- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- 1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

My daughter has an associates degree and has used 2 AOTCs thus far.

She worked the past few years but decided to go back and get a bachelors starting school in Jan 2023.

In Dec 2023 she paid $ 4,024 tuition.

In Dec 2023 she withdrew $2,024 from a 529 plan anticipating the remainder would be a $2000 AOTC.

1099 T received as expected with Box 7 checked to indicate for academic period starting 2023.

1098 Q came as expected from 529 plan.

After entering in Turbo Tax, it didn't give the result I expected.

It counted the earnings ($1320) of the 529 withdrawl as income rather than college expense reimbursement.

It gives a $2500 AOTC rather than the $2000 expected.

Is this supposed to be how it works? Or have I don't something wrong in Turbo Tax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

Q11. How do I calculate AOTC?

A11. You calculate the AOTC based on 100 percent of the first $2,000 of qualifying expenses, plus 25 percent of the next $2,000, paid during the tax year.

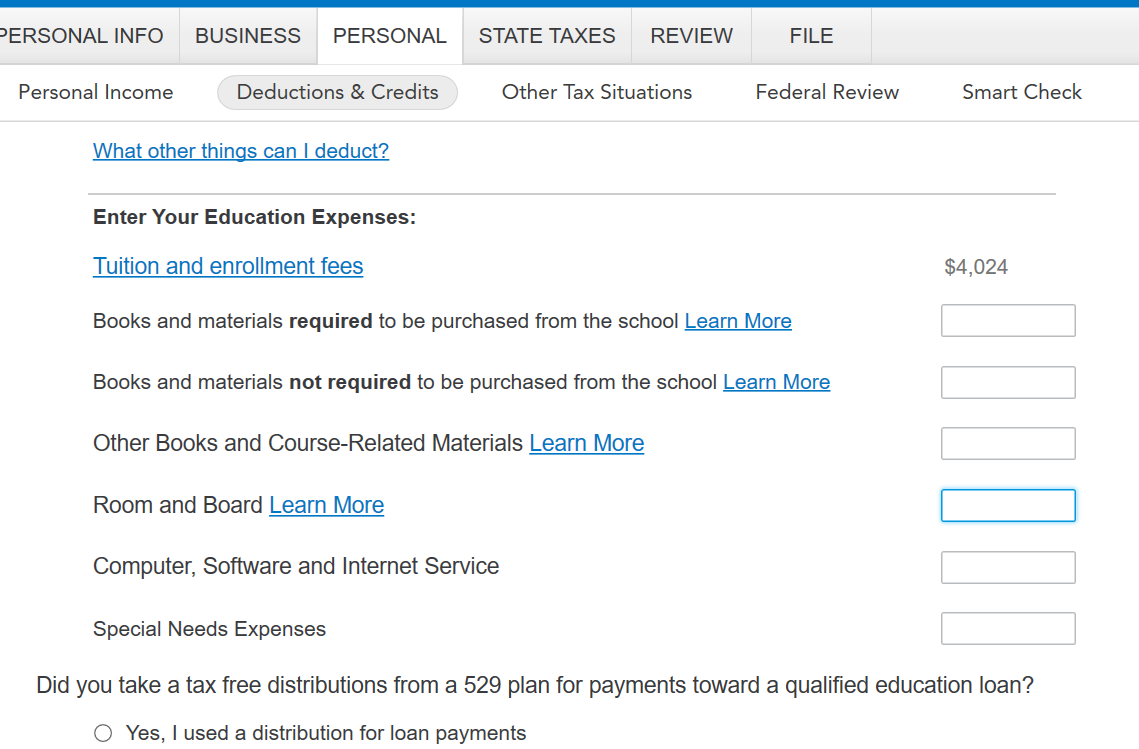

If you allocated the 529 to things like room and board; or other eligible expenses such as a computer, other required materials (books, etc.) for the AOTC, these count as well, not just the tuition. Basically, once you hit 4,000 of eligible tuition and expenses you get the full credit after your 529; for example, 6000(expenses)- 2000(529)= 4000 eligible expenses (full credit). 2,500, Remember, a 529 can be used for room and board as well.

@krk3384

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

The main question I have is why was the 529 withdrawal not counted as a college expense reimbursement. It acted as if it taken out for personal use. Therefore it counted the 529 earnings as income. It should not be income as it was used for qualified college expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

There are multiple ways to allocate educational expenses. The bottom line is it's tricky using TurboTax (TT) to get the results desired or even the best results. TT has assigned (almost) all the expenses to AOTC and that forces some of the 1099-Q to be taxable.

Her plan was good: only take $2000 AOTC and use the 529 plan for the rest. But the tax on $1320 should only be about $158 (assuming12% bracket). You may want to take the extra $500 AOTC, instead. The 10% penalty doesn't apply because you use those expenses to claim the AOTC.

If not, here's a simple workaround: you know that none of the 1099-Q is taxable. So, so just don't enter the 1099-Q in TT.* When you enter the 1098-T, enter only $2000 in box 1. The 1098-T is only an informational document. The numbers on it are not required to be entered onto your tax return. The 1098-T that you enter in TT is not sent to the IRS.

*On form 1099-Q, instructions to the recipient reads: "Nontaxable distributions from CESAs and QTPs are not required to be reported on your income tax return. You must determine the taxability of any distribution."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

Right, when entering expenses, it increases the amount of qualified educational expenses. Like say you bought a 1000 computer, and books for 250, and tuition for 4000. Your total qualified educational expenses is 5,250. If you enter an unqualified expense or over-allocate the amount, it may cause some to be taxable; this is especially true when there's an amount in Box 5 of your 1098-T, that is greater than or equal to Box 1, or any amount in Box 5. As Hal_Al stated a 1099-Q doesn't have to be reported on a return if used for educational expenses. But make sure, if you took out for example, 2000 from 529, and have tuition for 1000, you could put books and other eligible expenses that wouldn't make this a taxable event and add to your refund, if applicable.. However, if annual distributions exceed your adjusted qualified education expenses (sounds like not your case), you may need to report some of the earnings reported in box 2 as income on your tax return and pay an additional 10 percent tax on it as well.

You may be referring to the part on your 1099Q that says

Box 1 Distributed

Box 2 Gains

Box 3 Basis

Since, the beneficiary is in school at an eligible institution and paying tuition and other educational expenses, they may be tax free including room and board if not more than the COA or cost of attendance in the college catalog or actual housing expenses, if more. For example, I entered a 1099Q on my side an it is coming up non taxable with other expenses included. I deleted it and there was no movement on my refund, kept the full AOTC.

Check out this guide for some more info, on not having to report the 1099Q.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

Wow. Thanks for your insightful comments. I never knew that the forms may be informational only.

It my daughter's case I think the full AOTC credit will actually work the best even though she has a 22% marginal tax rate for 2022.

Thanks so much. your combined comments have answered it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

I don't think you can claim room and board for the 1099-Q. in your case. There was no room and board paid in 2022 because she wasn't in school yet. There is a provision in the tax code for paying first term 2023 expenses, in 2022, and claiming them on 2022 tax return. But, you must actually pay them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

Sorry, another twist on the AOTC that has lost me. TT said when maximizing the AOTC that it was a $2500 credit but I noticed in reality she didn't get that much. It was $1000 (40%) - a refundable tax credit. Why did it go this route and not give her the $2500 credit? Her total tax for the year was $7031 and she withheld $8348 from her paycheck. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

I should add that she was 24 at end of 2022 which may be relevant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

The refundable portion ($!000) of the AOTC is found on line 29 of form 1040. The other $1500 is included on line 20 via Schedule 3 and form 8863.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

I don't understand what is considered her tax liability. I am reading if the AOTC is greater than the the taxpayer's tax liability, then it is 40% refundable. I would have thought her tax liability was $7,031.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

Q. I would have thought her tax liability was $7,031?

A. Yes.

There should be $1500 (or more) on line 20 of form 1040. Review Schedule 3 and form 8863 for details

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098 T and 1099 Q - Paid in 2022 for 2023 Spring Semester

Ah. I get it now.

Line 20 on 1040 is $1500. (non refundable) + line 32 $1000 (refundable).

I thought she was only getting the latter.

Thanks for your patience.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

8469d820914b

New Member

casraecav

New Member

Taxes_Are_Fun

New Member

mrsystem

Level 1

grosiles

Level 1