- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

User Testing 1099-k

Hello,

I made about $3000 and received a 1099-k from user testing.com. It was a side gig and I could work on my own time. The payments were deposited to PayPal. I tried searching the topics here but could not find the answer. How do I go about filing this? I am using the Home and Business desktop version of turbotax. I also have the filer's TIN and and address listed on the 1099-k but it is PayPal and not user testing.

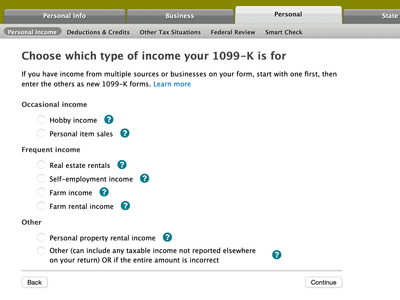

1. Should I choose Self Employment income in the screenshot below?

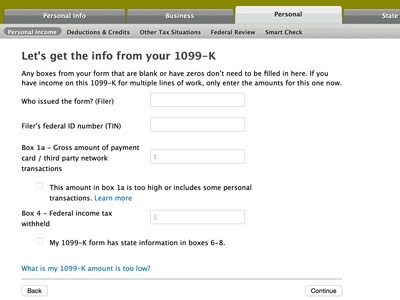

2. Should I enter Filer as "PayPal" and TIN as "Paypal's TIN". Screenshot 2 below.

3. Should I enter "Website Testing or my name" as the name of the business once I proceed with Self-Employment income?

4. The smart check comes back with below errors once I enter the TIN

4a. Personal Business Code, would this be 999000?

4b. Schedule C (Address must be entered): Would this be my home address?

4c. Check the box at top of schedule C to indicate that the taxpayer's name and business name are the same: "I think I should check this box"

4d. Accounting method: "Should I use Cash Box"? Payments were made using paypal

4e. Schedule C, Material Participation Box must be entered: No Entry, Line G Yes Box, Line G No Box. These are the options

4f. Required to file form 1099: Yes or No. Should I choose Yes?

4g. Qualified business income - yes or No. What Should I choose here?

I know these are a lot of questions but any guidance would be appreciated. Thank you