- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 entries in Turbo Tax Desktop Premier when disposing of all shares

@Rick19744 You are the expert on turbo tax based on what I have seen so really hoping you can help me.

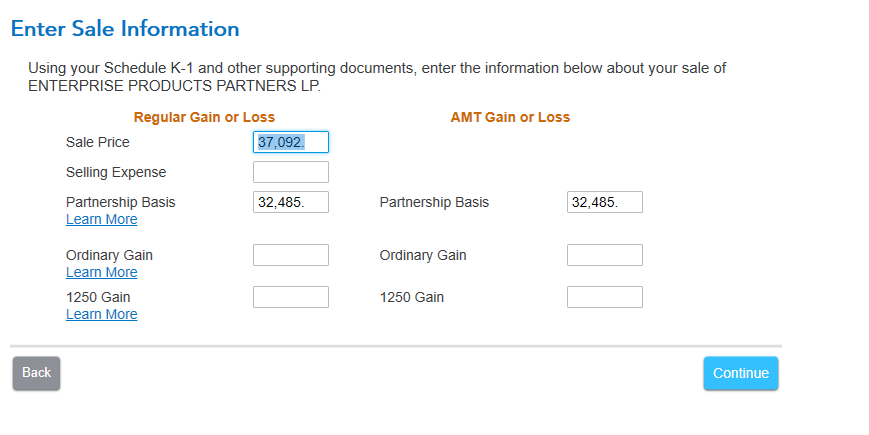

I sold all my shares which I have purchased over several dates - this is a resulting in gain through the 1099B i received through the brokerage, however I believe I am supposed to be able to take losses (carried over the years) through the K1 form, however not very clear on what needs to be entered in TT. I've picked ended partnership through disposition of all shares but the next screen is difficult to enter.

Firstly I did two sales transactions and the purchase dates were also different, while I can enter the term various in both, it forces the gain to be a short term gain vs what it should be long term since i held these shares for several years.

secondly not sure where the following ifromation should come from - the K1 or from the 1099B??

I wish their was better support for this but it appears you've helped with this is the past so would appreciate any help you can provide.