- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- User Testing 1099-k

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

User Testing 1099-k

Hello,

I made about $3000 and received a 1099-k from user testing.com. It was a side gig and I could work on my own time. The payments were deposited to PayPal. I tried searching the topics here but could not find the answer. How do I go about filing this? I am using the Home and Business desktop version of turbotax. I also have the filer's TIN and and address listed on the 1099-k but it is PayPal and not user testing.

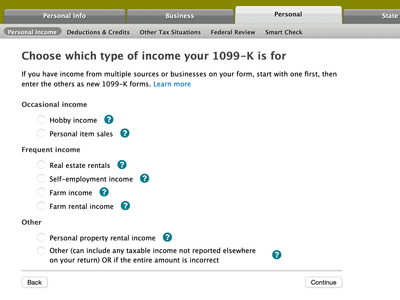

1. Should I choose Self Employment income in the screenshot below?

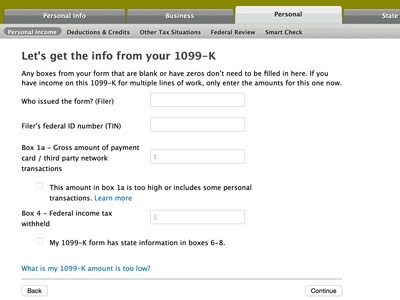

2. Should I enter Filer as "PayPal" and TIN as "Paypal's TIN". Screenshot 2 below.

3. Should I enter "Website Testing or my name" as the name of the business once I proceed with Self-Employment income?

4. The smart check comes back with below errors once I enter the TIN

4a. Personal Business Code, would this be 999000?

4b. Schedule C (Address must be entered): Would this be my home address?

4c. Check the box at top of schedule C to indicate that the taxpayer's name and business name are the same: "I think I should check this box"

4d. Accounting method: "Should I use Cash Box"? Payments were made using paypal

4e. Schedule C, Material Participation Box must be entered: No Entry, Line G Yes Box, Line G No Box. These are the options

4f. Required to file form 1099: Yes or No. Should I choose Yes?

4g. Qualified business income - yes or No. What Should I choose here?

I know these are a lot of questions but any guidance would be appreciated. Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

User Testing 1099-k

Yes, the activity you describe is considered self-employment income.

The 1099-K screen should be answered based on the form you received, so it would be PayPal and their EIN.

If you haven't formally created a business name, leave it in your name.

You can use 999000 as your business code since none of the other codes describes this activity very well.

Use your own name and address as the name and address of the business.

Accounting method should be cash. That just means you report your income when you get it.

Yes, to material participation, this means you are working for this money, not just collecting an investment.

No, to Required to file 1099. This question is asking if you paid others and you need to issue 1099 forms to them.

Yes to Qualified Business Income (QBI). This is a self-employment activity with a net profit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

User Testing 1099-k

Yes, the activity you describe is considered self-employment income.

The 1099-K screen should be answered based on the form you received, so it would be PayPal and their EIN.

If you haven't formally created a business name, leave it in your name.

You can use 999000 as your business code since none of the other codes describes this activity very well.

Use your own name and address as the name and address of the business.

Accounting method should be cash. That just means you report your income when you get it.

Yes, to material participation, this means you are working for this money, not just collecting an investment.

No, to Required to file 1099. This question is asking if you paid others and you need to issue 1099 forms to them.

Yes to Qualified Business Income (QBI). This is a self-employment activity with a net profit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

User Testing 1099-k

Thank you for the answers and the details explanations. I followed them and was able to fill out Schedule C. It also generated a Form 1099-K Wks (PayPal, Inc) but I am guessing this is just a worksheet and not submitted to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

User Testing 1099-k

Yes, you are correct, worksheets are not submitted to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

abz123

Level 1

ghanoch

Level 2

murphey

Level 3

deltabravo

Level 1

joaquinoakland

Level 3