- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Tax Year Prior to 2020: Can't input tuition expense

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

When I input 1098-T, Box 2 is not available. Box 1 on my 1098-T is blank. When I use the link to "What if this is not what I paid to the school" to input my tuition amount, this number is changed back to 0 when I click "Continue". How can I input the tuition and school expenses?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

If the 1098-T that the school issued to you has Box 1 AND Box 2 reported, enter the amount from Box 1 and continue through the TurboTax software. Box 2 is not needed.

If the 1098-T that the school issued to you has ONLY Box 2 reported, you may have a problem.

Why the confusion this year? There was a time that schools had the option of reporting Box 1 OR Box 2, but in 2016 the IRS mandated that schools report Box 1. The IRS was lenient for a couple of years, accepting a 1098-T with either box reported, but for tax year 2018, Box 1 must be used.

Education Credits are based on Box 1 “What was paid to the school”.

Box 2 reports “What was billed by the school” and that amount may, or may not, be the same as the amount in Box 1. (WHY?? Because schools often bill in one year for classes that start the next year. If the school bills in 2018 for classes that start the first three months of 2019, the amount will be included in Box 2; HOWEVER, if the classes are paid for in 2018, that amount should also be included in Box 1 of the 2018 1098-T and may be used as “Qualified Education Expenses” to offset tax-free assistance ((such as a scholarship)) or to apply for a tax credit. ON THE OTHERHAND, if the classes are paid for in 2019, the amount will still be in Box 2 of the 2018 1098-T, but not Box 1. That amount is “not usable” until tax year 2019. That amount will be in Box 1 on the 2019 1098-T and may be used on your 2019 tax return.)

WHAT SHOULD YOU DO IF THE SCHOOL REPORTED ONLY BOX 2 AND NOT BOX 1 ON YOUR 1098-T?

First:

you need to contact the school and tell them to issue a corrected 1098-T. They need to report Box 1.

Next:

you can wait for the corrected 1098-T, or

use the original 1098-T and adjust for the amount of tuition paid.

Remember, the IRS gets a copy of the 1098-T, and if Box 1 is blank, the IRS is under the assumption that the school did not receive any payments on your account. If this is not the case, and you are reporting education expenses, you will need PROPER DOCUMENTATION proving those payments. A copy of your student account would work. Be sure to keep a copy of your school account activity with your tax file in case you face an audit and need to prove to the IRS that the payments were made. Check with the school to see if your amount matched what they will/should have reported in Box 1

HOW TO ENTER IN TURBOTAX:

To illustrate, I will use an example of $10,000 tuition paid.

The tuition was paid with 3,000 cash (from you, your parents, your aunt, whomever), a 3,500 school loan you took out, a 1,500 distribution from a 529 savings plan, and a 2,000 scholarship. Whatever the school received in 2018 as payment on the student’s account.

On the 2018 1098-T you received,

Box 1 is blank -the school did not properly report the 1098-T

Box 2 is 12,000 -the school billed 10,000 for 2018 classes and 2,000 for 2019 classes that you did not pay for until 2019

Box 5 is 2,000 -the scholarship you received in 2018

Enter the 2018 1098-T -leave Box 1 blank, also do not use the information from Box 2

You may get to a screen that points out that Box 1 is blank and if you enter an amount on this screen. It will force the amount onto the 1098-T. I do not suggest this solution since the 1098-T the IRS gets will show Box 1 blank and I prefer to not alter the form. I suggest you move on from this screen and allow the program to enter a “0” into Box 1. (see screenshot #1 below)

After you enter the 1098-T and get to the “Here’s Your Education Summary” page, scroll down to “Other Education Expenses (for all schools)” and click Start or Edit. When you land on the “Did You Pay for Books or Materials to Attend School?”, enter the amount of tuition and fees paid directly to the school in the box provided. In my example it is 10,000. The program will round up or down to whole dollars. This is the equivalent of the amount having been reported in Box 1. The scholarship amount was already entered in box 5, so I do not report it a second time. If you have other expenses you paid, for instance purchasing books on Amazon, enter that on the accompanying line, “Books and materials not required to be purchased from the school” (see screenshot #2 and #3 below).

AGAIN, keep good school records with your tax file.

Always CONTINUE through the Education section of the software until you get to the “Maximize My Credit” page. Do this after any entries you make that could affect the education credit, such as a 1099-Q reporting 529 distributions. If you follow the interview step-by-step you’ll be fine, but if you make any entries out of order, you may need to update the “Maximize My Credit” page. (see screenshot #4 below)

Read IRS Pub 970 for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

You cant add tuition from 1098T with thr free version of TURBOTAX.

You must buy the DELUXE!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

Where can I input tuition expense for my dependent from her 1098-T? We have the Small Business version. Every time I go to enter either the 1098-T or the 1099-Q, it puts me back to where the tuition is already $0, greyed out, and even going to "Help" and "jump to 1098-T or 1099-Q" it takes me back to the same place. Same thing happens on her TurboTax, and she already purchased Deluxe.

I still don't even know who has to do it - her or us? She is still our dependent, yet she has an income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

You mentioned you have the small business version. If that's the case, then you are filing a return for an incorporated business. So it means you cannot file your personal return with the business version. You will file your business taxes using TurboTax business and transfer the resulting K-1 to your personal tax return.

If you do have TurboTax home and business, then you can file your self-employed business along with your personal return. So, if that's what you have, then you can file your personal taxes by claiming the tuition credit for your daughter. If you are claiming the tuition credit, then you will be claiming your daughter as a dependent and she will indicate on her own taxes that she has been claimed on someone else's tax return. It is usually more beneficial for the parent to claim the tuition credit since your daughter may not have made enough income to realize the benefit of the tuition credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

Hi, my tuition expense is grayed out as well and I have tried everything to make it not. I am an independent and have a 1098t with a box 1 if it matters.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

Here's how to edit the 1098-T in TurboTax:

- From Deductions & Credits

- Expenses and Scholarships (form 1098-T) hit Update

- From the page that says Now Let's Gather The Additional Education Expenses

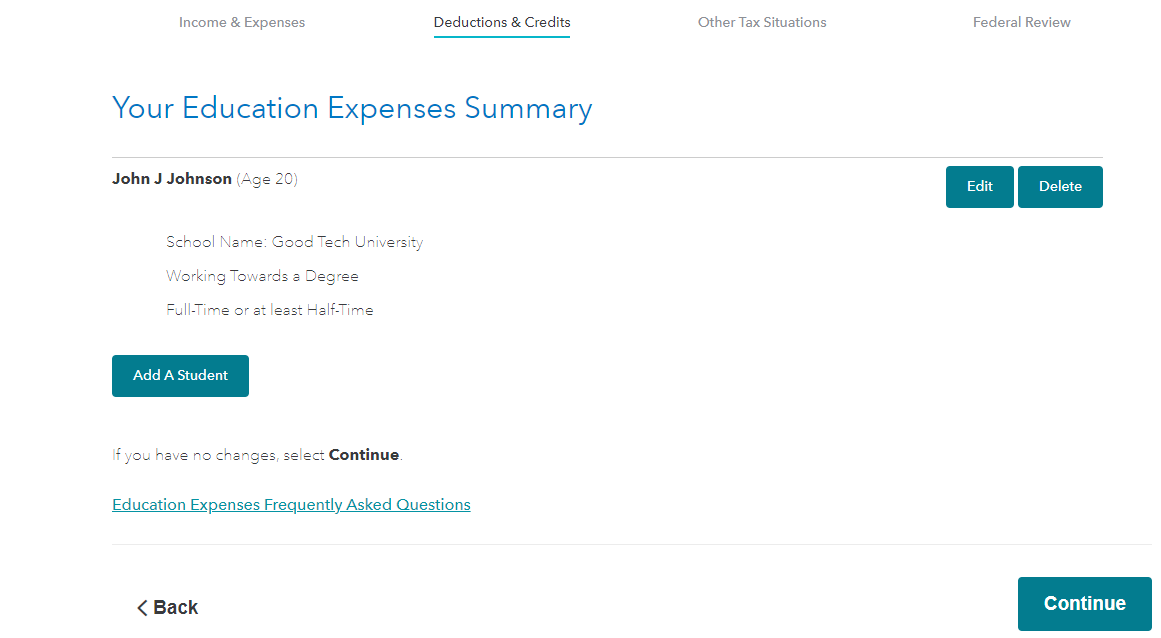

- Hit Continue. You will need to continue through several screens until you get to the screen that says Your Education Expenses Summary click Edit

At Here's Your Education Summary you can Edit, Delete or Add New School

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

I think that I have found the solution!

You MUST update to TURBOTAX DELUXE to add box 1 from your 1098T

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

I had a similar problem and this answer helped me figure it out. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

I have TT Premier and encountered the same problem. This fixed it. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

I have the Deluxe version of Turbotax, but am not able to enter my tuition expenses for the 1098-T. When I click on "Deductions and Credits -> Update, it says that my Tuition and enrollment fees are $0. Clicking on the "Tuition and Fees" box gives me this message:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

Go through the entire education interview until you reach a screen titled "Your Education Expenses Summary". Click edit next to the student's name. That should take you to a screen “Here’s your Education Summary”. Click edit next to the section you want to change; tuition, in your case.

Details:

To enter your Form 1098-T information (even when TurboTax thinks it has already been entered and is showing $0), go through the entire education expenses section of your return until you reach the screen titled “Your Education Expenses Summary”, then follow these steps:

- Click Edit next to the student name.

- On the screen titled “Here’s your Education Summary”, click Edit beside Tuition.

- Enter the information from your Form 1098-T.

To go directly to the Education section of your return, use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “education” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to education”

- Click on the blue “Jump to education” link

Also see: https://ttlc.intuit.com/community/entering-importing/help/how-do-i-enter-form-1098-t/00/26336

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

I can't input tuition $. It shows "0" I can't edit and says

Tuition and Fee Expenses

This number includes the total amount of tuition and related fee expenses (such as student fees, attendance fees, enrollment fees or assessment fees) that you paid to your school in 2020.

Note: You entered this number in earlier.

I kept looping this again and again, however, nothing in Help Center helps

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

Go back to the Federal section of the program.

To enter your 1098-T information:

- Go to the Federal section of the program

- Select Deductions & Credits

- Select Expenses and Scholarships (Form 1098-T) and click start

- Select Edit to the right of your student's name to review or input your information for the 1098-T

- Or you can Add a student if needed on this section

If you are still having issues, please comment so we can assist you further.

Attached is a link to the education credits available to you as well depending upon your particular situation.

Tuition & Fees deduction information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't input tuition expense

I also have the same issue with Tuition and Enrollment Fees. It says $0 and there is no place to edit it.

When I click on "Help" I get the same message:

This number includes the total amount of tuition and related fee expenses (such as student fees, attendance fees, enrollment fees or assessment fees) that you paid to your school in 2020.

Note: You entered this number in earlier.

I am using TT Deluxe.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Tax_Lego

Returning Member

baut484528

New Member

apple33

New Member

adrian_moore100

New Member

lkatker

New Member