It depends.

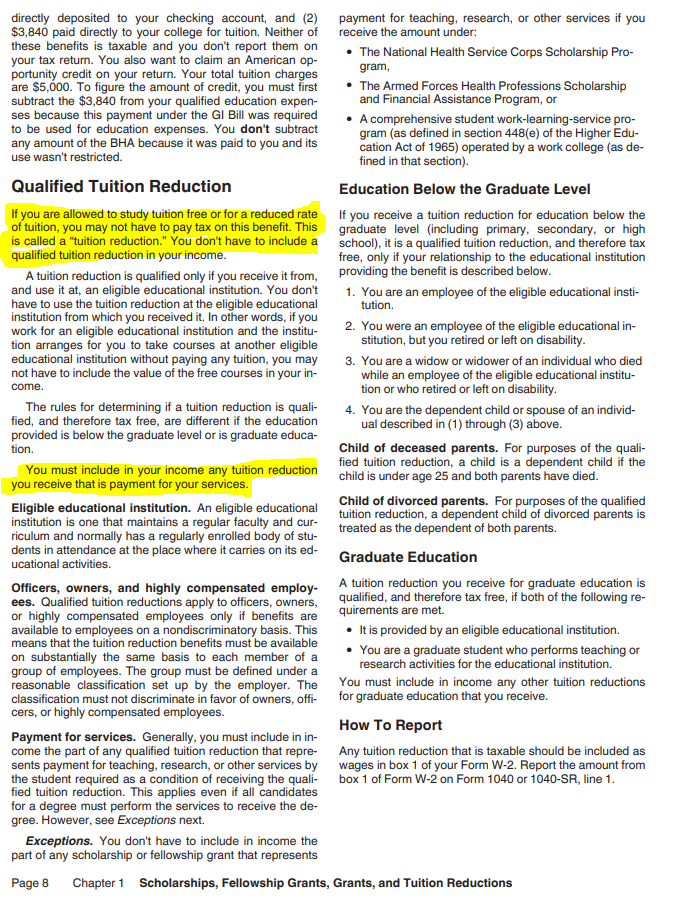

Qualified tuition reduction amounts are not taxable if they are used for education at a qualified educational institution.

If the payments are for services, then you would include the portion in income if it was for teaching, research, or other services.

Please see the attached for more details to help you determine if anything needs to be reported based upon your circumstances.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"