- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: You can enter Room and Board expenses in the Education (F...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

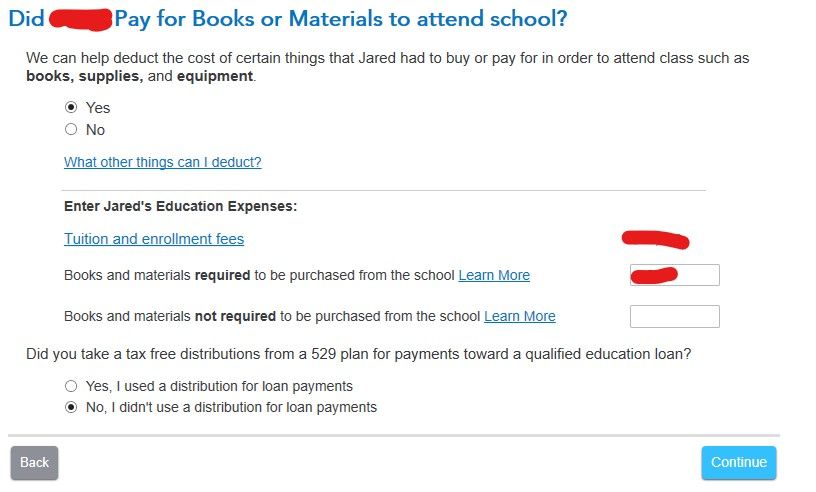

Yes, finally! TurboTax will not give you the room and board entry screen/box until you enter the 1099-Q and complete the 529 distribution interview. Room & board (and other 529 qualified expenses) entry box will be on the same screen as books.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

TurboTax will not give you the room and board entry screen/box until you enter the 1099-Q and complete the 529 distribution interview. Room & board (and other 529 qualified expenses) entry box will be on the same screen as books.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

I did enter 1099Q

I didn't have 529, I had Coverdell Education Savings Account, does that matter?

Where do I find the interview that you mention?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

I believe the interview came up after I checked the 529 box. I don’t know about the Coverdell Savings account - I bet you can search for information about Coverdell within TurboTax. Another thing you could try, check the 529 box and see if the correct screens come up. If they don’t come up for Coverdell, but do for a 529, maybe it’s not deductible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

Select Federal Taxes

Select Deductions and Credits

Select Show More at Education

Select Start or Revisit at ESA and 529 qualified tuition programs (Form 1099-Q)

The Coverdell screen will come up in the interview and you can choose the correct options for you.

@ DTMT

@ DTMT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

Please advise on where to input university Room and Board in the TT Home and Business for Mac.

I am running into the same problems noted by other TT users who found that qualified distributions from our 529 are being calculated as taxable income, thus significantly reducing our expected refund (from issues stemming from the order of input of 1099-Q and 1098-T?)

Your help is much appreciated.

Here are the related threads for your reference:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

If all of the 529 went to qualified expenses, it is not required to be entered. See page 52 for qualified distributions at IRS Publication 970, Tax Benefits for Education.

Please see my 529 example with IRS information here.

The IRS says in Publication 970 (2020), Tax Benefits for Education | IRS: When figuring an education credit or tuition and fees deduction, use only the amounts you paid and are deemed to have paid during the tax year for qualified education expenses.

@mamarama The room and board would be part of the 529 expenses, if you actually need to enter the 529 - which I doubt.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

To get the screen to enter Room & Board, answer yes when asked if you have book expenses. Usually, you must have also entered the 1099-Q earlier.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

I have followed the instructions below and the list item for entering Room and Board do not show up. There are

Tuition and enrollment fees - Entered from 1099-T

Books and materials required to purchased

Books and materials not required to be purchased.

In previous years - there has been an entry for Room and Board but it is not there this year.

Without putting Room and Board - I will have too much money taken out of the 529 and it would be taxed?

Any ideas? I saw another posting that said that if you have enough expenses - you can simply not enter the 1099-Q as it will not be submitted to the IRS if your expenses are greater than your withdrawal (which it is).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

Yes, it's true, you can just not enter the 1099-Q.

You can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. You also cannot count expenses that were paid by tax free scholarships. You cannot double dip!

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

As Hal_Al stated you don't need to enter a 1099-Q if there is no tax liability attributed towards it.

The option to enter Room and Board will only show on the screen listing expenses for book if you have entered the 1099-Q first.

Without a 1099-Q to reconcile, the TurboTax program has no need for Room and Board expenses.

Education credits cannot be based on expenses for room and board.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

Thank you @Hal_Al and @KrisD15 .

I will probably not enter the 529 - but I am still trying to figure out why I can not get the image that you have for the additional expenses. Mine seems to be truncated. I have not had this issue in past years. Perhaps TurboTax is not taking into account if the owner of the 529 and the recipient of the 529 are different?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

There's a flaw in TT. Sometimes, if you don't do it right the first time, you're not given a 2nd chance. This appears to be one of those. You have to delete the item (1099-Q )and start over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

@Hal_Al Thank you so much. That worked immediately and I was able to enter everything. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I take the eligible room and board deduction, which was paid by a 529 savings distribution?

The line for the room and board does not show up UNTIL you enter the 1099-Q.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

newt45

Level 2

MythSaraLee

Level 4

Liv2luv

New Member

in Education

QRFMTOA

Level 5

in Education

jpgarmon1

New Member

in Education