- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

Hi Hal-Al!

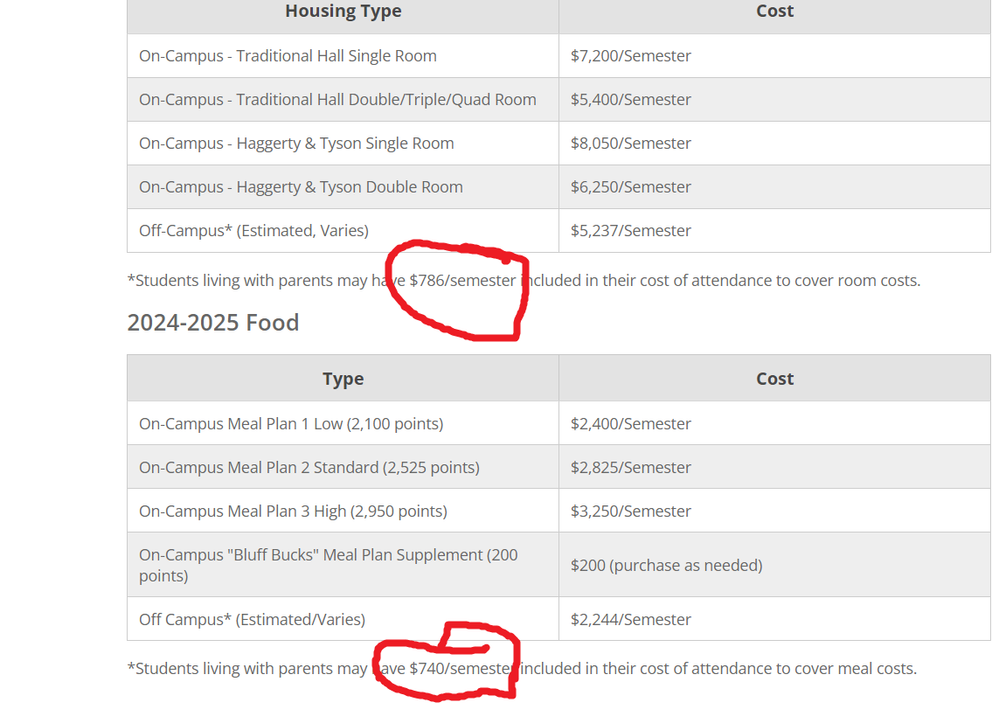

Thank you so much for your quick response. I kept learning new things after I read your posts replying to me or other people. I didn't know that I could claim room asnd board for student living at home. It probably won't change my situation this year since education expenses were over 529 distribution. But I definitely would like to take advantage of 529 distribution for next couple years. I went to my daughter's school website and found these information.

1) Is this amount in the circles could be claimed as room and board for student living at home?

2) My daughter took out subsidize loan and Doucette loan to pay off her education expenses ( which are both interest-free until she graduates). These loans apply directly to her school bills after scholarship grant, and I usually paid the left over with 529. These loans are about $10,000/year. So when I file tax at the end of year, I usually have about 10k of education expenses more than 529 distribution. Can I leave $4000 education expenses to claim for AOTC, and get reimbursed $6000 out from 529 even though it is loan? I hope my question make sense. Thank you so much in advance.