in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

If the 1099-Q was completely used on qualified expenses, you can amend your return and remove the 1099-Q with the explanation that the 1099-Q was not required due to being fully used for qualified expenses.

Otherwise, if you have some portion that is taxable, you can make a statement about expenses not properly allocated as no education credit was taken or however you would like to word it. The point is to keep it simple to understand for whomever is reading your form.

Do not file the amended form until your original form is complete with any refund received. Be sure to note any refund or payment made with the original on the amended return.

You may need to amend your state return as well. See I need to amend my state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

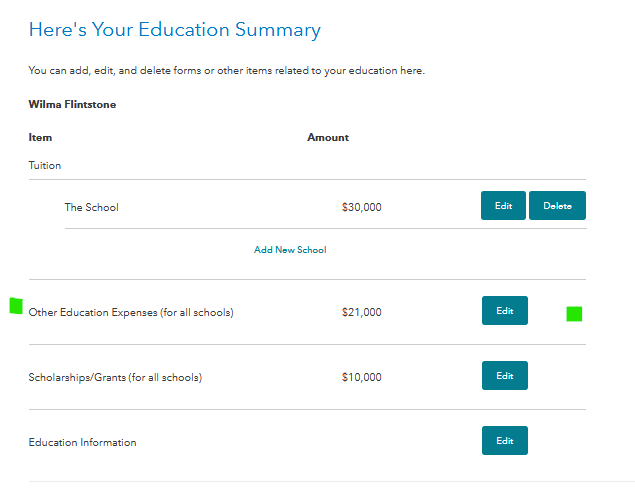

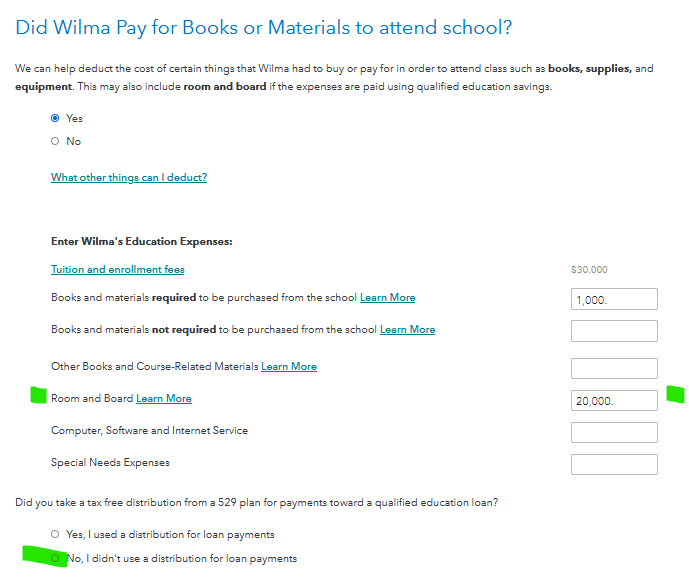

Yes, it is important to enter all the income, then the Form 1099-Q, and then the Expenses and Scholarships ( Form 1099-T section.

If it is entered out of order, the system may be reserving $10,000 of educational expenses toward an education credit, either American Opportunity Credit or Lifetime Learning Credit. You may want to see if that leads to qualify for a credit, but if it does not, or if it will cause part of your 529 distribution to become taxable, then yes, it is fine to change that field to zero.

If room and board were paid from the 529 distribution, please go back through the Education Credit section and be sure those were entered. That is not a qualifying expense for the Education credits but can be used with 529 funds.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

Unfortunately, I submitted the return a few days ago with the mistake and must amend it. It was only after carefully reviewing the worksheets that I realized the issue that it incorrectly over-taxed my son's return (even though I did not take AOTC or LLC credits). As I have never amended a return - what should I populate under the "Why did you need to amend your return? Enter a brief description of why you needed to change your original return."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

If the 1099-Q was completely used on qualified expenses, you can amend your return and remove the 1099-Q with the explanation that the 1099-Q was not required due to being fully used for qualified expenses.

Otherwise, if you have some portion that is taxable, you can make a statement about expenses not properly allocated as no education credit was taken or however you would like to word it. The point is to keep it simple to understand for whomever is reading your form.

Do not file the amended form until your original form is complete with any refund received. Be sure to note any refund or payment made with the original on the amended return.

You may need to amend your state return as well. See I need to amend my state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

Q. or 529 prompted to input amount used to calculate education credit (field pre-populated with 10k). There were 0 amount claimed by parent - Can I input 0 amount?

A. Yes. For those not claiming a credit change the amount to 0. For those claiming the American Opportunity Credit, instead of the Lifetime Learning Credit, change the amount (usually) to $4000.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MikeGTaxes

Level 2

student2025

Level 1

in Education

lavoyka

New Member

in Education

tvo1983

Level 2

in Education

vs16

Level 1