- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule K1 with loss last year and gain this year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 with loss last year and gain this year

Background: I reside in New York and am a partner in an investment firm based in New Jersey. Within the investment company, I hold assets worth $100,000. In 2022, the New Jersey company incurred a loss of $45,000, but in 2023 it generated a profit of $50,000. At the end of 2023, I withdrew $55,000, leaving me with $50,000 still invested in the company.

Upon a rough calculation, it seems I profited $5,000 from the transaction and thus should be subject to taxes on this amount. However, when using TurboTax, the results seemed unusual.

1) Under Turbo Tax, Personal, Personal Income, Schedule K-1

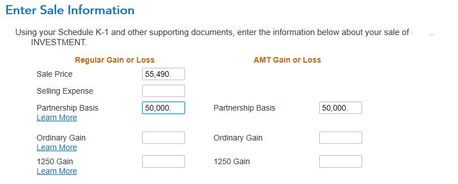

I selected "sold partnership interest" and entered the relevant numbers into the provided table (see the following figure). My assumption was that the "partnership basis" should reflect the cost of my interest. Therefore, a higher number would indicate that I made less money. However, the outcomes are counter intuitive. When I input 0 as the partnership basis, I receive the highest federal tax return. Conversely, if I input $50,000, I receive the lowest federal tax return, with a difference of $7,725. This raises the question: why? If this is indeed accurate, I would opt to set the cost of disposition to 0 and defer the original cost to a later date.

2)

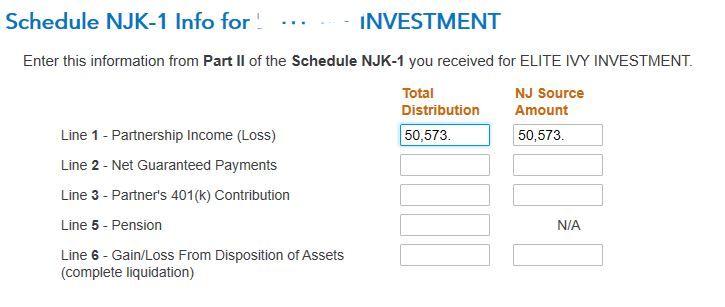

For my New Jersey tax return, I selected non-resident status and entered the NJK-1 number. Surprisingly, I now owe $2,500 in NJ taxes. However, considering that I only made $5,000 in NJ, this figure doesn't seem to align logically.

I strongly believe there should be a section where I can input the loss from last year to carry over to this year, but I have yet to locate where to enter these carryover numbers.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 with loss last year and gain this year

for these purposes, I'm ignoring liabilities that can affect your tax basis assuming that between the two years the affect washes out.

what do you mean "hold assets of $100,000"? what did you contribute as capital to the partnership? This is your beginning basis. This would show on your 2022 K-1 schedule L on the capital contribution during year line

the 2022 loss of $45,000 reduces your tax basis. Schedule L ending capital account should be your tax basis at the end of the year

the 2023 profit of $50,000 increases your basis.

if the $55,000 you received terminated your ownership in the partnership and your original tax basis was $100,000 then your tax basis before the $55,000 would be $100,000 - $45,000 + $50,000 or $105,000

so you're saying you got $55,000 for which you had a tax basis of $105,000 for a loss of $50,000

last year's loss was either deducted that year - look at schedule E page 2 - to the extent allowed if would also show on schedule 1 or if subject to the pasive/at-rrisk rules and not deducted then schedule E page 2 would only reflect $5,000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 with loss last year and gain this year

Thank you. Any answers are helpful, appreciate it!

My initial contribution was $100K. My 2022 Schedule K-1 said I lost $45K and My 2023 Schedule K-1 said I gain $50K. My asset is worth $105K at the the end of 2023. Then I took $55K out, leaving $50K in my account.

This is a capital investmetn and only $3K can be deducted each year. Therefore The $45K loss should carry over to this year. to offset the $55K gain.

However, I could not find a place in Turbo tax NJ state asking me to enter the loss from last year.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

AlexSagrat

Level 2

Shannerzzzz

New Member

Flanda

New Member

USM Professor

Level 1

jiillll

New Member