- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Can I send my W2s now and when my College releases my 1098 at the end of February, add that to my return then??? Was laid off. Single Dad. Time are tight.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I send my W2s now and when my College releases my 1098 at the end of February, add that to my return then??? Was laid off. Single Dad. Time are tight.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I send my W2s now and when my College releases my 1098 at the end of February, add that to my return then??? Was laid off. Single Dad. Time are tight.

You need to file your return with all your data including your 1098, you can not file one piece at a time. Hold off on completing your taxes until you receive all data as it will save you time and money in not having to file an Amended Return later.

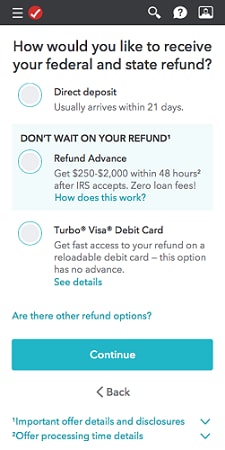

You may have the opportunity to apply for a no-fee Refund Advance.

If you apply for a Refund Advance, your application will need to be approved by First Century Bank, N.A. before you can receive your advance. You will also need to be approved for a Turbo Visa Debit Card.

You will be able to select Refund Advance in the Your refund info step of the File section. The Turbo Visa Debit Card option does not include a Refund Advance. Here’s an example of what you'll see when you can apply for a Refund Advance.

You must completely fill out your tax return, including entering your tax forms (like a W2 or a 1099), before you can apply for Refund Advance. You cannot apply for Refund Advance after you file your taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I send my W2s now and when my College releases my 1098 at the end of February, add that to my return then??? Was laid off. Single Dad. Time are tight.

Yes, you can do that, but not exactly. You file now and later file an amended return when other tax information is received.

But, as the other reply said, you should NOT do that. It's messy. Furthermore, the 1098-T is only an informational document. You are not required to enter it onto your tax return. If you do need it, your 1098-T is due any minute now and may already be available, on line, at your school account. Your school billing statements probably have all the info you need to claim the education credit, if you are eligible.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bfollowell

Level 3

KenshinT

Returning Member

liyahardeman

New Member

metalcatmakeup

New Member

Val02

Level 1