- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

I followed some of your posts related to how to enter a schedule K1 so that it is not added twice on form 8949. I did not know what I was getting into when buying these LP so sold all of them this year so that I would not receive any more K1 starting next year. So all the K1 are Final. I am currently using the online version

But I have some questions if you can help (Attached screenshots for both)

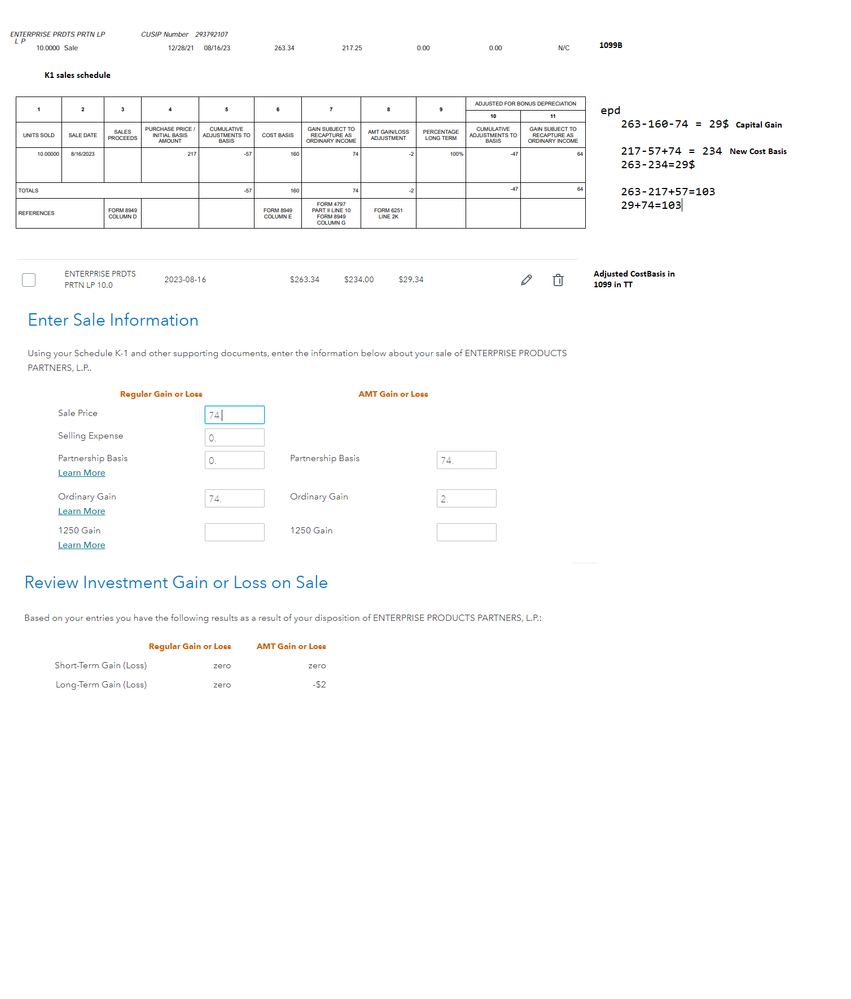

1) Just want to double check my entries on the long term only sale as I had to enter it differently for AMT gain to show up as -2 : EPD

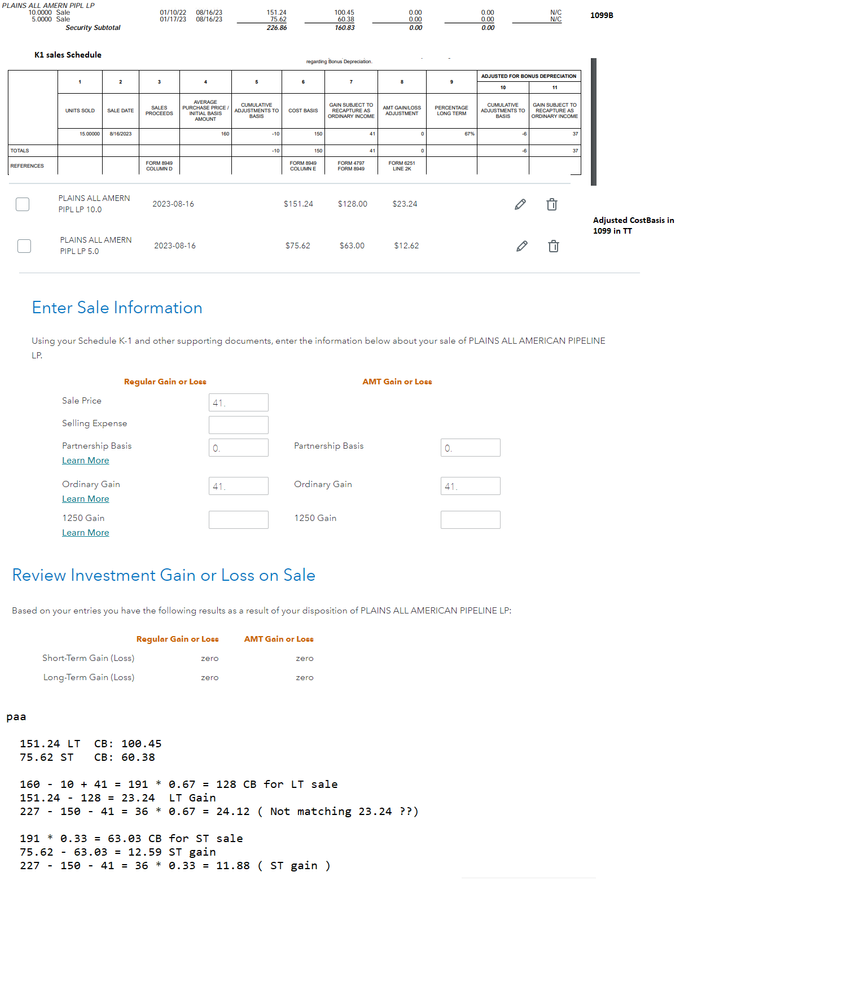

2) On the short term and long term I am not sure if I am calculating the math correctly : PAA

Hoping you could shed some light on both

3) Should I classify the above 2 entries in TT as Long term and short term gain so that it is taxed appropriately since the broker reported both as not reported to IRS or will TT automatically do it based on the dates on the final 8949 form?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

reply nit sure wgere the sael price came from unless you did a limit order but for practivle purpose the few cents difference can be ignored

so you have the option

151.24+75.62=226.86

226.86*.67 =152-191*.67=152-127.97=24.03 (in TurboTax due to rounding would probably be 24 & 12)

226.86*.33=74.86--191*.33=74.86-63.03=11.83

total for both 35.86

OR

151.24 -191*.67=151.24-127.97=23.27 (in TurboTax would probably be 23 and 13)

75.62-191*.33=75.62-63.03=12.59

total for both 35.86

I wouldn't worry about the $1 difference,

the difference is the k-1 is using 67%/33%

and the broker is using 2/3 &1/3

resulting in slight differences

your choice

the ordinary income is reported correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

@sharonenoch When AMT is in play, enter $0 for sales price, and the inverse of the Ord Gain for cost basis. So for EPD, you'd enter -74 (regular) and -72 (AMT) on the basis line, and 74/72 on the Ord Gain line, giving all 0s for Gain or Loss and prevent TT from creating more 1099-Bs.

On the allocation of basis adjustments, start with what you actually paid (according to your broker, not the K-1, since broker has the actual records for the transaction). Assuming that's the $100.45 (LT) and $60.38 (ST), you'd just take the adjustment of $31 (-10+41) and allocate it 67% to the LT sale and 33% to the ST. So new cost basis would be $121.22 (LT) / $70.61 (ST)

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

reply nit sure wgere the sael price came from unless you did a limit order but for practivle purpose the few cents difference can be ignored

so you have the option

151.24+75.62=226.86

226.86*.67 =152-191*.67=152-127.97=24.03 (in TurboTax due to rounding would probably be 24 & 12)

226.86*.33=74.86--191*.33=74.86-63.03=11.83

total for both 35.86

OR

151.24 -191*.67=151.24-127.97=23.27 (in TurboTax would probably be 23 and 13)

75.62-191*.33=75.62-63.03=12.59

total for both 35.86

I wouldn't worry about the $1 difference,

the difference is the k-1 is using 67%/33%

and the broker is using 2/3 &1/3

resulting in slight differences

your choice

the ordinary income is reported correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

@Mike9241 : Thanks for the quick reply. I did not understand the following statement

" reply not sure where the sale price came from unless you did a limit order ". Which sale price where you referring to?

I did understand the math though which you have give. . Thanks for the explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

It depends on whether you did a limit order. I can't speak for Mike9241 however as he indicated a few cents does not make a difference. And you know what the sales prices are for your investment.

A limit order in the financial markets is a direction to purchase or sell a stock or other security at a specified price or better. This stipulation allows traders to better control the prices at which they trade. A limit can be placed on either a buy or a sell order:

- A buy limit order will be executed only at the limit price or a lower price.

- A sell limit order will be executed only at the limit price or a higher one.

The price is guaranteed, but the filling of the order is not. Limit orders will be executed only if the price meets the order qualifications.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

Thankyou for your reply @DianeW777

It was not a limit order, I checked the order history. It was at market price.. Moreover the sale price was 263.34.. which if I had entered a limit it would be a rounded amount to the nearest dollar.. I was trying to get rid of the stock due to the complicated nature of the tax filing,.

The Cost basis was 217.25$ which I re-calculated it to be 234$ based on the capital gain and adjusted the cost basis in the 1099 B in Turbotax.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jiillll

New Member

annienni2011-gma

New Member

AndrewK24

New Member

lbru442413

New Member

jim202400

New Member