- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

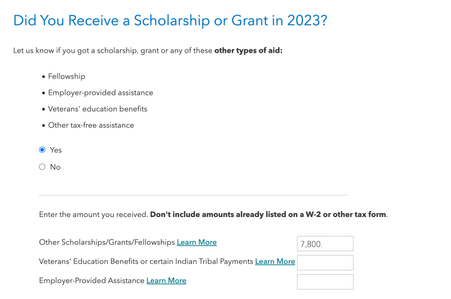

I received $7,800 in taxable scholarships last year and included them here:

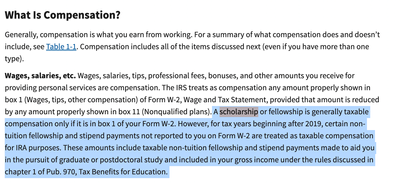

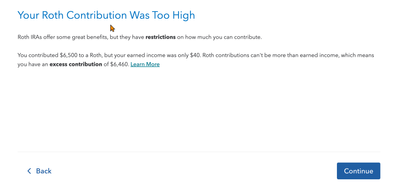

However when I enter my $6500 roth contribution it says that it's an excessive contribution. My understanding is that the IRS allows this type of taxable scholarship to count towards Roth limits (after 2019).

I see other solutions to this problem apparently working on turbotax desktop, but on turbotax web I can't seem to solve the issue. To be clear, I marked that I was a full-time graduate student.

Thanks for the help!

-

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

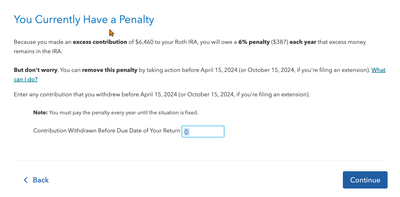

This is the error I see:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

There is new screen in the IRA contributions section, titled "How much of the taxable scholarship was for graduate or post doctoral studies?" Be sure you filled in an amount there (usually all of the taxable scholarship).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

Thanks @Hal_Al ! I've seen others mention this but it never shows up for me on the IRA flow. Is it possible it's only available on the desktop version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

Oh I figured it out - it only shows up when you note that it was used for non-education expenses.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cade798910

New Member

elLaszlo

Returning Member

RAD9

Returning Member

eaker619

Returning Member

BabaBC

Level 1