- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

@Rick19744 You are the expert on turbo tax based on what I have seen so really hoping you can help me.

I sold all my shares which I have purchased over several dates - this is a resulting in gain through the 1099B i received through the brokerage, however I believe I am supposed to be able to take losses (carried over the years) through the K1 form, however not very clear on what needs to be entered in TT. I've picked ended partnership through disposition of all shares but the next screen is difficult to enter.

Firstly I did two sales transactions and the purchase dates were also different, while I can enter the term various in both, it forces the gain to be a short term gain vs what it should be long term since i held these shares for several years.

secondly not sure where the following ifromation should come from - the K1 or from the 1099B??

I wish their was better support for this but it appears you've helped with this is the past so would appreciate any help you can provide.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

Partnership tax gets complicated very quickly and TT is developed for the masses. A few follow-up questions:

- Based on the current facts, I am assuming that your K-1 reflects that the partnership is a PTP?

- Since this is a flow-through entity, you should be maintaining a basis schedule of your investment. Have you been maintaining your basis schedule?

- If bullet #2 is "no", then the alternative would be to use your K-1 section L as your tax basis.

- Assuming that your K-1 is marked "final"?

- If my assumption is correct in bullet #1, then you should only be determining the gain in one place.

- My preference is to handle this in the K-1 section, which is reflected in your facts

- Does the sales price you reflect in your facts agree to the distribution reflected on your K-1?

- What was the K-1 activity; ie: trade or business?

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

- Based on the current facts, I am assuming that your K-1 reflects that the partnership is a PTP? >> Yes

- Since this is a flow-through entity, you should be maintaining a basis schedule of your investment. Have you been maintaining your basis schedule? >> I have all my K-1 since 2017 when I first bought the "EPD" through a broker.

- If bullet #2 is "no", then the alternative would be to use your K-1 section L as your tax basis.

- Assuming that your K-1 is marked "final"? >> Yes marked as final

- If my assumption is correct in bullet #1, then you should only be determining the gain in one place.

- My preference is to handle this in the K-1 section, which is reflected in your facts >> I also received a 1099B from my online brokerage so per notes in the form section, it says to put 0 for proceeds and cost in the K-1 section)

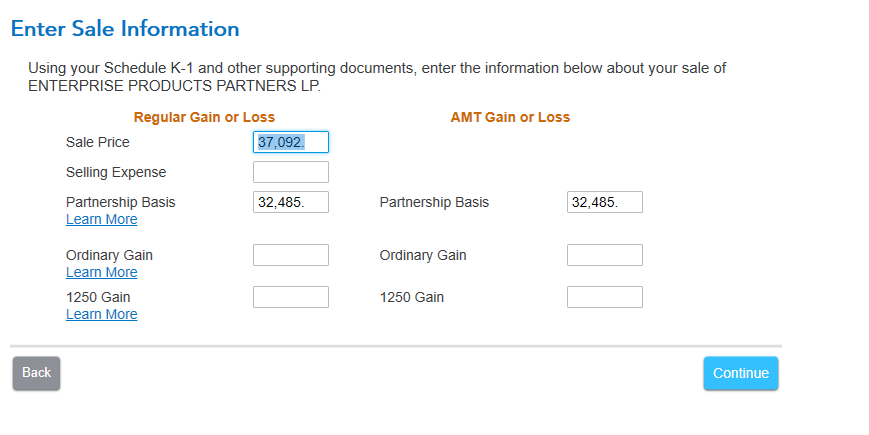

- Does the sales price you reflect in your facts agree to the distribution reflected on your K-1? >> sale price is my total proceeds from the 1099-B and partnership basis is the cost of purchase as per the 1099-B - if I put it as per the image above, it double counts the transaction, so I left it as 0 and am using the 1099-B to report it as a long term stock sale

- What was the K-1 activity; ie: trade or business? >> it was EPD stock.

Also now it appears to not be recognizing my QBI deduction (Section 199A reported gain/loss) over the years and TT is just showing only last years - not sure if the QBI deduction is going to matter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

Follow-up comments:

- There is a lot going on here and it is very difficult to provide direction without the ability to see exactly what you have in front of you; but do not post any personal information on a public forum such as this.

- While the notes with the 1099-B appear to be helpful, this assumes that the brokerage is reflecting an accurate tax basis which I doubt is correct. They are correct in that they are helping you only determine your gain in one place.

- A key in your case is what is reflected on your K-1 Part II box L and also Part III box 19.

- Sch K-1 Part II box L

- does this section reflect any distributions

- do the distributions in box L agree to box 20

- does box L "withdrawals and distributions" reflect anything other than just distributions? Sometimes there is an amount on this line to zero out this capital account section.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

- Sch K-1 Part II box L

- does this section reflect any distributions >> Yes

- do the distributions in box L agree to box 20

- does box L "withdrawals and distributions" reflect anything other than just distributions? Sometimes there is an amount on this line to zero out this capital account section

Distributions are A - 2524 in Box 20

i think i need to see a CA (lol)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

Sorry I referred to the wrong box.

What does box 19 reflect?

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

It reflects Distributions - which is equal to the Dividend I received this year. $2524

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

Ok. Here are some final thoughts based on the facts provided:

- There appears to be a clear disconnect between the 1099-B and the K-1.

- The information from the 1099-B indicates you have a gain of $4,607; 37,092 less 32,485.

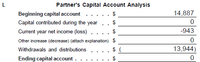

- The details from the K-1 indicate you have a loss of $11,420

- This is arrived at taking the beginning figure in box L of 14,887 and subtracting out the current year loss of 943 which leaves 13,944.

- So the 13,944 is your tax basis (in theory) and then the K-1 reflects the "sales" price (distribution) of $2,524

- The difference is the $11,420; an overall loss because you have basis remaining after the distribution

- Since I can't see everything, nor can I determine what should be your tax basis, I recommend one of the two suggestions:

- You may want to meet with a tax professional. Provide this individual with everything you have related to this investment; which means all K-1's since inception

- In general, I have more confidence in the K-1 information than the 1099-B information in these types of investments. Relying on the K-1 information:

- Input the 1099-B information as reflected; this reflects the gain shown above (4,607). This information is reflected in the normal investment section in TT, which you have most likely already done.

- Box L should be close to your tax basis; at least in theory. In order to arrive at the K-1 loss of $11,420 you would need to show proceeds (your distribution) of $2,524 and tax basis of $18,551.

- This produces a loss of $16,027 which when netted with the gain from the 1099-B arrives at the net loss of $11,420 which is noted earlier.

- So that's the best I can do with the information provided.

Also keep in mind the date of replies, as tax law changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

hello do you have experience about this :

I own some share of limited partnership and they provide me K-1 to fill out every year

, my partnership ended in 2023 when I fill out the tax return. I select the "complete disposition" option.

and enter the purchase date and sale date, the next section is entering sale information.

I enter sale price.

but I am confused on the partnership basis box.

on the sale sheet it gives me 2 options

1 -(purchase price/initial basic amount) @9379$ (this is what i paid to purchase these partners few years back)

2- cost basic $7463

which one is the correct on to fill out on section partnership basis

lastly on box ordinary gain on the sale sheet it gives me 2 option.

1- gain subject to recapture as ordinary income

2- gain subject to recapture as ordinary income

which one is use for option ordinary gain

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

I own some share of limited partnership and they provide me K-1 to fill out every year.

, my partnership ended in 2023 when I fill out the tax return. I select the "complete disposition" option.

and enter the purchase date and sale date, the next section is entering sale information.

I enter sale price. which is $12,500.0

but I am confused on the partnership basis box.

on the sale sheet it gives me 2 options

1 -(purchase price/initial basic amount) @9379$ (this is what I paid to purchase these shares originally)

2- cost basic $7463

which one is the correct on to fill out on section partnership basis box 1 or 2

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

David2024

Level 2

rachel2024

New Member

DavidArizona

Level 2

steveb444

New Member

kiran

Level 3