- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K1 : 1099B vs K1 entries in TurboTax for Short term and Long term

I followed some of your posts related to how to enter a schedule K1 so that it is not added twice on form 8949. I did not know what I was getting into when buying these LP so sold all of them this year so that I would not receive any more K1 starting next year. So all the K1 are Final. I am currently using the online version

But I have some questions if you can help (Attached screenshots for both)

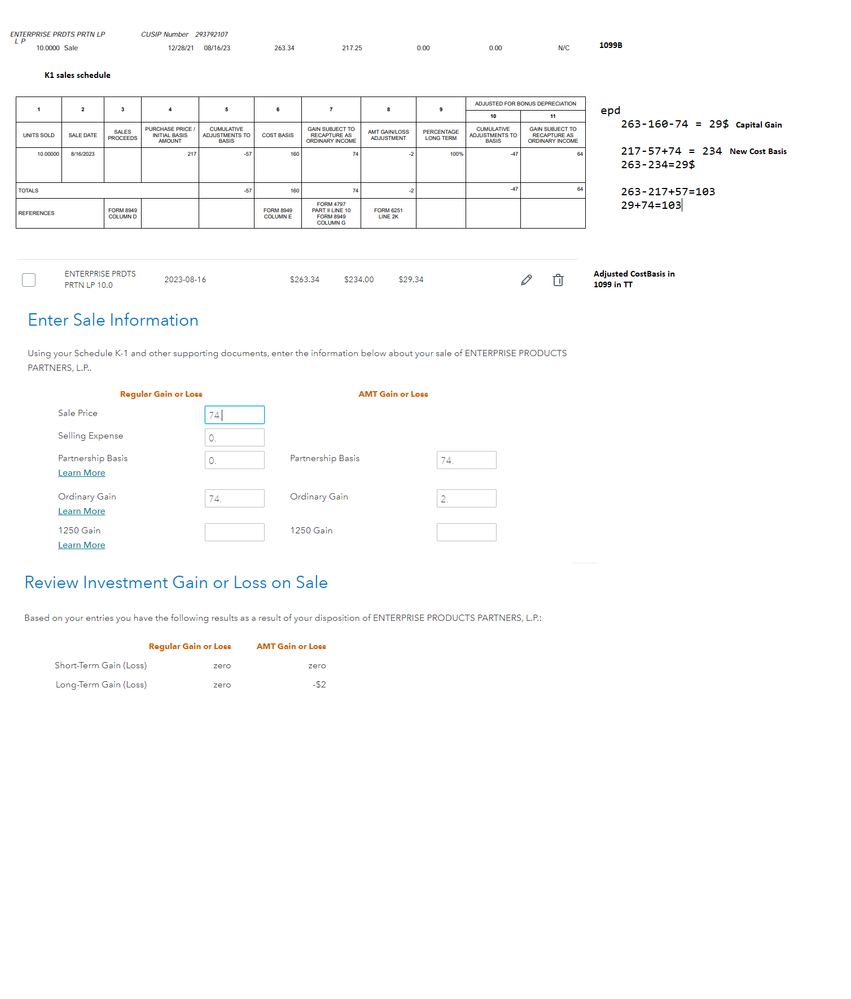

1) Just want to double check my entries on the long term only sale as I had to enter it differently for AMT gain to show up as -2 : EPD

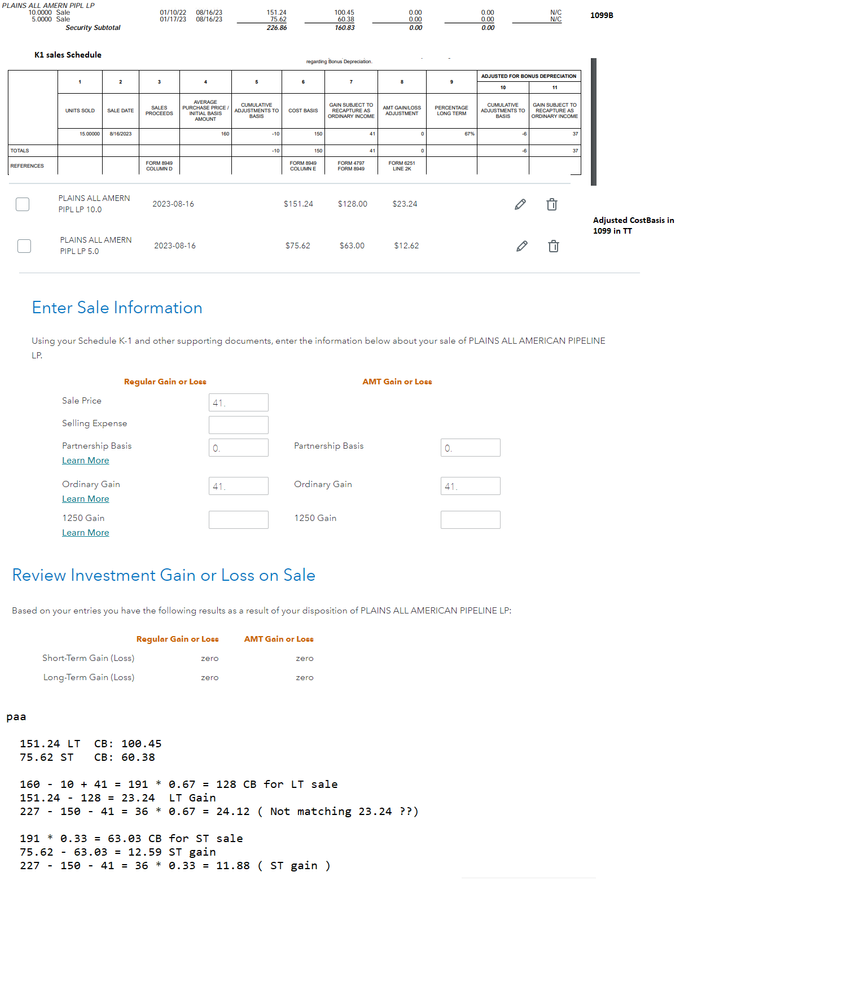

2) On the short term and long term I am not sure if I am calculating the math correctly : PAA

Hoping you could shed some light on both

3) Should I classify the above 2 entries in TT as Long term and short term gain so that it is taxed appropriately since the broker reported both as not reported to IRS or will TT automatically do it based on the dates on the final 8949 form?