- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

If you are filing a form 1065 then you should be using the downloaded TT Business program so to check on the return open the program to see the filing status.

TurboTax CD/Download software

- First, open your return.

- Then, from File menu in TurboTax, select Electronic Filing > Show Electronic Filing Status History (Windows) or Check E-Filing Status (Mac).

- Click Print.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

Hi Critter-3, very astute on your part. 😉😊 My wife & I live in a Mac world. I'm logged into the Community from my machine, while her machine has the windows emulator and the TT Business SW. I will have to wait for her to step away to double check, but in the meantime I'm pretty sure I'm gone down the path you've outlined. I've been waiting some 90 days to allow the IRS, ADOR and TT to catchup and become less frantic, so memory no longer remains that detailed. The TT software didn't respond during April with confirmation emails the second time around after I updated our forms and re-submitted them following the extension for both Fed and & State filings (there was a delay in closing our partnership books for 2022 - first time I've had to use an extension). And it's proven astonishingly difficult to confirm that the updated numbers have actually been filed. Thanks for your response - it's the first constructive info I've had - ADOR was less helpful during my first attempt over the phone. I'll be back once I've re-opened the return. Marty

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

Thanks to Critter-3 and to the Community! Based upon the collective 'experience' emanating from here, I feel I can cease obsessing about my concern and move on.

Upon opening the file, the initial frame lists the Name, Status and Date, which in my case showed as return Accepted (for Status). Opening the file and following Critter-3's instructions, 'check e-filing status (Mac)' took me to the same language - return accepted. And on the right of the frame 'Continue' (rather than Print), which in turn leads to the print selections. I was there back in April but unsure whether to trust the program, not having been down this path before.

Thanks for the help. Marty

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

You need to save/print your completed and accepted return in PDF format. (If that's allowed on MACs; I don't know)

IN the printout will be an "electronic receipt" of acceptance by the IRS. The receipt will show the date/time you filed it, along with the date/time the IRS accepted the e-filed return. That is your primary proof that you filed it, and that the IRS accepted it as filed.

Do take note however, that just because the IRS has accepted the e-filed return, does not mean they agree with it. So if it's been 90 days since you filed, there may be an issue beyond your computer that is delaying any refund you may be due. For example, if your W-2 employer has not submitted their form 940 showing wages paid and tax withheld, that can delay things and there's no much that "you" can do about it but wait.

However, if for any reason in the future the IRS states you did not file or that you filed late, then that "electronic postmark" printout is your proof that you did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

@Carl wrote:However, if for any reason in the future the IRS states you did not file or that you filed late, then that "electronic postmark" printout is your proof that you did.

Unlike the personal editions of TurboTax, there is no electronic postmark printout for the Business edition (TurboTax Business) in the saved forms PDF. Users need to access the electronic filing information as described by @Critter-3.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

First off, I apologize for my delay in logging back into the community. And once again, thank each of you for providing your expertise. In my current situation there is no tax due, so my only worry has been ensuring I met the filing deadlines on time.

I have one further question about how to confirm a filing while using the 1065, Business software. When TurboTax sends a filing the first time, the program sets a flag labeled ‘return accepted’ (in the Print or Continue portion of the software).

When income values (in my instance) are updated and a second submission is filed using TT, the program displays the identical flag, ‘return accepted’. How can one determine whether the second filing, with the updated values has actually been submitted?

Visually, the flag being displayed in either case appears indistinguishable from the other?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

@Marty31 wrote:How can one determine whether the second filing, with the updated values has actually been submitted?

@Critter-3 outlined the procedure in the first post in this thread:

TurboTax CD/Download software

- First, open your return.

- Then, from File menu in TurboTax, select Electronic Filing > Show Electronic Filing Status History (Windows) or Check E-Filing Status (Mac).

- Click Print.

The returns should have different filing (return) IDs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

Thank you, thank you, thank you! Finally, a definitive way of distinguishing filings. I should have realized interactions with government entities would likely be serialized.

(Temporary change of subject to Form 1040) Am I correct in concluding that TT Home & Business does not provide any filing ID? Only an E-file Status when using the ‘Check E-file Status’ tab. These returns were filed ahead of the deadline and did not require any amendment, and I’m simply asking out of curiosity.

And apologies ahead of time for how long this description is.

I have a question down below (regarding Form 1065, Business). And it revolves around my lack of knowledge regarding requesting a filing extension.

———

Re. your previous reply, and listed in the order presented by my TT (Business) Electronic Filing History:

March 15, 2023 02:51 PM PDT Arizona Partnership

Filing Received…

March 15, 202302:51 PM PDT

Filing Received…

[Blank - no date or time]

[No entity, presumably the IRS]

Filing changed state to SUCCEEDED_AGENCY

[Blank - no date or time]

Arizona Partnership

Filing changed state to SUCCEEDED_AGENCY

March 15, 202302:59 PM PDT

Filing Accepted - This Federal 1065 Partnership Filing was accepted by the government on Mar. 15, 2023. The Return ID for this filing is 44…7407inqf5.

March 15, 2023 06:09 PDT Arizona Partnership

Filing Accepted - This Arizona Partnership Business Filing was accepted by the government on Mar. 15, 2023. The Return ID for this filing is 44…7407inqf7.

The previous two entries are duplicated here.

The previous two entries are duplicated here. (A second time)

The previous two entries are duplicated here. (A third time)

———

Am I correct in assuming, that the additional duplicated entries were generated each time I attempted to re-submit the filing (after the income figures were updated following the original request for an extension)?

I attempted three times, on these dates:

23 April 2023, 07:35

29 April 2023, 10:30

02 June 2023, 16:30

Each time, the filing failed and I received the following warning. I’m going to also assume that the warning was duplicated (twice, for each of the three attempts), both federal and state returns.

“Warning! Duplicate Social Security Number - The Intuit Electronic Filing Center is currently processing a return with the same SSN or EIN as the one in the return you just transmitted. You cannot e-file this return again at this time.”

——-

My Question: After requesting an extension from the program, everything appeared to occur normally, and I did receive successful e-mailed confirmations from the IntuitElectronicFilingCenter.

Am I correct in expecting TT Business to let me file again, having updated numbers within the original return (after having requested an extension)?

Or does the return have to be treated like an amended return, accompanied with a special Form?

I haven’t yet attempted a fourth submission, and while I’m sitting at about 155 days from 15 March at this point, I am holding off until I can receive this additional feedback from the Community.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

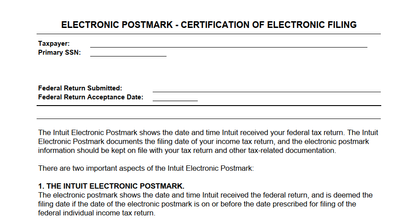

TurboTax Home & Business (as well as the other desktop programs) have an electronic postmark sheet rather than a file ID of some sort that appears as shown in the screenshot below.

With respect to the additional submissions from within TurboTax Business, I can't be of much help but can only state that other users have faced issues with subsequent transmissions of the same return and amended returns generally need to be printed and mailed with this program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wrt a 1065 partnership extension (requested and received in March 2023 (before the deadline)), how can I confirm that the updated 1065 forms have been filed by turbotax?

Solution:

The answer to the question that has been bothering me all along, has been staring me in face the entire time. I simply needed to read the IRS instructions for Form 7004 correctly.

“All the returns shown on Form 7004 are eligible for an automatic extension of time to file from the due date of the return.” (Six months in this case).

As TT reaches the end point of the Business process (Form1065), it asks whether an extension of time will be requested. If yes, then the program steps forward and attaches Form 7004. It then transmits the request for an extension along with the relevant portions of the return, documenting having transmitted the request ahead of the deadline.

The point here is that the filing has been delayed.

After updating select operating values for the LLC in the program, I e-filed a second time and received an identical ‘Accepted’ indication as the original request for an extension.

And this duplication in labeling is what led me down this rabbit hole.

Thanks to everyone who offered solutions along my quest, and especially those who showed how to distinguish one ‘Accepted’ from another. That was key.

Recently revisiting the return, looking for similar feedback from the program but in another location, it didn’t take long to solidly establish that I successfully filed (e-filed) on 04/18/2023. The program also pointed out that it had been ‘accepted’ on 03/15/2023. However when I go to ‘Check E-file Status’ it also labels this as ‘Accepted’. I still don’t feel this is a particularly clear way of labeling the two separate submissions.

Here’s a screen capture from the program: (frustratingly this paste isn't allowed, so here's the content in text...)

File tab | File a Return

Not Eligible for E-filing

You have no returns eligible for e-filing.

The following returns have been transmitted.

- Federal Return - on 04/18/2023 (accepted on 03/15/2023)

- Arizona Return - on 04/18/2023 (accepted on 03/15/2023)

It reports ‘Not Eligible for E-filing’ because the only way I’ve discovered to reach this frame is by attempting to file again. Note my listing above in an earlier Community message, of my history of attempts to file. This was at least my fifth or sixth attempt historically. Again, I misunderstood that submitting Form 7004 along with the 1065 was not the same as filing a return.

Users more experienced than myself might want to feed this back to the developers. And to those maintaining the help files. I’ve been to quite a few places here and on the .gov sites without coming across any info that would have explained this.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

mbeer01

Level 1

magellan0

Level 3

brucetlee

New Member

jmurphy0214

New Member

avery1sdestinee

New Member