- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 with loss last year and gain this year

Background: I reside in New York and am a partner in an investment firm based in New Jersey. Within the investment company, I hold assets worth $100,000. In 2022, the New Jersey company incurred a loss of $45,000, but in 2023 it generated a profit of $50,000. At the end of 2023, I withdrew $55,000, leaving me with $50,000 still invested in the company.

Upon a rough calculation, it seems I profited $5,000 from the transaction and thus should be subject to taxes on this amount. However, when using TurboTax, the results seemed unusual.

1) Under Turbo Tax, Personal, Personal Income, Schedule K-1

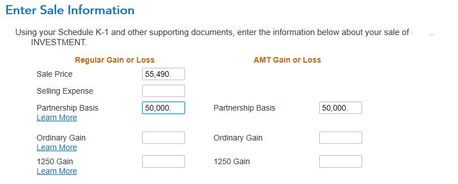

I selected "sold partnership interest" and entered the relevant numbers into the provided table (see the following figure). My assumption was that the "partnership basis" should reflect the cost of my interest. Therefore, a higher number would indicate that I made less money. However, the outcomes are counter intuitive. When I input 0 as the partnership basis, I receive the highest federal tax return. Conversely, if I input $50,000, I receive the lowest federal tax return, with a difference of $7,725. This raises the question: why? If this is indeed accurate, I would opt to set the cost of disposition to 0 and defer the original cost to a later date.

2)

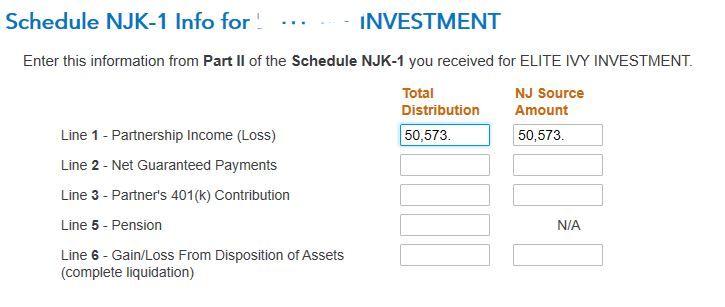

For my New Jersey tax return, I selected non-resident status and entered the NJK-1 number. Surprisingly, I now owe $2,500 in NJ taxes. However, considering that I only made $5,000 in NJ, this figure doesn't seem to align logically.

I strongly believe there should be a section where I can input the loss from last year to carry over to this year, but I have yet to locate where to enter these carryover numbers.