- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable scholarship for graduate student not counted for Roth IRA limit (excess contributions)

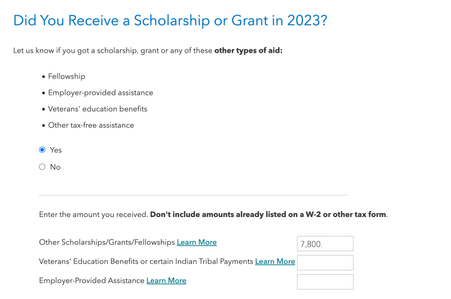

I received $7,800 in taxable scholarships last year and included them here:

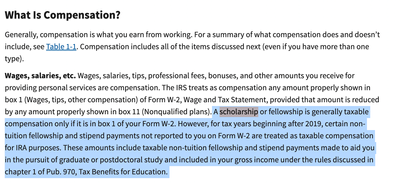

However when I enter my $6500 roth contribution it says that it's an excessive contribution. My understanding is that the IRS allows this type of taxable scholarship to count towards Roth limits (after 2019).

I see other solutions to this problem apparently working on turbotax desktop, but on turbotax web I can't seem to solve the issue. To be clear, I marked that I was a full-time graduate student.

Thanks for the help!

-

Topics:

April 11, 2024

12:56 PM