- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: Form 8615

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8615

In the "fixing" stage at the end, just before filing, TT pulled up the 8615 and asked me to check a box for filing status of parents (ie my wife and I) but only offered the option of "single". I viewed what it is ready to file and it (and the equivalent CA form) are indeed showing my filing status as Single. I don't want this to get bounced somehow as inconsistent with how my wife and I are filing our return so how do I go in and correct this?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8615

@sroussak wrote:

In the "fixing" stage at the end, just before filing, TT pulled up the 8615 and asked me to check a box for filing status of parents (ie my wife and I) but only offered the option of "single". I viewed what it is ready to file and it (and the equivalent CA form) are indeed showing my filing status as Single. I don't want this to get bounced somehow as inconsistent with how my wife and I are filing our return so how do I go in and correct this?

It asks the filing status if yiur *parents* not you.

If you are married and filing jointly then the 8615 dose not apply anyway.

https://www.irs.gov/pub/irs-pdf/i8615.pdf

Who Must File

Form 8615 must be filed for anyone who meets all of the

following conditions.

1. You had more than $2,100 of unearned income.

2. You are required to file a tax return.

3. You were either:

a. Under age 18 at the end of 2020,

b. Age 18 at the end of 2020 and didn’t have earned income

that was more than half of your support, or

c. A full-time student at least age 19 and under age 24 at the

end of 2020 and didn’t have earned income that was more than

half of your support.

4. At least one of your parents was alive at the end of 2020.

5. You don’t file a joint return for 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8615

Sorry if I wasn't clear: the 8615 is for my daughter's return, and it's asking about the filing status of her parents ie my wife and me, who are filing jointly. ie Boxes A and B ask for parents' info (my name, as listed first on our return, and SSN), Box C asks for *parents" filing status and has Single checked, which is wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8615

There should be a question in the 8915 interview that asks for the parent filing status.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8615

That's the thing, there was no 8615 interview, or else I would have had the opportunity to specify that we file jointly. It only came up in "fixing" things before filing because at that point nothing had been specified at all, but it only offered the option of checking the Single box.

So how do I go back in and correct the form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8615

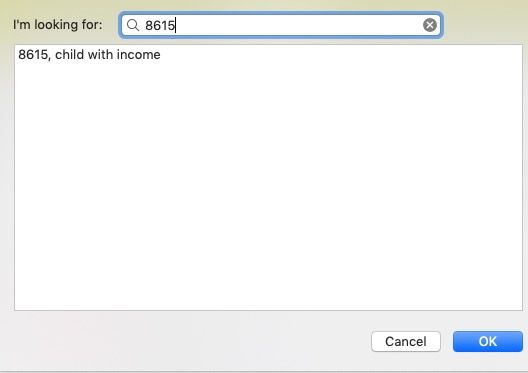

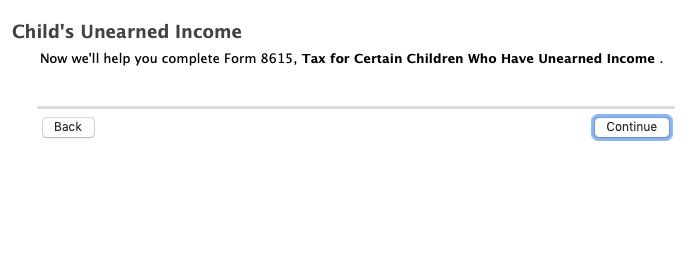

Use the "search topics" for 8615.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bgoodreau01

Returning Member

RandlePink

Level 2

in Education

RandlePink

Level 2

taxanaut

Level 3

in Education

cpeacore

New Member

in Education