- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Separate from my business as a freelancer, I have condos that I rent. Do I enter my condos as a second business after entering the 1099-MISC so I can enter the expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Separate from my business as a freelancer, I have condos that I rent. Do I enter my condos as a second business after entering the 1099-MISC so I can enter the expenses?

At the end of entering the 1099-MISC under rental income, you get this message:

"Be sure to visit the Business Income and Expenses section so we can cover the business deductions you may be eligible to deduct."

My freelancing business is under an EIN. The rentals are under my SSN. Do I enter/create "a new business" for the rentals?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Separate from my business as a freelancer, I have condos that I rent. Do I enter my condos as a second business after entering the 1099-MISC so I can enter the expenses?

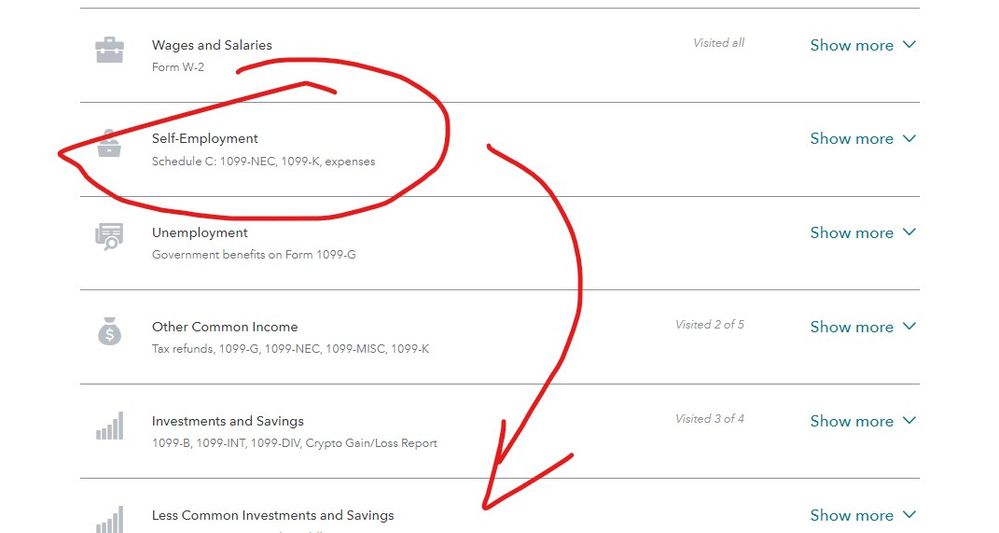

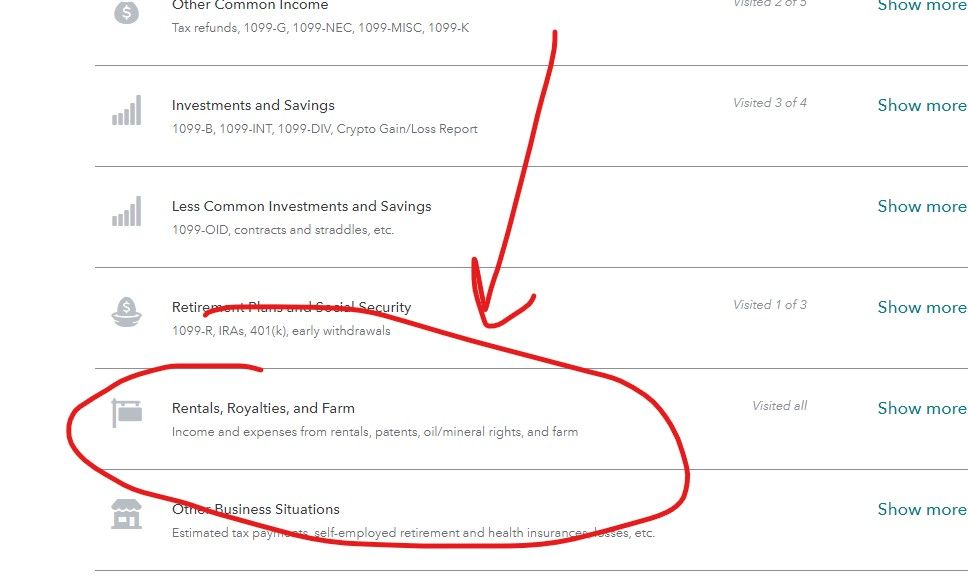

The rentals go on a Sch E in the rental income section and the self employment goes on a Sch C ... once you have completed the Sch C entries you will continue thru the interview to get to the RENTAL section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Separate from my business as a freelancer, I have condos that I rent. Do I enter my condos as a second business after entering the 1099-MISC so I can enter the expenses?

The rentals go on a Sch E in the rental income section and the self employment goes on a Sch C ... once you have completed the Sch C entries you will continue thru the interview to get to the RENTAL section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Separate from my business as a freelancer, I have condos that I rent. Do I enter my condos as a second business after entering the 1099-MISC so I can enter the expenses?

Rental income reported to you on a 1099-MISC is reported in box 1 of that form. If so, then the program should semi-automatically direct/guide you to the SCH E.

Long term residential rental real estate is reported on SCH E, and not SCH C.

For the rental income, it's usually best to not enter the 1099-MISCs until you are actually in the SCH E section of the program. In there for rental income, one of your choices is to indicate that you do have rental income reported to you on a 1099-MISC. Entering it there will ensure it's reported on the correct tax filing document (SCH E) provided the rental income is "in fact" reported to you in box 1 of the 1099-MISC.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

friend80

Level 1

daniya

New Member

Eli67

Level 1

Nicolas8

Level 2

kristyn-c-cole

New Member