - Used for Credit $10,000 - {which is NOT correct. Should be $4000}

Line 19 - Total Adjustments $10,000 - {Not correct due to line 17. Should be $4000}

Line 20 - Adjusted Qualified Expenses (529 plan column) $0 - {Not correct due to line 17. Should be $6000}

I should be allowed to take up to a $6000 529 distribution without any of the gain being taxed.

Even though I took a $1000 529 distribution with $600 basis and $400 gain, Turbo Tax is saying that all of the $400 gain is taxable.

I have had the same situation in previous tax years, where I have taken the $4000 American Opportunity deduction. The $4000 AOC deduction was deducted from my total qualifying expenses. The resulting adjusted qualifying expenses were always higher than what I took for the 529 distribution, so I never had to pay any taxes on the distribution. This appears to be a bug.

I tried this with another tax program and it performed all the calculations correctly. It properly used $4000 for the AOC credit in line 17 and it properly calculated line 20 to be $6000 for the allowed 529 distribution with no additional tax.

I looked at the answer given in : turbotax-taxing-a-529-distribution

Example:

$10,000 in educational expenses(including room & board)

-$3000 paid by tax free scholarship***

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (usually on the student’s return)

In my example there was no scholarship, so this value was zero, which is what results in $6000 can be used against the 1099-Q. In this case, I see TurboTax is taking all that was paid in tuition and books ($9000 + $1000 => $10,000) and using the entire amount as the credit, instead of using $4000 credit which is the correct amount used for the AOC credit.

I called TurboTax customer service. One of the service agents entered the same values in their customer support version of TurboTax as me and got the same exact results. They entered the same tuition amount from the 1098T, the books, and the 529 distribution amount from the 1099-Q. They ended up with the same exact incorrect calculations on the Student Information Worksheet, Part VI, education expenses, and resulting message that taxes were owed on the 529 distribution gain as I did.

I am still waiting to hear back from TurboTax on my issue. I am also concerned about this issue especially since the other tax software program that I used for this same scenario is calculating correctly. It never made this error in previous years of filing for our education credit and 529 distribution.

I am hoping that TurboTax will be able to resolve this issue.