- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- 1098T, 1-1099Q

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

I have 1 undergrad college =student, I claim as dependent. She files her own returns as well for a part time job income. Expenses exceed the 529 distributions.

1098T= box 1 $60,007

1098T=box 5 $28,520

1099Q under my name as parent for FBO of student, SS# is parent (I paid daughter's tuition with my own money due to tuition deadline time sensitive, and later got reimburse through 529 in the same year)

1099Q= box 1 $8,489

1099Q=box 2 $2,719

1099Q under student name, SS# is student (I requested 529 to paid directly to my child's school)

1099Q= box 1 $14,563

1099Q= box 2 $4,654

As you can see, education expenses exceed $529. Since I claim her dependent, can I enter form 1098T, my 1099Q, and "her 1099Q" in my tax returns? Can she just claim nothing? The reason I ask is because I read somewhere that the person with the SS# in the form need to enter the info. If my daughter enters her 1099Q on her tax returns, Turbo Tax will treat like it is income and tax her, since I already claim 1098T in my tax returns.

Any suggestion on what I should do? Thank you in advance for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. Since I claim her as a dependent, can I enter "her 1099Q" in my tax returns?

A. No. You can not enter her 1099-Q on your return. If it gets entered anywhere, it must go on her return. You read correctly that the person with the SS# in the form need to enter the info. But, in your case, it does not need to be entered anywhere, because the distribution was fully covered by educational expenses. So, yes she Can just claim nothing.

Q. If my daughter enters her 1099Q on her tax returns, Turbo Tax will treat like it is income and tax her, since I already claim 1098T in my tax returns.

A. The 1098-T is only an informational document. If needed, it can be entered on both returns, with adjustments.

Since you have more than enough expenses to cover both 1099-Q , you can also claim nothing about your 1099-Q. The 1099-Q is also just an informational document.

You can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. You also cannot count expenses that were paid by tax free scholarships. You cannot double dip!

References:

- On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

- IRS Pub 970 states: “Generally, distributions are tax free if they aren't more than the beneficiary's AQEE for the year. Don't report tax-free distributions (including qualifying rollovers) on your tax return”.

While room and board (R&B) are not qualified expenses for claiming an education credit, R&B is qualified for a 529 distribution. So, you can consider taking bigger distributions next year without penalty .

________________________________________________________________________________________

Qualified Tuition Plans (QTP 529 Plans) Distributions

General Discussion

It’s complicated.

For 529 plans, there is an “owner” (usually the parent), and a “beneficiary” (usually the student dependent). The "recipient" of the distribution can be either the owner or the beneficiary depending on who the money was sent to. When the money goes directly from the Qualified Tuition Plan (QTP) to the school, the student is the "recipient". The distribution will be reported on IRS form 1099-Q.

The 1099-Q gets reported on the recipient's return.** The recipient's name & SS# will be on the 1099-Q.

Even though the 1099-Q is going on the student's return, the 1098-T should go on the parent's return, so you can claim the education credit. You can do this because he is your dependent.

You can and should claim the tuition credit before claiming the 529 plan earnings exclusion. The American Opportunity Credit (AOC or AOTC) is 100% of the first $2000 of tuition and 25% of the next $2000 ($2500 maximum credit). The educational expenses he claims for the 1099-Q should be reduced by the amount of educational expenses you claim for the credit.

But be aware, you can not double dip. You cannot count the same tuition money, for the tuition credit, that gets him an exclusion from the taxability of the earnings (interest) on the 529 plan. Since the credit is more generous; use as much of the tuition as is needed for the credit and the rest for the interest exclusion. Another special rule allows you to claim the tuition credit even though it was "his" money that paid the tuition.

In addition, there is another rule that says the 10% penalty is waived if he was unable to cover the 529 plan withdrawal with educational expenses either because he got scholarships or the expenses were used (by him or the parents) to claim the credits. He'll have to pay tax on the earnings, at his lower tax rate (subject to the “kiddie tax”), but not the penalty.

Total qualified expenses (including room & board) less amounts paid by scholarship less amounts used to claim the Tuition credit equals the amount you can use to claim the earnings exclusion on the 1099-Q.

Example:

$10,000 in educational expenses(including room & board which is only qualified for the 1099-Q)

-$3000 paid by tax free scholarship***

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (on the recipient’s return)

Box 1 of the 1099-Q is $5000

Box 2 is $2800

3000/5000=60% of the earnings are tax free; 40% are taxable

40% x 2800= $1120

There is $1120 of taxable income (on the recipient’s return)

**Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. Again, you cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

***Another alternative is have the student report some of his scholarship as taxable income, to free up some expenses for the 1099-Q and/or tuition credit. Most people come out better having the scholarship taxable before the 529 earnings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. Since I claim her as a dependent, can I enter "her 1099Q" in my tax returns?

A. No. You can not enter her 1099-Q on your return. If it gets entered anywhere, it must go on her return. You read correctly that the person with the SS# in the form need to enter the info. But, in your case, it does not need to be entered anywhere, because the distribution was fully covered by educational expenses. So, yes she Can just claim nothing.

Q. If my daughter enters her 1099Q on her tax returns, Turbo Tax will treat like it is income and tax her, since I already claim 1098T in my tax returns.

A. The 1098-T is only an informational document. If needed, it can be entered on both returns, with adjustments.

Since you have more than enough expenses to cover both 1099-Q , you can also claim nothing about your 1099-Q. The 1099-Q is also just an informational document.

You can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. You also cannot count expenses that were paid by tax free scholarships. You cannot double dip!

References:

- On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

- IRS Pub 970 states: “Generally, distributions are tax free if they aren't more than the beneficiary's AQEE for the year. Don't report tax-free distributions (including qualifying rollovers) on your tax return”.

While room and board (R&B) are not qualified expenses for claiming an education credit, R&B is qualified for a 529 distribution. So, you can consider taking bigger distributions next year without penalty .

________________________________________________________________________________________

Qualified Tuition Plans (QTP 529 Plans) Distributions

General Discussion

It’s complicated.

For 529 plans, there is an “owner” (usually the parent), and a “beneficiary” (usually the student dependent). The "recipient" of the distribution can be either the owner or the beneficiary depending on who the money was sent to. When the money goes directly from the Qualified Tuition Plan (QTP) to the school, the student is the "recipient". The distribution will be reported on IRS form 1099-Q.

The 1099-Q gets reported on the recipient's return.** The recipient's name & SS# will be on the 1099-Q.

Even though the 1099-Q is going on the student's return, the 1098-T should go on the parent's return, so you can claim the education credit. You can do this because he is your dependent.

You can and should claim the tuition credit before claiming the 529 plan earnings exclusion. The American Opportunity Credit (AOC or AOTC) is 100% of the first $2000 of tuition and 25% of the next $2000 ($2500 maximum credit). The educational expenses he claims for the 1099-Q should be reduced by the amount of educational expenses you claim for the credit.

But be aware, you can not double dip. You cannot count the same tuition money, for the tuition credit, that gets him an exclusion from the taxability of the earnings (interest) on the 529 plan. Since the credit is more generous; use as much of the tuition as is needed for the credit and the rest for the interest exclusion. Another special rule allows you to claim the tuition credit even though it was "his" money that paid the tuition.

In addition, there is another rule that says the 10% penalty is waived if he was unable to cover the 529 plan withdrawal with educational expenses either because he got scholarships or the expenses were used (by him or the parents) to claim the credits. He'll have to pay tax on the earnings, at his lower tax rate (subject to the “kiddie tax”), but not the penalty.

Total qualified expenses (including room & board) less amounts paid by scholarship less amounts used to claim the Tuition credit equals the amount you can use to claim the earnings exclusion on the 1099-Q.

Example:

$10,000 in educational expenses(including room & board which is only qualified for the 1099-Q)

-$3000 paid by tax free scholarship***

-$4000 used to claim the American Opportunity credit

=$3000 Can be used against the 1099-Q (on the recipient’s return)

Box 1 of the 1099-Q is $5000

Box 2 is $2800

3000/5000=60% of the earnings are tax free; 40% are taxable

40% x 2800= $1120

There is $1120 of taxable income (on the recipient’s return)

**Alternatively; you can just not report the 1099-Q, at all, if your student-beneficiary has sufficient educational expenses, including room & board (even if he lives at home) to cover the distribution. You would still have to do the math to see if there were enough expenses left over for you to claim the tuition credit. Again, you cannot double dip! When the box 1 amount on form 1099-Q is fully covered by expenses, TurboTax will enter nothing about the 1099-Q on the actual tax forms. But, it will prepare a 1099-Q worksheet for your records, in case of an IRS inquiry.

On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

***Another alternative is have the student report some of his scholarship as taxable income, to free up some expenses for the 1099-Q and/or tuition credit. Most people come out better having the scholarship taxable before the 529 earnings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Hi Hal_Al,

I am glad to hear that my daughter doesn't have to put in her 1099Q in her tax returns. You also mention that I, as a parent, don't have to enter 1099Q and 1098T if the expenses exceed the 529. However, I do want to get $4000 American education credit. Is it possible that only I enter the 1098T and my 1099Q and my daughter just skips hers completely? ( because I don't know how to make adjustments according to your advice- "If needed, 1098T can be entered on both returns, with adjustments." Total education expenses are more than the 529 + $4000. Thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. Is it possible that only I enter the 1098T and my 1099Q and my daughter just skips hers completely?

A. Yes*. She has no reason to report the 1098-T. She cannot claim a credit (you can, on your return). None of her scholarship is taxable. If she tries to enter, you risk making mistakes and there may be an upcharge by TT.

Since "Total education expenses, less scholarships, are more than the 529 + $4000, you can claim the AOTC. Just enter the 1098-T, without adjustment, on your tax return.

Q. I don't know how to make adjustments according to your advice.

A. Alternatively, you can enter the 1098-T with $4000 in box 1 and 0 in box 5 (or leave it blank), since you know you have the needed $4000 of expenses after allocating expenses to the 1099-Q. Your actual amount is $60,007-28,520-8,489-14.563=8435. You could enter the adjusted 1098-T with $8435 in box 1 and box 5 blank

*The 1098-T is only an informational document. The numbers on it are not required to be entered onto your tax return. However receipt of a 1098-T frequently means you are either eligible for a tuition credit or possibly your student has taxable scholarship income.

If you claim the tuition credit, you do need to report that you got one or that you qualify for an exception (the TurboTax interview will handle this)

You claim the tuition credit, or report scholarship income, based on your own financial records, not the 1098-T. In the 1098-T screen, click on the link "What if this is not what I paid the school" underneath box 1. You will then be able to enter the actual amounts paid. You will also reach a screen that allows you to adjust the scholarship amount for "amounts not awarded for 2023 expenses".

Or if you find it easier, just change the numbers in boxes 1& 5 to what your records show. The 1098-T that you enter in TT is not sent to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Although room and board (R&B) are not qualified expenses for a tuition credit or for scholarships to be tax free, R&B are qualified expenses for a 529 distribution.

Off campus rent and food are eligible expenses for a 529 distribution, but the amount is limited to the lesser of your actual cost or what the school charges on campus students for R&B (technically the schools "allowance for cost of attendance" for financial aid purposes). If he lives at home, the school’s R&B “allowance for cost of attendance” for student living with parents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Hello,

I have a similar questions. The software displayed a message, "the student beneficiary must report $xxxx of taxable income from this distribution (1099-Q). Yes I claim the student as a dependent, so I entered all 1099-Qs (one to the student, one to the parent) , and 1098-T into my return. The software does a worksheet for the 1099-Qs, as stated the math gets convoluted, especially with the education credits (AOC). All seems OK with my return.

Now moving to the students. Yes, he worked a job, W-2 with taxes deducted, and now I am ready to deal with the message above. I went to enter in the 1099-Q, that is in his name, but this doesn't seem correct. Since the software calculated the taxable income for this distribution and gave me a detailed message in my return, I believe that I should make sure the calculated value from my return, must match Schedule 1 8z, Other income $xxxx, with the description of "Qual State Tuition Prgm from 1099-Q. Does this seem correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. Since the software calculated the taxable income for this distribution and gave me a detailed message in my return, I believe that I should make sure the calculated value from my return, must match Schedule 1 8z, Other income $xxxx, with the description of "Qual State Tuition Prgm from 1099-Q. Does this seem correct?

A. Yes, basically. But, 2 buts. 1. There is no short cut to just putting that number on line 8z. The 1099-Q has to be entered on his return along with the adjusted expenses. 2. The calculations on your return may not have included all the data. It helps to have an idea of the outcome.

Provide the following info for more specific help:

- Are you the student or parent.

- Is the student the parent's dependent.

- Box 1 of the 1098-T

- box 5 of the 1098-T

- Any other scholarships not shown in box 5

- Does box 5 include any of the 529/ESA plan payments (it should not)

- Is any of the Scholarship restricted; i.e. it must be used for tuition

- Box 1 of the 1099-Qs

- Box 2 of the 1099-Qs

- Who’s name and SS# are on the 1099-Qs, parent or student (who’s the “recipient”)?

- Room & board paid. If student lives off campus, what is school's R&B on campus charge. If he lives at home, the school’s R&B “allowance for cost of attendance” for student living with parents.

- Other qualified expenses not included in box 1 of the 1098-T, e.g. books & computers

- How much taxable income does the student have, from what sources

- Are you trying to claim the tuition credit (are you eligible)?

- Is the student an undergrad or grad student?

- Is the student a degree candidate attending school half time or more?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Agreed. I idea of outcome is important.

Provide the following info for more specific help: my answers after the = sign.

- Are you the student or parent. = I am the parent.

- Is the student the parent's dependent. = yes, the student is my dependent.

- Box 1 of the 1098-T = $10,450

- box 5 of the 1098-T = $8,125

- Any other scholarships not shown in box 5 = no other scholarships

- Does box 5 include any of the 529/ESA plan payments (it should not) = it does not.

- Is any of the Scholarship restricted; i.e. it must be used for tuition = no restrictions

- (There are two 1099-Qs, 1 in my name & 1 in my son's name)

- Box 1 of the 1099-Qs = $10,000 (son's) / $5000 (mine)

- Box 2 of the 1099-Qs = $6483 (son's) / $3140 (mine)

- Who’s name and SS# are on the 1099-Qs, parent or student (who’s the “recipient”)? recipient of the $10,000 is my son. recipient of the $5,000 is me.

- Room & board paid. If student lives off campus, what is school's R&B on campus charge. If he lives at home, the school’s R&B “allowance for cost of attendance” for student living with parents. = Off campus living @ $4,525.00

- Other qualified expenses not included in box 1 of the 1098-T, e.g. books & computers = Other QE's $17.55

- How much taxable income does the student have, from what sources = Earned income = $10,624

- Are you trying to claim the tuition credit (are you eligible)? Yes, American Opportunity Education Credit. In my return, an AQEE is calculated at $2,343. The software asks a question about this on son's return.

- Is the student an undergrad or grad student? = undergrad

- Is the student a degree candidate attending school half time or more? = full time student, in a degreed program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

First question about your son's return: Yes, your program gave you the taxable amount to use. The IRS will not be cross checking as your tax return does not show that amount, it is just a courtesy of the program.

To enter the taxable income from the 1099-Q, you will enter the one in his name and subtract out $xx qualified expenses to give you the correct taxable amount. The amount subtracted will be less than total expenses. It is just the variable needed for the correct taxation value. It looks like the 1098-T would also need to be entered.

Second response:

Your AQEE of $2343 is 1098-T box1 minus box 5 plus the $18 other expenses. There is no consideration of the 1099-Q income which is either pure income with no credits, or it must be accounted for in your calculations.

You have Q income of $15,000 plus 1098-T scholarships of $8125 = $23,125 total income minus expenses of tuition, supplies, room and board $10,450 - $17.55 - $4525 = $8,132.45 income to the student.

You can shift more income to the student for you to claim education credit. I hope the room and board is for one semester rather than a year. If AQHEE falls short of gross distributions, some portion of the earnings shown on Form 1099-Q will have to be reported on Form 1040 as ordinary income, and you or your beneficiary may have to pay an additional 10 percent penalty tax on the taxable earnings

Don't forget the kiddie tax. Please see another post of mine here for more details of the 529 exceeding college expenses.

See

IRS Publication 970, Tax Benefits for Education

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. However, I do want to get $4000 American education credit.

A. The maximum AOTC credit is only $2500. The $4000 is the amount of AQEE needed to get the $2500. The AOTC is 100% of the first $2000 AQEE and 25% of the next $2000. So the $2343 AQEE, currently being used, gets you $2086 of that maximum $2500. You still come out ahead by reallocating more expenses to the AOTC but not by much.

Check my math:

$13,850 (student's maximum standard deduction) - $10,624 earned income = $3226 the amount of scholarship the student should declare taxable. He will owe no tax on the scholarship, but will owe on the 1099-Q.

$8125 -3226 = $4899 scholarship applied to AQEE

$10,450 + 4525 + 18 = 14,993 QEE - 4899 = 10,094 AQEE

$10,094 -$4000 used for the AOTC = $6094 AQEE

$6094 - $5000 applied to parent's 1099-Q = $1094 AQEE left for the student's 1099-Q

$1094 / 10,000 (box1) = 10.94% of the earnings are tax free. 89.06% are taxable.

89. 06% x $6483 (box 2) = $5774 taxable income to line 8z of student's return. The kiddie tax will apply to much of that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Wow! Thanks the calculations make sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Hi Hal-Al!

Thank you so much for your quick response. I kept learning new things after I read your posts replying to me or other people. I didn't know that I could claim room asnd board for student living at home. It probably won't change my situation this year since education expenses were over 529 distribution. But I definitely would like to take advantage of 529 distribution for next couple years. I went to my daughter's school website and found these information.

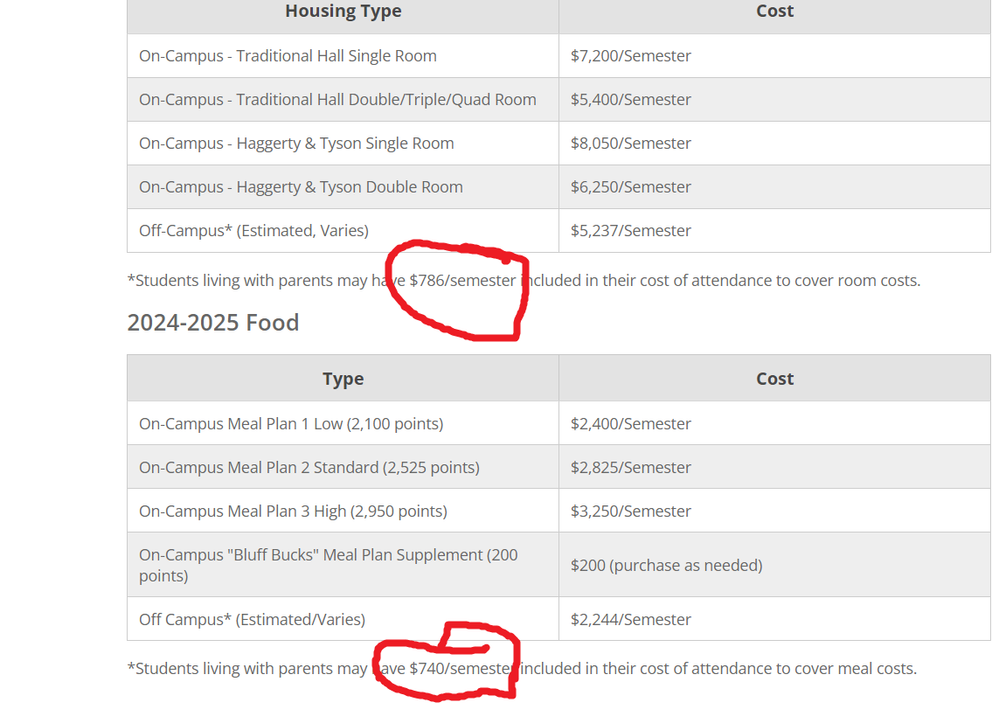

1) Is this amount in the circles could be claimed as room and board for student living at home?

2) My daughter took out subsidize loan and Doucette loan to pay off her education expenses ( which are both interest-free until she graduates). These loans apply directly to her school bills after scholarship grant, and I usually paid the left over with 529. These loans are about $10,000/year. So when I file tax at the end of year, I usually have about 10k of education expenses more than 529 distribution. Can I leave $4000 education expenses to claim for AOTC, and get reimbursed $6000 out from 529 even though it is loan? I hope my question make sense. Thank you so much in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. Is this amount in the circles could be claimed as room and board for student living at home?

A. Yes. Technically, you use the lower of those figures or your actual costs. But those amounts are so low, you're probably safe just using them and not bothering with any accounting.

Q Can I leave $4000 education expenses to claim for AOTC, and get reimbursed $6000 out from 529 even though it is loan?

A. Yes. You ignore loans, in your calculations. For these tax benefit allocations of expenses, there are three sources of money: scholarships, 529 plan and your (you and your student) money. Loans are just part of "your money", since they have to be paid back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Thank you so much. I also plan to use 529 to pay off lifetime limit of 10,000k in student loans when my daughter graduates. Since I will leave 4000k for AOTC each year not asking for 529 reimbursement, do you think it is safe to say that I am not double dip in these benefits? Thank you in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098T, 1-1099Q

Q. Since I will leave 4000k for AOTC each year not asking for 529 reimbursement, do you think it is safe to say that I am not double dip in these benefits?

A. I can't tell. You wording on this and your last post are little unclear. It depends on the actual numbers. Yes, based on your 2023 numbers.

There are three things you can do with your Qualified educational expenses (QEE):

- Allocate then to scholarships (so that the scholarship remains tax free)

- Use them to claim an education credit (AOTC)

- Allocate them to the 529 distribution (1099-Q) so that it will not all be taxable

Note: it is not necessary to allocate expenses to loans or "your money". Depending on the student's other income, one technique is to have the student treat some of her scholarship as taxable to free up expenses for the AOTC or the 529 distribution. The first $13,850 of earned income (including scholarships) goes untaxed.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

gxhadong

Level 1

Kevin381

Returning Member

adamkwitkop

Level 1

CRL2

Returning Member

adultingisscary

New Member