- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

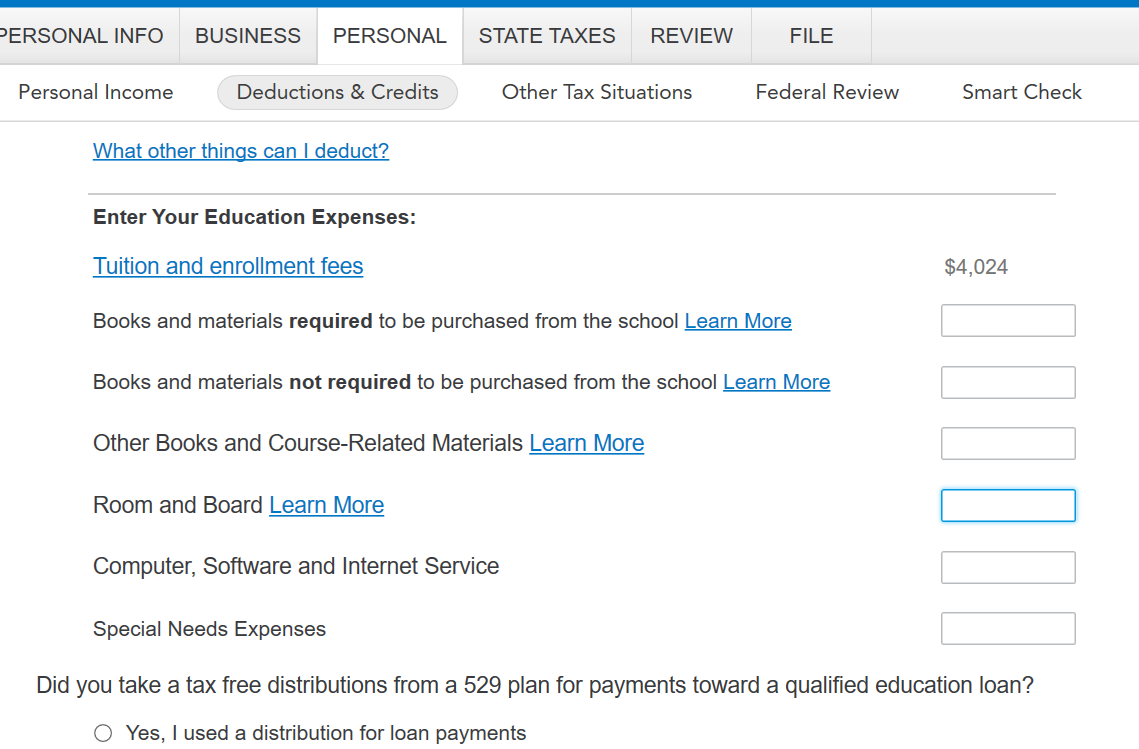

Right, when entering expenses, it increases the amount of qualified educational expenses. Like say you bought a 1000 computer, and books for 250, and tuition for 4000. Your total qualified educational expenses is 5,250. If you enter an unqualified expense or over-allocate the amount, it may cause some to be taxable; this is especially true when there's an amount in Box 5 of your 1098-T, that is greater than or equal to Box 1, or any amount in Box 5. As Hal_Al stated a 1099-Q doesn't have to be reported on a return if used for educational expenses. But make sure, if you took out for example, 2000 from 529, and have tuition for 1000, you could put books and other eligible expenses that wouldn't make this a taxable event and add to your refund, if applicable.. However, if annual distributions exceed your adjusted qualified education expenses (sounds like not your case), you may need to report some of the earnings reported in box 2 as income on your tax return and pay an additional 10 percent tax on it as well.

You may be referring to the part on your 1099Q that says

Box 1 Distributed

Box 2 Gains

Box 3 Basis

Since, the beneficiary is in school at an eligible institution and paying tuition and other educational expenses, they may be tax free including room and board if not more than the COA or cost of attendance in the college catalog or actual housing expenses, if more. For example, I entered a 1099Q on my side an it is coming up non taxable with other expenses included. I deleted it and there was no movement on my refund, kept the full AOTC.

Check out this guide for some more info, on not having to report the 1099Q.

**Mark the post that answers your question by clicking on "Mark as Best Answer"